Business now firing on all cylinders.

A director of a diesel mechanics business operating on the Sunshine Coast was severely impacted by a range of extreme business pressures and culminated with a very difficult personal loss. These events were:

During the peak of the COVID-19 pandemic, the business suffered a significant loss in its customer base.

To adjust to the change in customer base, the staff had to be adjusted accordingly which resulted in employee entitlement expenses (not foreseen and allowed for in capital reserves).

Tax debt accrued from staff downsizing, protracted customer payment terms, slow debtor payments, and non-payments.

The director suffered a personal loss to his home due to a storm event in 2022. Subsequently the director and his family were without essential services for 18 months and became engaged in a dispute with the insurers (still ongoing).

All these emotional and financial strains also put additional pressure on being able to smoothly manage the business operations.

When the director came to discuss the position with me, the two main debts owed were to the Australian Taxation Office (ATO) for approximately $157,000 and to the Queensland Rural and Industry Development Authority (QRIDA) for $250,000. The Authority had granted COVID-19-related financial assistance to the company.

The director was confident of the company’s long-term profitability and appointed me as small business restructuring practitioner. The director also took several steps to address the company’s operating costs with cost-cutting measures actioned to ensure future viability.

Offer under restructuring plan:

Monthly instalments over 36 months.

Payments made from future trading revenue.

Creditors to receive 20 cents in the dollar.

Creditors accepted the offer. The director was trading on the business with certainty about the future and without the significant overhead of debt and associated personal stress. Six employees’ jobs were also saved and secured for the future.

This case is just one of many success stories. This year alone, the Worrells principals across Australia have been appointed to over 80 SBRs since the beginning of the year.

So, how do small business restructuring appointments work, exactly?

First of all they only apply to companies that meet the following qualifying criteria:

Debts under 1 million.

Up-to-date employee entitlements.

Current ATO lodgments up to date.

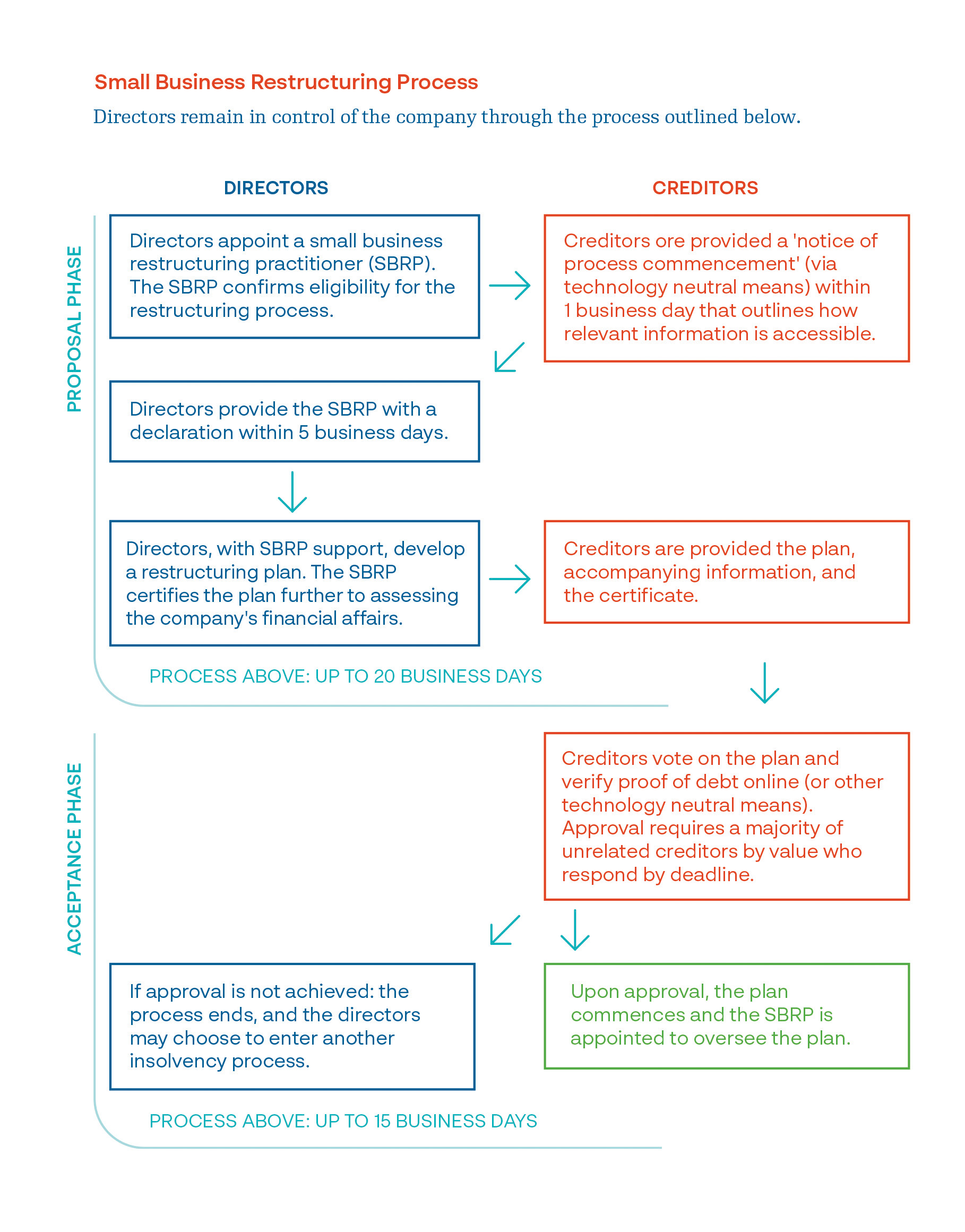

The process lasts 35 business days (extendable by 10 business days). The main steps in the process from the directors and their advisors are:

Engage a SBR expert who is qualified to administer (all registered liquidators are entitled to act and be appointed as a restructuring practitioner).

Collaborate with SBR expert to develop a strategic plan.

The SBR expert then:

Validates the plan with ATO and other creditors.

Certifies the restructuring plan and presents to creditors.

Has creditors vote (excluding related creditors).

Implements restructuring plan upon approval.

The following flowchart assists in visualising the process.

What do you need to do?

Pick up the phone and call. I will provide a free 30-minute consultation to review and advise whether an SBR can save your client's business.

The sooner we work together, the greater the chance we can save your client.

Source: ASIC Insolvency Statistics (Current) – Series 1 & 2 (23 October 2023) https://asic.gov.au/regulatory-resources/find-a-document/statistics/insolvency-statistics/insolvency-statistics-current/