As we close out the 2024–25 financial year, now is the perfect time to go beyond the numbers and take a broader view of your clients' financial health. Over the past 12 months, we’ve seen a clear shift in the insolvency and restructuring landscape—one that you need to keep front of mind heading into 2025–26.

A Year of Rising Insolvencies

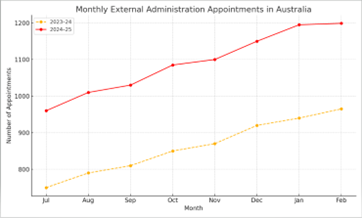

Insolvency appointments have surged in 2024–25, with ASIC recording its highest number of external administrations since before the pandemic, signaling that the deferred consequences of several tough years are now being felt across the economy. While insolvencies had been artificially suppressed by government stimulus and regulatory forbearance, we are now seeing a return to more “normal” levels—albeit with added intensity due to compounded financial pressures.

Construction remains the most at-risk sector, plagued by fixed-price contracts, margin erosion, material cost increases, and persistent labour shortages. Retail and hospitality have also continued to struggle with inconsistent demand, higher wages, and increasing overheads. In the hospitality sector, nearly 10% of registered businesses have shut down over the past year due to substantial tax defaults (creditor watch). Many businesses in these sectors had already been operating on thin margins and now find themselves with little buffer to absorb further shocks.

Another major driver has been the ATO’s return to proactive enforcement. Thousands of Director Penalty Notices (DPNs) and statutory demands were issued this year, with many businesses caught off guard after delaying tax obligations during the post-pandemic period. For many, this resulted in formal insolvency proceedings that could have been avoided with earlier action.

One notable trend in 2024–2025 has been the increased utilisation of Small Business Restructuring (SBR) and simplified liquidation processes. These mechanisms, introduced as part of insolvency reforms during the COVID-19 pandemic, are now becoming a mainstream option for distressed businesses with liabilities under $1 million.

Another significant development was the growing focus on director accountability. With regulators cracking down on phoenix activity and insolvent trading, directors are facing heightened scrutiny and potential personal liability. This underscores the importance of seeking professional advice at the earliest signs of distress.

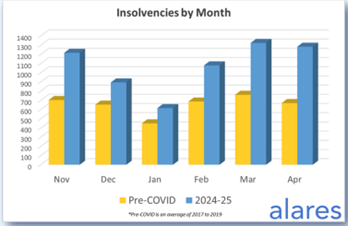

The insolvencies in March 2025 and April 2025 were almost double historical levels:

and over 25% higher than last year

What to Prepare For in 2025–26

Economic conditions are likely to remain challenging. Inflation and interest rates are still elevated, and consumer confidence remains low. As insolvency practitioners, we expect demand for restructuring advice and turnaround services to grow into the next financial year.

Here’s how you can help clients prepare:

Review cash flow regularly and stress-test for rate increases

Encourage early engagement with advisors when warning signs appear

Educate clients on restructuring options, particularly SBR and voluntary administration

Strengthen governance practices to improve early detection and decision-making

The key takeaway is this: clients who appear to be just "getting by" may be far more vulnerable than they realise. The external environment is far less forgiving than it was in the past three years, and proactive planning is essential to avoid avoidable insolvency scenarios. You’re often the first to notice the red flags. Keep an eye out for:

ATO debts without repayment arrangements

Negative working capital or ongoing trading losses

Clients putting off decisions around staff, debt, or lease commitments

When caught early, there are far more options available—including informal workouts or formal restructures—long before liquidation becomes the only outcome.

Conclusion

The end of the financial year is more than a compliance deadline—it’s a strategic moment to reflect, reset, and plan. If you’re working with businesses showing signs of financial stress, now is the time to start the conversation.

We’re here to support you and your clients with practical, solutions-focused advice—whether it's restructuring, compliance, or crisis management. Please don’t hesitate to reach out for a confidential discussion.

If you or your clients need assistance, feel free to reach out to your local Worrells office for a confidential and complimentary consultation.

.jpeg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=800&h=480&q=25&blur=5&sat=-100)