At Worrells, we continue to see a strong uptake in small business restructuring (SBR) appointments.

However, we are often seeing that companies seeking an appointment for SBR do not meet the strict eligibility criteria – particularly the $1 million liability threshold. Companies that exceed this cap are automatically excluded from the process, meaning VA/DOCA is the only viable option.

It is important to consider all liabilities in this assessment prior to commencing an SBR appointment, as if an appointment is commenced, and it is later found that the total liabilities exceed the threshold, the appointment is automatically terminated.

We have seen this occur in several instances due to additional liabilities that were not considered at the time of appointment, including but not limited to:

Shortfall liabilities related to outstanding secured finance

Guarantees provided for third-party debt (e.g., related party bank borrowings)

Outstanding lodgements (e.g., ATO) which will result in a liability

Debts that are the outcome of legal action (e.g., judgment, VCAT order)

Contingent liabilities

Even if a company is eligible for an SBR appointment, there are certain circumstances where the voluntary administration (VA) and deed of company arrangement (DOCA) process may be a more suitable option. Although generally more expensive due to the nature of the appointment, a VA/DOCA has its own advantages, one such instance being if there are significant valid related party claims.

Key Differences Between SBR and VA/DOCA

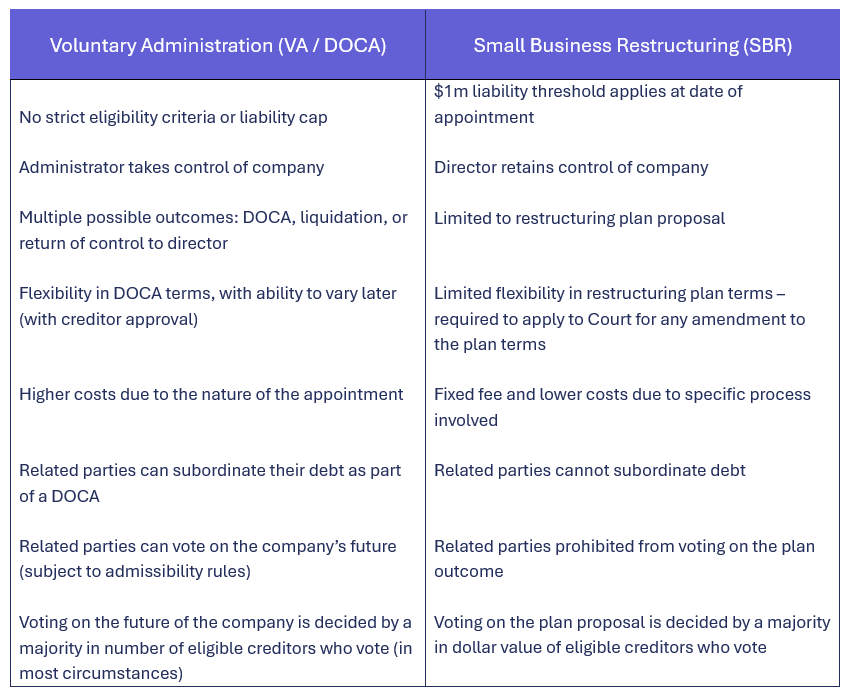

Beyond eligibility, there are also structural differences between the two appointment types that directors and advisors should be aware of.

Below is a comparison of the key distinctions between the processes:

The Role of Related Parties

One of the most overlooked differences between VA/DOCA and SBR lies in the treatment of related parties. A few of the key differences are summarised below.

Subordination of Claims

SBR: Related parties cannot subordinate their claims. In practice, this often means those claims must be forgiven outright to improve returns for other creditors.

DOCA: Related parties may subordinate their debt. This allows their claims to remain on the books while excluding them from DOCA distributions, thereby boosting the return to external creditors without requiring full forgiveness.

Voting on the Outcome

SBR: Related parties are not entitled to vote on the outcome of the restructuring plan. The outcome of the voting on the restructuring plan is determined by the majority in value of those creditors voting. What this means in practice is that if there is a single creditor who holds the majority in value, they control the outcome of the vote, which other creditors are bound by, irrespective of the number of opposing votes.

VA/DOCA: The VA and DOCA processes look at the best interests of creditors generally, including related parties. As such, related parties can vote on the company’s future. The outcome of the voting on the future of the company is determined by a majority in number of those creditors voting, or if a poll is called by a majority in number and value. In the event of a hung outcome during a poll (only a majority in one of number or value voted to pass the resolution), a casting vote is exercised by the chairperson, determining the outcome of the vote, generally based on their recommendation.

Administrators must consider whether any proposal is in the best interests of creditors as a whole and provide a recommendation, in addition to assessing the admissibility of all claims (including related parties). Creditors can seek Court intervention to set aside a DOCA if it is not in the creditors’ best interests.

This process enables a more complete representation of the creditor body, allowing the voices of parties other than just the majority in value creditor to be heard when determining the company’s future.

Summary

The SBR process is a powerful tool for eligible companies. It is cost-effective, less disruptive, and keeps directors in control—making it well-suited to certain small businesses.

However, even when the eligibility criteria are satisfied, whilst being a more costly appointment, a VA/DOCA may ultimately provide more flexibility, options for restructuring, and better creditor outcomes, particularly where related party debts are involved.

If some or all of the following circumstances apply to your situation, we would recommend you consider a VA/DOCA even where you are otherwise eligible for SBR:

Total liabilities are at risk of exceeding the $1 million threshold in the event that further minimal liabilities are identified.

There is a substantial imbalance in the value of creditors, e.g., a pool of creditors exists within which a single creditor may hold >50% in value and therefore control the outcome of voting, against the opposing views of other creditors.

Significant related party claims exist that wish to participate in the process, including voting on the future of the company or leveraging related party debt to facilitate a restructure.

Where a company may have significant outstanding superannuation debt and insufficient capacity to immediately satisfy the same to qualify for the SBR process, and/or payment of the same has a significant impact on the ongoing viability of the Company’s business.

If you are weighing up these options, reach out to Worrells. We can review your company’s circumstances and provide tailored advice on your eligibility for the SBR process and whether an SBR or VA/DOCA is the better fit for your company.