A mortgage always gets paid… right?

One would expect that once a mortgage is registered on the title of a property that it’s going to get paid and/or receive first priority when the property is sold. But what if the mortgage hasn’t been paid in a long time? Can secured debts become statute barred?

Background

By way of background, our office has been administering the bankrupt estate of an 80-year-old former successful businessman who:

between 2005-2008 gave security over his property to invest in Storm Financial;

felt like he had lost everything in the collapse of Storm Financial in 2009;

was having difficulties in 2022 obtaining the age pension due to the property which remained in his name without the mortgagee taking possession; and

was frustrated by the outstanding secured debt on the property which continued to show up on his internet banking and was double the original finance amount.

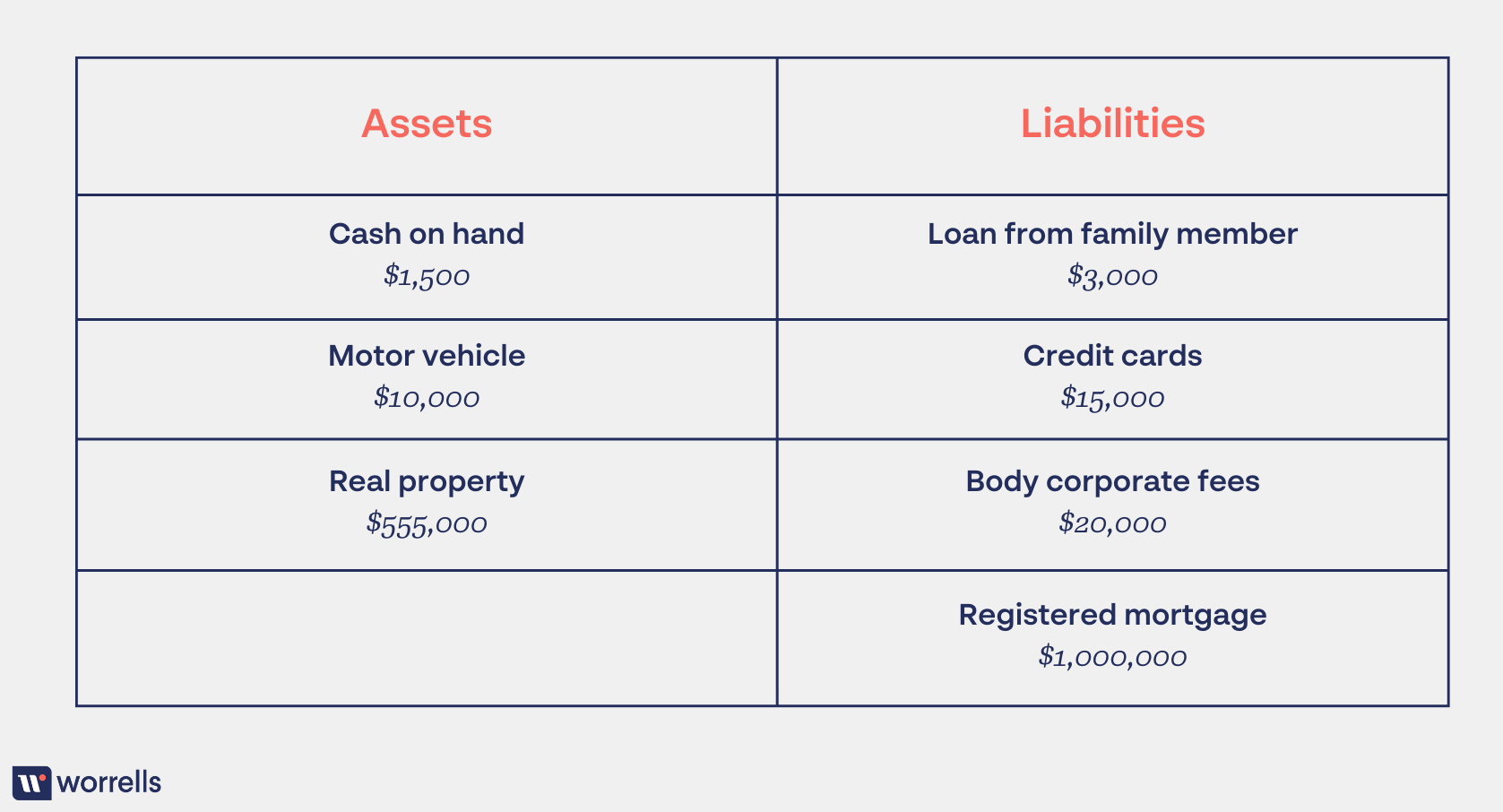

At the date of bankruptcy, the bankrupt’s financial position was as follows:

Given that the vehicle (after considering selling costs) was exempt in bankruptcy, our office commenced steps to investigate the dealings on the real property. In this regard, the debtor advised that he had not made any repayments on the secured debt since the collapse of Storm Financial in 2009 and the mortgagee had not taken any steps to enforce their security.

Our investigations could not identify any recovery actions being taken against the property in respect of the mortgage, nor any payments being made against same. Statements we obtained on the loan showed nothing other than continually accruing interest and an ever growing balance ballooning to $1m by the date of bankruptcy.

So what happened?

We engaged solicitors to review the matter and to provide advice on the mortgagee’s security and whether the debt could be statute barred. The advice essentially provided the following:

Sections 13 and 26(1) of the Limitations of Actions Act 1974 (Qld) – a secured debt becomes statute barred 12 years from date on which the right of action accrued;

Section 13 of the Limitations of Actions Act 1974 (Qld) – a right of action shall be deemed to have accrued on and not before the date of acknowledgement of the debt or the last payment – i.e. the 12 year starts again if a debt is acknowledged in writing and/or a payment is made on the debt; and

Price v Spoor [2021] HCA 20 – the High Court reaffirmed that the limitation period for some debts can be contracted out of.

Consideration was also given to the requirements under general conditions on the mortgage and applicability of the National Consumer Credit Protection Act 2009 (Qld), which we were advised did not apply due to the loan(s) being for investment purposes.

After some difficulties obtaining further information from the financier about the registered mortgage, our solicitor sent a letter to the mortgagee setting out our position that the debt was statute barred and seeking they discharge their mortgage over the property.

In response, and after providing several extensions for the mortgagee to respond, we were simply provided with a discharge of the mortgage and a letter stating the financier reserved the right to lodge a claim in the bankrupt estate for the amount owing at the date of bankruptcy (i.e. $1,001,316.82).

Our office has now attended to the sale of the unencumbered property for $550,000 and upon the sale of same discharged the outstanding rates and body corporate fees which had accrued to a total of some $27,000.

What happens next?

We currently hold approximately $460,000 in the bankrupt estate and the mortgagee has since lodged a claim for the amount owing being $1,001,316.

This file is ongoing. Our office is currently working with the debtor, attending to tax obligations arising from the sale of the property (i.e. capital gains tax). We will proceed to declare a dividend to creditors in the estate once this has been attended to.

Whilst we are yet to formally rule on the claims in the bankrupt estate, given the legal advice above regarding the mortgagee’s debt, we consider it possible that there will be surplus funds of approximately $400,000 returned to the 80-year-old debtor.

An outcome no one would have predicted at the start of the matter, when it appeared that the property was upside down to the tune of almost $500,000.

If you’re facing financial trouble and bankruptcy is staring you down, reach out to your local Worrells office. We’ve got the care, tools and framework to help start the next chapter. Tough situations need a balance of genuine care matched with an expert understanding of the options available. We’ll listen to your story, then give you the straight talk on the best plan of attack for your unique situation.