What can advisors expect in the near future?

This week, the Australian Small Business and Family Enterprise Ombudsman (ASBFEO) released its report on the Australian Taxation Office’s (ATO) early debt recovery action. Commissioner of Taxation, Chris Jordan said that while the ATO would consider the ASBFEO’s recommendations, he pointed out that debt recovery action was only used in exceptional circumstances:

Where there are links to organised crime, phoenixing, evasion or other fraudulent activity, or where we have evidence of the taxpayer dissipating assets or transferring funds to frustrate collection of tax.

As most advisors would be aware, the ATO is quite active when it comes to court winding-up applications filed against delinquent debtors. Usually this form of debt recovery is the last step in the process in view of suitable repayment plans; and not all applications result in the company actually being wound up.

But just how active is the ATO at present?

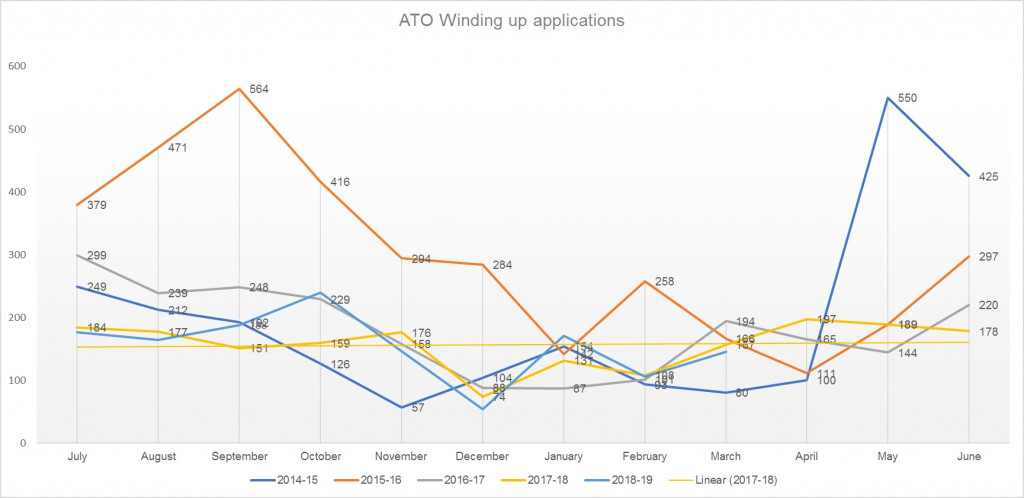

The current level of winding-up applications being filed by the ATO appears to be steady with statistics collated from the ASIC Published Notices website showing an average of 140 applications since January this year.

ATO winding up applications spiked once again in January 2019 following the trend of an influx of applications following the Christmas period. In fact, the 171 winding up applications filed is the highest January figure since we started our records five years ago.

On a calendar month average, since 2017: February, and March this year continued the post-Christmas “what-goes-up-must-come-down” trend and sets the pace with 106 and 145 applications.

However, given the looming end of financial year and the Federal Budget, what can advisors and business owners expect to see?

Historically, June and July are bedfellows to another spike in the numbers. They tout an average[1] of 280 and 257 applications respectively.

In late March, it was reported that the ATO had been given more funding in the pursuit of the black economy activity with cash businesses square in its crosshairs. According to Smart Company[2], Chris Jordan said, “there’s $10 billion in unpaid small-business tax outstanding” and that the tax gap figures for 2019 would soon be released.

And while the issue of businesses deliberately manipulating or deceiving the tax system is a critical and ongoing discussion, the ATO is said to recently:

Published an updated set of small-business benchmarks and warned they will be reviewing businesses which are found to be outside of accepted parameters ahead of the end of financial year.

This assertion backed with an injection of public funds along with other government targets such as phoenixing, attests to a changing tax environment and an empowered execution strategy. While we never again see the unprecedented peak of 564 winding up applications recorded in September 2015, an increase from current average in the near future would not be surprising.

Or perhaps it would be wise to consider that a new precedent in winding up applications is imminent.

As always, the advice to those debtors with accumulated tax debts remains unchanged. That is, it is not a question of will the ATO take some form of recovery action, but a question of when. If your client receives any form of formal debt recovery action, our local partners are here to help.

[1] Since our records commenced in July 2014.

[2] Smart Company: A $10 billion deficit: Small businesses are Australia’s biggest tax dodgers, ATO says. Published Monday, 18 March 2019.