Majority of rules now effective.

On 27 June 2019, the majority of the Debt Agreement Reform Bill[1] became effective. The Bill was introduced in February 2018 and received Royal Assent September last year. Its aim is to make the debt agreement system more accessible and to “provide greater protection for debtors and creditors”.

A debt agreement also called a Part 9 (under Part IX of the Bankruptcy Act 1966) is when a person (debtor) makes a formal proposal to their creditors to ask them to accept an arrangement that is less than full payment of their debt.

Attorney-General, Christian Porter, was quoted last year saying that the reform was in response to debt agreements being exploited by the debt agreement industry. “It will boost confidence in the professionalism of debt agreement administrators, deter unscrupulous practices and enhance transparency,” he said.

The following is now effective:

- Only registered administrators, the Official Trustee (AFSA) or registered trustees can administer debt agreements.

- Administrators must pass a “fit and proper test” and have personal indemnity insurance.

- New offences apply to failure to "maintain trust accounts for debtors’ funds” and “failure to keep records.”

- Debt agreements are limited to a three-year period (compared to the previous and common practice of a four- to five-year term)—unless they have equity in their principal residence, then a five-year term is allowed.

The reforms are centred on changing the criteria for people to be eligible to propose/enter into a debt agreement and change how the payments are calculated. Currently, three main threshold limits[2] dictate if a debt agreement is an option for debtors struggling with personal debt:

- Unsecured debts must be less than $115,733.80.

- Unsecured assets must be less than $231,467.60.

- After-tax income must be less than $86,800.35 in a 12-month period (following the accepted debt agreement starting).

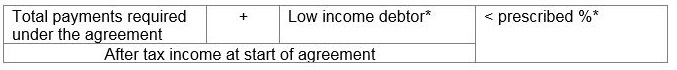

However, details on when the payment-to-income ratio will become effective is yet to be released. The new ratio aims to ensure repayment affordability and increasing access to assets (doubling the asset threshold). For example, allowing people with equity in their homes to use a debt agreement as a solution. The Attorney-General will prescribe* the percentage and ‘low income debtor’ amount in the calculation below. It’s reported that it will be determined in consultation with industry groups and stakeholders.

Other changes include:

- Official Receiver’s power to reject a debt agreement proposal.

- Creditor voting rules.

- Arrears notification requirements.

- Disclosure of referral relationships including any payments made.

- Disclosure of any relationships between debtor and administrator.

- New offences and certification rules.

Debtors that have current debt agreements are being administered by the debtor themselves or an unregistered administrator will be transferred to the Official Trustee (at AFSA[3])

All debt agreements active prior to 27 June 2019 that are being administered by a debtor or an unregistered administrator—i.e. a person not permitted to under law—will be transferred to be the administered by Official Trustee on 27 September 2019. Those debtors affected should consider appointing a registered debt agreement administrator before September this year.

To support the reform’s efficiency and to enforce debt agreement administrators to comply, the Attorney-General is also “bolstering the Official Receiver’s authority” over debt agreements being proposed that would cause “undue financial hardship to vulnerable debtors”.

We believe that any reform should provide a fair balance for creditors to take into account their interests to recoup their loss and for debtors to have assurance over their financial wellbeing. At Worrells, we thoroughly explain the effects of all personal insolvency solutions, particularly when considering an agreement against bankruptcy. Several factors influence how debtors are affected by their choices. For example:

- Life events like an employment loss, unexpected medical expenses or having a baby, can change the ability to make the agreed payment amounts.

- If the agreement terms are no longer favourable to creditors and is consequently terminated, debtors are left only to contemplate bankruptcy as a solution.

We are pleased to see that only duly qualified and professionals can administer debt agreements. We always urge that advisors and debtors seek the right advice for their circumstances from appropriately qualified specialists.

All too often we hear of debtors seeking advice from organisations that in our view aren’t acting in the best interests of the debtor. Worrells have the largest number of private registered trustees in Australia always available to provide appropriate advice based on the debtor’s circumstances.

[1] Bankruptcy Legislation Amendment (Debt Agreement Reform) Bill 2018.

[2] Current as at 28 June 2019.

[3] The Australian Financial Security Authority (AFSA).