Short term pain (STP) for a long-term gain.

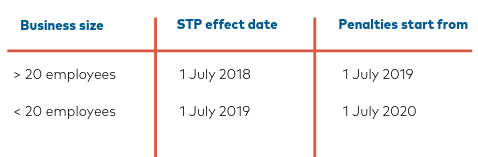

The Single Touch Payroll (STP) system for employers to report payroll data to the Australian Taxation Office (ATO) came into effect for employers with fewer than 20 staff as of 1 July this year. And a three-month grace period applied to assist smaller businesses make the transition to the system. However, the STP system is not new. It was rolled out to employers with 20 or more employees on 1 July 2018 with penalties for non-use applying from 1 July 2019.

The final milestone in the STP reform commences Tuesday, 1 October 2019—when employers of all sizes must use the STP system, although penalties for non-use for smaller businesses will be waived until 1 July 2020.

The table below recaps on the STP rollout.

In July last year, in our article ‘Non-payment superannuation entitlements—a window of opportunity’, we reported on the government’s 12 month amnesty for employers to bring their superannuation guarantee obligations up to date, potentially saving businesses thousands of dollars in penalties that they may otherwise had to pay. During that period, it’s reported that over 7,000 business took advantage of the amnesty. While this amnesty period has lapsed, the government recently introduced a Bill in parliament seeking to extend the amnesty period. Reportedly, accountants have recently noticed an increase in their clients receiving ATO ‘please explain’ letters, particularly around irregularities around superannuation reporting and payment obligations. It comes of no surprise that the STP substantially adds to the suite/range of tools now at the ATO’s dispense that increases its visibility into small businesses’ financial information. One tool includes data provided by super funds[1] that will feed into a combined enforcement approach with STP reporting information, enabling the ATO to conduct “health checks” with businesses not paying super properly.

Should the extension be implemented, another window of opportunity will open for businesses to bring their superannuation guarantee obligations up to date with not only potentially huge savings on penalties but also getting into the ATO’s ‘good books’. While interest would still be payable, missing the amnesty could mean employers face a minimum of a 100 percent penalty in addition to the outstanding superannuation charge and interest. Directors and their advisors must remain vigilant particularly with recent changes to the Director Penalty Notice (DPN) regime reducing the reporting period on superannuation from three months to 28 days to avoid receiving a lockdown DPN, as explained in our article: Director penalty notice change to superannuation rules.

The STP implementation, the superannuation amnesty, and the reduced reporting time for superannuation under the DPN regime are all measures that indicate the ATO is sending a clear message to small business: its efforts are squarely focused on ensuring businesses meet their superannuation obligations. With that in mind, it is vital that advisors work with their clients to proactively rectify any non-compliance. An upfront discussion with the ATO addressing any issues along with the potential savings under the amnesty could be the difference between the company’s survival or demise—and its directors—should an ATO audit uncover any shortcomings. In one Worrells administration, we reconstructed records that culminated in—for one quarter alone—a Part 7 penalty of $31,000, nominal interest of $47,000, and the administration fee for 199 employees totalled $4,000. This amounts to a substantial sum totalling $82,000 plus the actual superannuation amounts owing.

We encourage advisors and their clients to see this as ‘short term pain’ for a long-term gain for peace of mind that employee entitlements are correct—and the ATO won’t need to delve deeper into these tax affairs. If you have any concerns about your clients and their superannuation guarantee obligations, please contact your local Worrells partner.

[1] Limited information on which funds and commencement detail available at the time of publishing.