Where a strategically employed Work Out ‘worked out’.

In this case study we dive into the specifics of an appointment as Receivers and Managers to a company by a major property investment fund. The goal? To recoup as much of our clients $18 million facility as possible.

The facility was in relation to a recently completed forty-two-apartment development on the central coast. Eight units had been sold, four contracts had exchanged but remained unsettled and eight additional properties were subject to lease agreements.

At the time of the appointment, appetite for apartments in the market was not sufficient to payout the loan facility in full. Furthermore, the prospective strata managers, who also happened to own a unit in the development, notified us that any amount of rain caused a major, chronic flooding issue in the building’s carpark.

This issue was affecting the ongoing unit sales and was a major cause of concern for the building’s residents and current owners. Lack of buyers and substantial building defects had effectively led to the default under the mortgage facility and to our appointment;

We had to contend with the following issues:

- Completing the four contracts that had been exchanged prior to our appointment and understanding how to go about obtaining vacant possession of the leased properties;

- Understanding the scope of the rectification works required and the costs and time needed to complete them. This was to assist us in putting a proposal to the client as part of the work out process; and

- How to address the building rectification issues when the building had not yet properly formed a strata committee or appointed a strata manager. There was effectively no mechanism available to have the owners resolve as a collective to complete the building rectification works.

Given the circumstances and complications, what was the potential return our clients could expect?

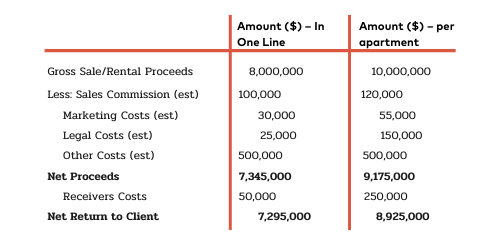

If we undertook a traditional course of action advertising the asset for sale, based on a valuation of the property on both an “in one line” and a “per apartment basis”, the anticipated potential return to our client was as follows:

In a best-case scenario, if the building was sold on an ‘as is where is’ basis, the estimated return would result in a more than 50% write down on our client’s loan facility over a six to eight month period – not ideal.

So what did we do instead?

The first step was to immediately recommend to the client that a building inspector be commissioned to finalise a report to identify any structural issues with the building, the options and costs to rectify those issues.

Based on the building report, we formulated a proposal that would see the following occur:

- A further contribution of $1,250,000 by the client to fund the rectification recommendations provided by the building inspector. This was contingent on the forming of a strata committee and the acceptance by the committee of a special levy being raised proportionate to each unit owners interest in the strata plan;

- A sales process that would be completed over a six to eight-month period. This would ensure that properties could be drip fed to the market so that the value in the building could be maximised;

- Negotiating additional concessions with the purchasers of the four properties that had previously exchanged in order to ensure they settled;

- A vacation schedule of the eight leased apartments progressively over the eight-month period. This allowed us to maximise the rental returns over the sales process but would also allow for units to progressively enter the market after being painted and cleaned;

Our scenario analysis highlighted that the value of the units could be increased by appropriately 20% overall and would also likely lead to a more efficient and effective sale process.

Once the proposal agreed to by the client, we:

- Undertook the requisite steps to form the strata committee;

- Obtained quotes from several contractors to complete the required rectification works;

- Successfully raised a special levy via the strata committee and facilitated the clients levy contribution to the required rectification works;

- Engaged, oversaw and project managed the successful contractor whilst the rectification works were completed over the eight-month period;

- Negotiated additional concessions for the buyers of the four units that had exchanged but not settled prior to our appointment to ensure they completed;

- Negotiated the vacation of the tenanted apartments and a refresh of their interiors over progressively over the eight-month period;

- Tendered and engaged a sales agency to market each of the remaining twenty-eight units progressively over the six to eight-month period.

- Managed and oversaw the sales process. All units were successfully sold over the same eight-month period the rectification works were completed.

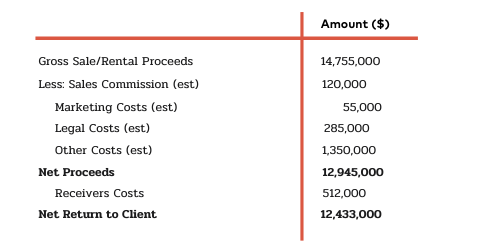

As a result of this Work Out, the actual return to the client was more than 67 cents in the dollar:

Whilst there remained a shortfall of just over 30% on the balance of the client’s facility, we were able to substantially increase the overall return to them through the work out process.

If you are interested in hearing more about our approach, on this or other matters, please don’t hesitate to contact your local Worrells office.