How the Supreme Court made this assessment

Tax, accounting, and legal advisors are often the first asked for advice by directors on potential insolvent trading claims.

As many are aware, section 588G of the Corporations Act 2001 effectively pierces the corporate veil and makes directors personally liable for company debts incurred where:

- The company was insolvent or became insolvent at the time the debt was incurred.

- Where the director (or a reasonable person in the director’s position) had reasonable grounds for suspecting the company’s insolvency or would become insolvent by incurring that debt.

Defences that directors have to an insolvent trading claim include if they had reasonable grounds to expect the company was solvent and would remain solvent (at the time of incurring the debt).

A plethora of court judgements deal with many scenarios to contemplate the position of when a company becomes insolvent. The theme that is evident throughout these judgements is whether the company at the time of incurring the debt was experiencing either a temporary liquidity problem, or a permanent/incurable shortage of working capital. In the case of temporary liquidity, it is easier for the director to mount a defence to an insolvent trading claim than a permanent shortage of working capital, if a liquidator was subsequently appointed to the company.

Critically, the courts recognise that a company experiencing a temporary working capital shortage should not be liquidated; the damage to stakeholders is unwarranted. Conversely, allowing a clearly insolvent company to trade and incur further debt with no chance of financial recovery, is equally damaging, especially to creditors and employees who risk not being paid once the company is placed into liquidation.

Therefore, the advisor’s role is critical to assess whether the company should continue to trade or be placed into administration or liquidation.

In the 2007 case of Hall and Poolman, the Supreme Court set out useful guidelines that a director (and advisors) may rely on in assessing temporary liquidity versus a permanent/incurable working capital shortage. Practically, it helps to determine whether an event (e.g. the impending sale of a surplus asset, or future capital raising,) could restore a company’s solvency.

The Court usefully found that a director would be justified in “expecting” the company to be solvent if an asset could be realised to pay creditors in full within about three months.

In practical terms this means that directors could be justified in including the expected proceeds on the sale of a surplus asset in the cash-flow forecast and relying on that inflow to assess and determine that the company will be solvent (within 90 days) and the company will thereby be able to pay its creditors when due. In doing so, the directors effectively assert that the company is at present time, experiencing a temporary liquidity problem and not a permanent and incurable shortage of working capital.

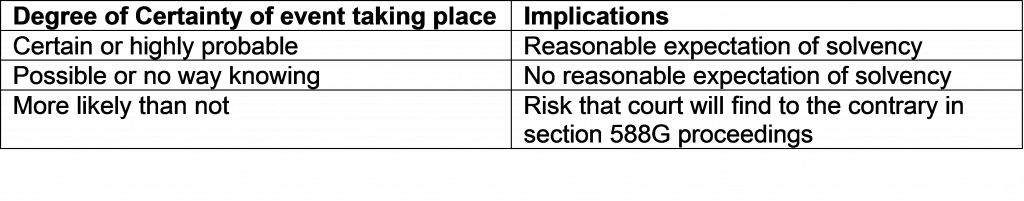

The degree of certainty of the event occurring is critical to assess solvency, which is detailed in the table below.

Arising from the above, the particular event that the director relies on to restore or maintain solvency must have a certain or high probability of happening within 90 days. Without these circumstances, the director defence of expecting the company to remain solvent will be severely diminished.

Directors are always exposed to the risks of company failure, so it is critical that advisors are careful to distinguish between temporary liquidity conditions, and the more severe and incurable shortage of working capital. The Worrells Partners are adept at assessing these situations and can deliver complimentary ‘Worrells Workshops’ to build your team’s awareness and capabilities in such insolvency matters.