A substantial win for creditors.

Creditors that face a preference claim from a liquidator now have new case law that says that the “peak indebtedness” of a running account is no longer the correct way to calculate the value of a liquidator’s claim. This means that, where there is a continuing business relationship prior to a company’s liquidation, the value of liquidators’ claims against creditors may be reduced or completely defeated.

This is a substantial win for creditors; but not necessarily an easy one as the case law relies on a number of principles and complexities that liquidators must factor in from the appointment’s outset.

What is the peak indebtedness rule?

The “running account” principle, as stated in section 588FA(3) of the Corporations Act 2001, provides that if a transaction is part of a continuing business relationship, the series of transactions during the relation-back period is treated as a single transaction. The purpose of the provision is to limit the value of a liquidator’s preference claim in circumstances where a debtor is making payments to a creditor who is supplying goods or services of value as part of a continuing business relationship.

Historically, the peak indebtedness rule allowed liquidators to calculate the effect of the running account by

subtracting the amount owing as at the relation-back day from the point of peak indebtedness. As the term ‘peak’ suggests, it captures the highest point of debt owing to a creditor during the relation-back period as a shorthand way of calculating the net effect of the running account. The relation-back day[i] varies based on the appointment type and sequence of appointments, which sets total period captured in this calculation.

subtracting the amount owing as at the relation-back day from the point of peak indebtedness. As the term ‘peak’ suggests, it captures the highest point of debt owing to a creditor during the relation-back period as a shorthand way of calculating the net effect of the running account. The relation-back day[i] varies based on the appointment type and sequence of appointments, which sets total period captured in this calculation.Let’s look to the Federal Court of Australia case (judgment delivered on 10 May 2021) to get the context of the practicalities of a creditor (Badenoch) alleged to have received preference payments in the lead up to a liquidation of their client (Gunns Limited).

In Badenoch Integrated Logging Pty Ltd v Bryant, in the matter of Gunns Limited (In liq) (receivers and managers appointed) [2021] FCAFC 64, the broad facts are:

- The creditor (Badenoch) provided harvesting and hauling services to Auspine Limited, a subsidiary of Gunns Limited (entity in liquidation).

- Badenoch raised an invoice at month’s end with a due date of the end of the subsequent month. During the business relationship, Badenoch’s invoices resulted in indebtedness levels fluctuating.

- Gunns started to make late payments regularly and often in partial satisfaction of the invoiced amounts.

- Badenoch issued Gunns a letter of demand, implemented a 10 day “stop supply” and negotiated a repayment plan.

- Badenoch issued Gunns a second letter of demand, ceased supply and negotiated a repayment plan for all outstanding debt in exchange for providing limited services with a view to “gradual tapering off” of services.

- Then Gunns Limited and its wholly owned subsidiary Auspine Limited was placed into administration. Gunns’ liquidators alleged that 11 payments made by Gunns to Badenoch between 26 March 2012 and 25 September 2012 (i.e. the relation-back period) were insolvent transactions and voidable under section 588FE of the Corporations Act 2001.

- The liquidators commenced proceedings against Badenoch to recover $3,360,876 as an unfair preference.

On appeal, the Full Court considered:

- Whether the payments to Badenoch were an integral part of a “continuing business relationship” within the meaning of s588FA(3) of the Corporations Act. (The series of transactions forming the relationship would constitute a single transaction).

- And If yes, whether the peak indebtedness rule is the correct way to calculate the running account.

Continuing Business Relationship

The Court reviewed the common law principles for determining a continuous business relationship and summarised these as follows:

- Payment is made where a continuing debtor-and-creditor relationship is mutually assumed and it’s expected further debits and credits will be recorded.

- A business statement of account assists to determine if each particular payment was connected with goods/services being subsequently provided.

- If the payment intends to induce the creditor to provide further goods/services and discharge an existing indebtedness, the payment is not a preference—unless the payment exceeds the goods’/services’ value.

- Where the relationship contemplates further debits and credits, appropriating payment to a past debt is commonplace; and has no significance unless parties expressly agree the payment will permanently reduce indebtedness below the level existing at the time of the agreement.

- Knowledge/suspicion (including reasonable grounds) of insolvency will not necessarily destroy a continuing business relationship.

