Summary

Established café

COVID-19 impacted

Creditors accepted a 75% reduction on debts

Main debt owed to the ATO

Background

Prior to the COVID-19 pandemic, the business owners ran a thriving café. The Victorian government-imposed restrictions throughout 2020 and 2021 materially impacted the business’s turnover and profitability. The business owners pivoted the business as best they could—they catered for take-away-only service, increased their reliance on food delivery platforms, and leveraged government support. However, sales reduced, cost of goods increased, and staff wage pressures strained the cash flow and meant the business was facing insolvency.

The business owners were referred to our team, eager to find a way to save their business.

Debt profile

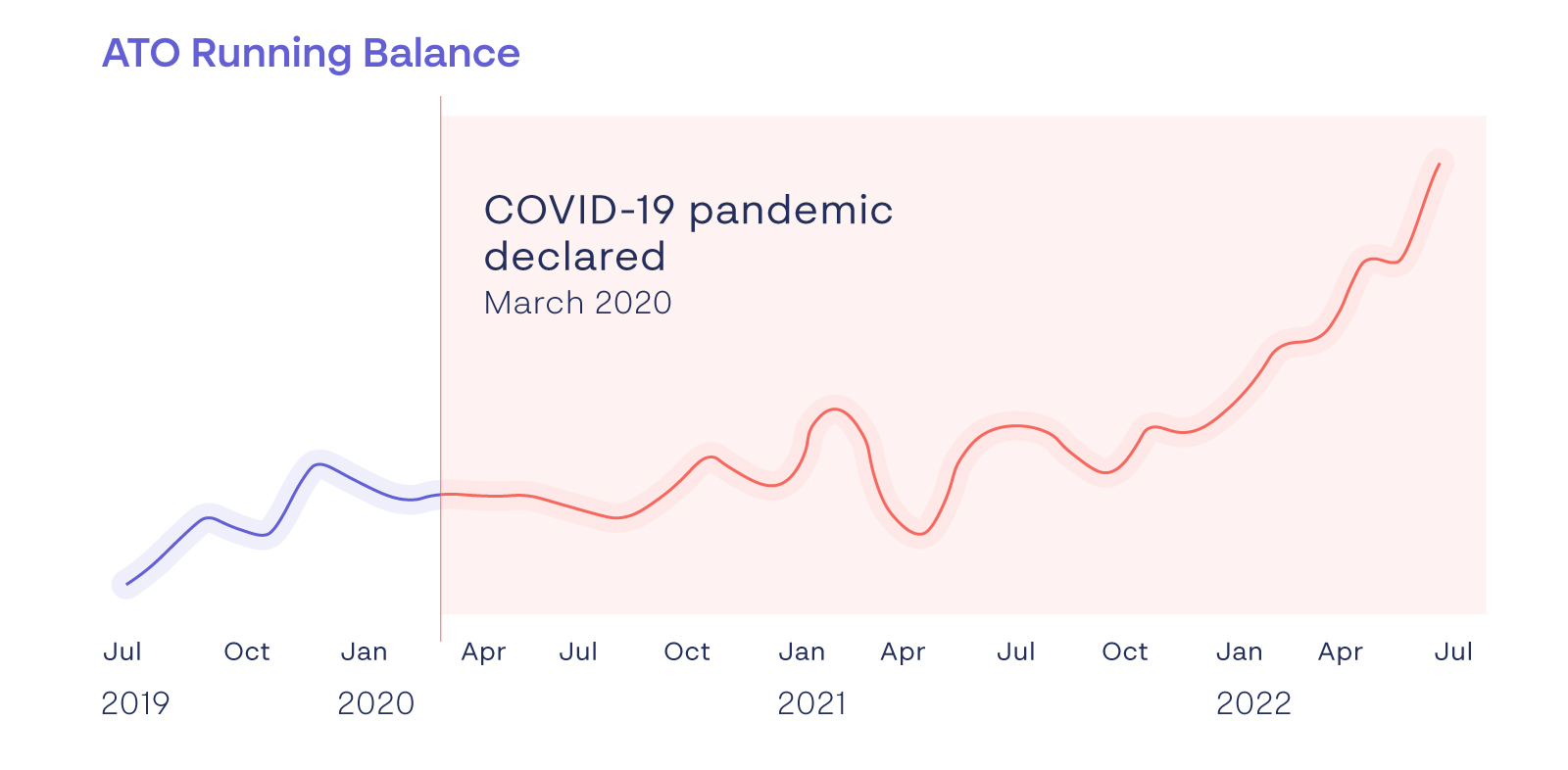

The majority of business expenses were paid cash on delivery, which kept most business suppliers up to date. The difficult trading period created a situation where the debt to the Australian Taxation Office (ATO) began to increase as shown in the graph below.

The ATO was the main creditor and tax debt was approximately $160,000 when we were engaged. Historically, the business maintained a good standing with the ATO—the mounting debt was causing real and deep-seated personal stress for the business owners. And while the ATO was supportive during the pandemic, it started applying pressure on the business owners for repayment of the debt.

The outlook

The owners had taken several steps to ensure business profitability into the future. They right-sized their workforce, revised menu pricing, and met regularly with their accountant to discuss budgets and cash flow. The future looked bright, but built-up debt posed a real challenge. Cash-flow projections showed a commercial repayment arrangement with the ATO would be difficult to negotiate, let alone be entertained.

The SBR process and the offer

It was decided to enter into a SBR process with a hope that the debt could be restructured into a more manageable amount. The business continued to trade as normal while the offer was being formulated and report completed.

Ultimately an offer to creditors was proposed at approximately 25 cents in the dollar, which the company would pay in instalments over a 24-month period. That is, creditors were being asked to write off 75% of the debt owed to them.

The offer proposed was affordable for the company and provided a higher return rate to creditors than what was likely in a company wind up scenario.

Outcome

Creditors unanimously accepted the offer. Within approximately one month, the business owners were carrying on the business with certainty about the future and without the significant overhead of debt and associated personal stress.

Other factors

This company owned a motor vehicle subject to finance and held a long-term lease with the landlord. There were no arrears owing to either of these parties and neither party participated in the SBR process.