Rising insolvency debt and tougher penalties define approach.

In his first annual report, Commissioner of Taxation Rob Heferen has laid out the Australian Tax Office's (ATO) performance and priorities, setting a firm tone on debt recovery measures. Released on 31 October 2024, the report reviews the ATO’s achievements for the year ending 30 June 2024, with a strong message underscoring the importance of meeting tax obligations.

The ATO’s annual report reiterates a key message from previous years: tax obligations are non-negotiable. Commissioner Heferen has indicated that the ATO will adopt a “progressively firmer approach” toward individuals and businesses failing to meet their tax responsibilities. This strategy builds on the ATO’s longstanding focus on debt recovery, reinforcing its stance that “paying tax is not optional.”

.png)

Increased enforcement to shift community attitude to debt

The COVID-19 pandemic shifted taxpayer attitudes away from voluntary compliance, a trend the ATO is addressing with renewed urgency. Efforts over the past year have focused on encouraging timely payments and educating taxpayers on the cost of unpaid debts.

The report notes that a return to standard debt recovery practices, alongside a firmer approach to debt repayment, has:

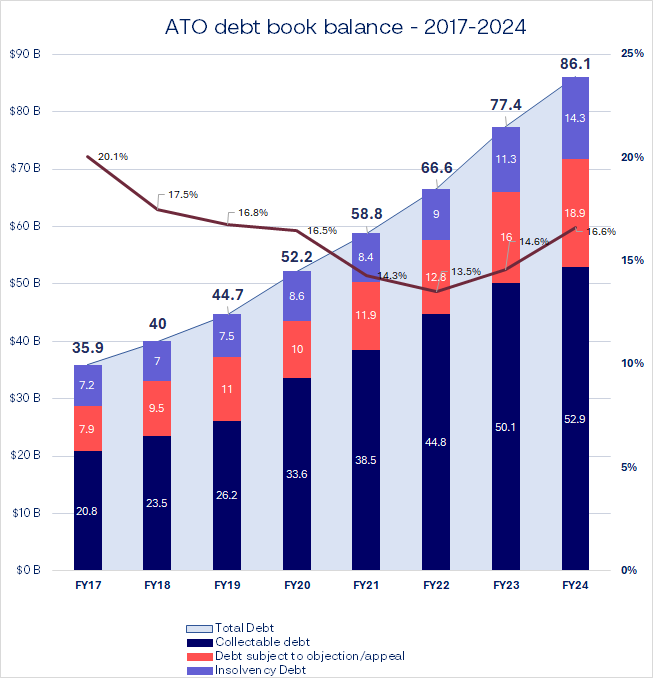

Slowed the growth in collectable debt, which increased by 5.2% ($2.6 billion) in 2023–24, compared to a 12% increase in the prior year. Total collectable debt now stands at $52.9 billion as of 30 June 2024.

Total debt, being the combination of collectable debt, debt subject to objection/appeal, and insolvency debt, has increased 11.24% ($8.7 billion) to $86.1 billion from $77.4 billion the previous year, the slowest rate of increase since financial year 2017.

Insolvency debt has increased from $11.3 billion to $14.3 billion, an increase of 26.5%, the highest growth rate since 30 June 2011.

Insolvency debt as a percentage of total debt shot up to 16.6%, the highest since the peak of 20.1% reached during the 2017 financial year.

It is my understanding that insolvency debt remains on the ATO’s books until such time the external administration is finalised. For restructuring solutions like Small Business Restructuring (SBR) or Voluntary Administration, that generally means once the SBR plan completes (all monies have been paid to creditors under the approved plan), or once the Deed of Company Arrangement (DOCA) is wholly effectuated. For liquidations, that means once the liquidation is finalised.

I expect that insolvency debt will grow exponentially over the next few years as more taxpayers become subject to some form of external administration, playing catch up for a quieter few years of insolvency and continuing headwinds in economic conditions for small business. I expect this will follow with a clearing of these debts off the ATO’s books as SBRs and DOCAs completes, and liquidations are finalised. The big question will be just how much will ATO actually recover from insolvency debt, with SBRs generally returning 20-40 cents in the dollar to creditors, and small business liquidations often returning little or no return.

Increased enforcement for non-compliance and phoenix activities

The ATO has placed particular emphasis on businesses managing cash flow responsibly, especially regarding withheld amounts for GST, PAYG, and employee superannuation. Commissioner Heferen highlighted that the ATO will apply firm recovery actions in cases of deliberate non-compliance and phoenix activities.