- A stop on an account will not necessarily destroy a continuing business relationship.

- The continuing business relationship is not required for the entire relation-back day period.

- A continuing business relationship is established by substance, not form.

The Court held that the key enquiry is whether payments during the relation-back period are in respect of a continuing business relationship or whether their “real purpose is recovery of past indebtedness”. Their Honours stated that courts should not take an unduly restrictive approach to identifying a continuous business relationship.

The Court determined four payments made were part of a continuing business relationship despite being made after Badenoch issued a letter of demand and implemented a 10 day “stop supply” and negotiated a repayment plan for its overdue invoices. This decision is significant as it raises the bar for creditors; and allows them to take steps to recover past debt without severing the continuing business relationship.

The remaining seven payments happened when the parties’ nature of their relationship changed. Badenoch insisted that Gunns enter into a repayment plan for all past debts as a precondition to supply any further services and proposed in writing a “transition to a mutually acceptable termination of the agreement”.

Peak indebtedness rule abolished

After the continuing business relationship period was established, the Court held the peak indebtedness rule should be rejected for the following reasons:

- The plain reading of section 588FA(3)(c) of the Corporations Act indicates the legislation’s intent to take into account “all transactions forming part of the relationship” and give creditors the benefit of all dealings between the parties.

- Creditors are not disadvantaged by payments made to induce supply goods of equal or greater value. This doctrine of ultimate effect was followed by the High Court in Airservices.

- Abolition of the peak indebtedness rule is consistent with the stated purpose of Part 5.7B of the Corporations Act being fairness between unsecured creditors. Using the peak indebtedness rule can produce differing outcomes between two creditors that have supplied the same value of goods and received the same value of payments—but on differing payment terms.

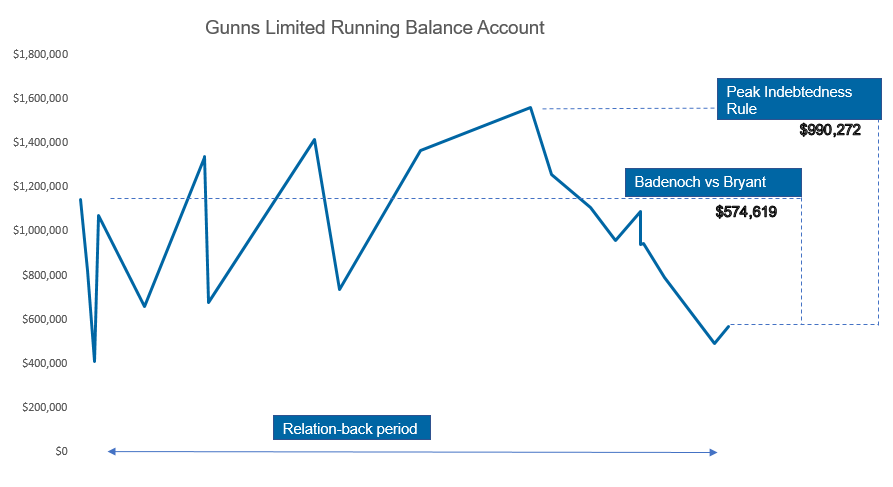

The graph below illustrates the quantum difference in the potential preference payment claim using the now defunct peak indebtedness rule when compared to the principles applied in Badenoch vs Bryant.

Note: the above graph assumes a continuing business relationship for the entire relation-back day period.

In this example, the liquidator’s potential preference claim is reduced by $415,653.

Where to from here?

As insolvency practitioners we are commercially-minded people. If you are the subject of a preference claim, it is best to deal with matters head-on. Talk it through—obviously if you or your clients receive a demand from a liquidator, then you should obtain appropriate legal advice before seeking to defend any such claim yourself. As always, we’re here to help. Contact your local Worrells office for these insights and more.

Related article: It's my money...get lost liquidator

[i] The relation-back day is subject to the appointment type, being:

- A liquidation that follows a voluntary administration—date of administrators being appointed (regardless of whether a DOCA was in effect during the intervening period).

- A court appointment—date of the application being filed.

- A creditors’ voluntary winding up—date of the members’ meeting that resolved to wind up the company.