In 2023–24, 26,702 director penalty notices were issued for company debts totalling over $4.4 billion, with $879 million collected by the end of June 2024. The ATO also disclosed over 36,000 business tax debts to credit reporting bureaus, marking a notable increase in transparency.

Super guarantee debt

The report highlights a substantial level of superannuation guarantee (SG) debt as of 30 June 2024. Approximately $3.7 billion is outstanding in super guarantee debt, with $1.4 billion tied to insolvent entities and $80 million disputed. Importantly, $2.2 billion of the debt is classified as collectable and owed by nearly 89,300 employers.

In 2023–24, the ATO issued 8,714 director penalty notices (DPNs) to directors of 6,493 companies, totalling $572.7 million in unpaid SG liabilities. Of this, $76.1 million was recovered, leaving $483.6 million in liabilities outstanding. The ATO has affirmed its commitment to pursuing these debts, employing its full suite of recovery tools.

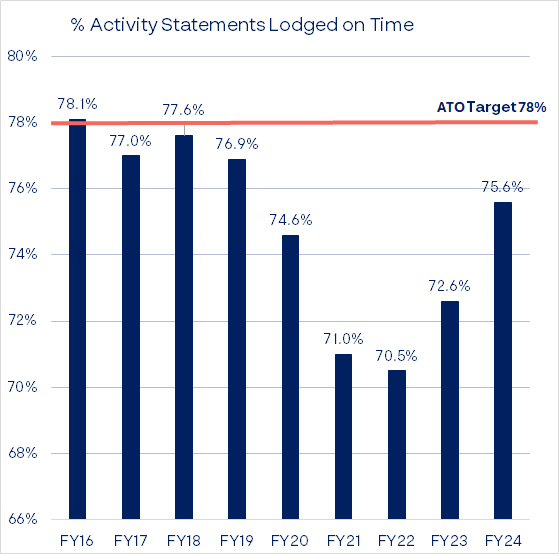

Activity statements lodge on time

At Worrells, we have been closely monitoring the ATO’s performance measures, including the percentage of activity statements lodged on time. This metric reflects the proportion of taxpayers meeting their lodgement obligations within the required timeframe. While the compliance rate showed a notable improvement, rising from 72.6% to 75.6% compared to the previous financial year, it still fell short of the ATO’s target of 78%. This increase in compliance is likely attributed to the ATO's intensified focus on debt collection and enforcement efforts, which appear to be driving greater adherence to lodgement obligations.

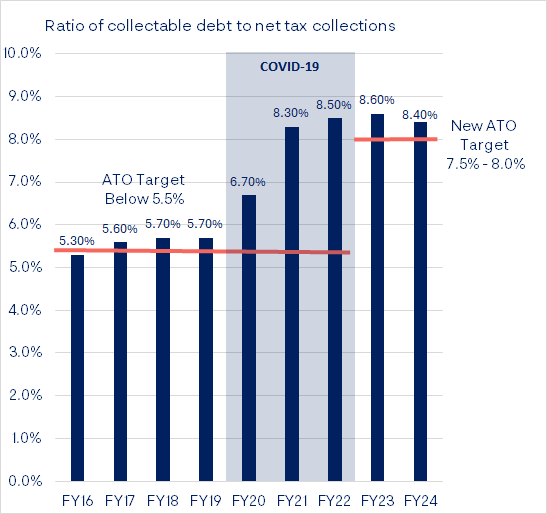

Ratio of collectable debt to net tax collections

The ratio of collectable debt to net tax collections is a measure of the effectiveness of the ATO’s debt prevention, collection, and management strategies, reflecting the proportion of outstanding debts that remain uncollected compared to total tax revenue. In 2023–24, the collectable debt to net tax collections ratio was 8.4%, which did not meet the target range of 7.5% to 8.0%. While this represents a slight improvement of 0.2 percentage points from the previous year's result of 8.6%, the higher percentage indicates that the ATO is not collecting tax as effectively as desired, as it suggests a greater proportion of tax liabilities remain unpaid relative to total collections.

This highlights the need for ongoing improvements in the ATO's debt collection and management strategies to reduce the ratio and improve overall tax compliance. Through actions such as garnishee notices, directions to pay, director penalty notices, and business debt disclosures, the ATO is actively working to ensure more timely payments.

Looking ahead, while total debt growth is likely to slow, I anticipate that insolvency debt will continue to materially increase and make up a larger portion of total outstanding debt. This is driven by the expected increase in the volume of insolvency appointments, which remain relatively low compared to the number of registered companies. I predict that the percentage of insolvency debt will surpass the post-GFC period within the next three years as financial pressures and ATO's firmer enforcement lead to a rise in insolvency numbers.