Will your clients be part of the insolvency debt book recovery?

During the COVID-19 pandemic, the Australian Taxation office (ATO) paused all collection activities. The ATO’s decision intended to give businesses an opportunity to recover, following the hit suffered from lockdowns and the unprecedented lull in economic activity.

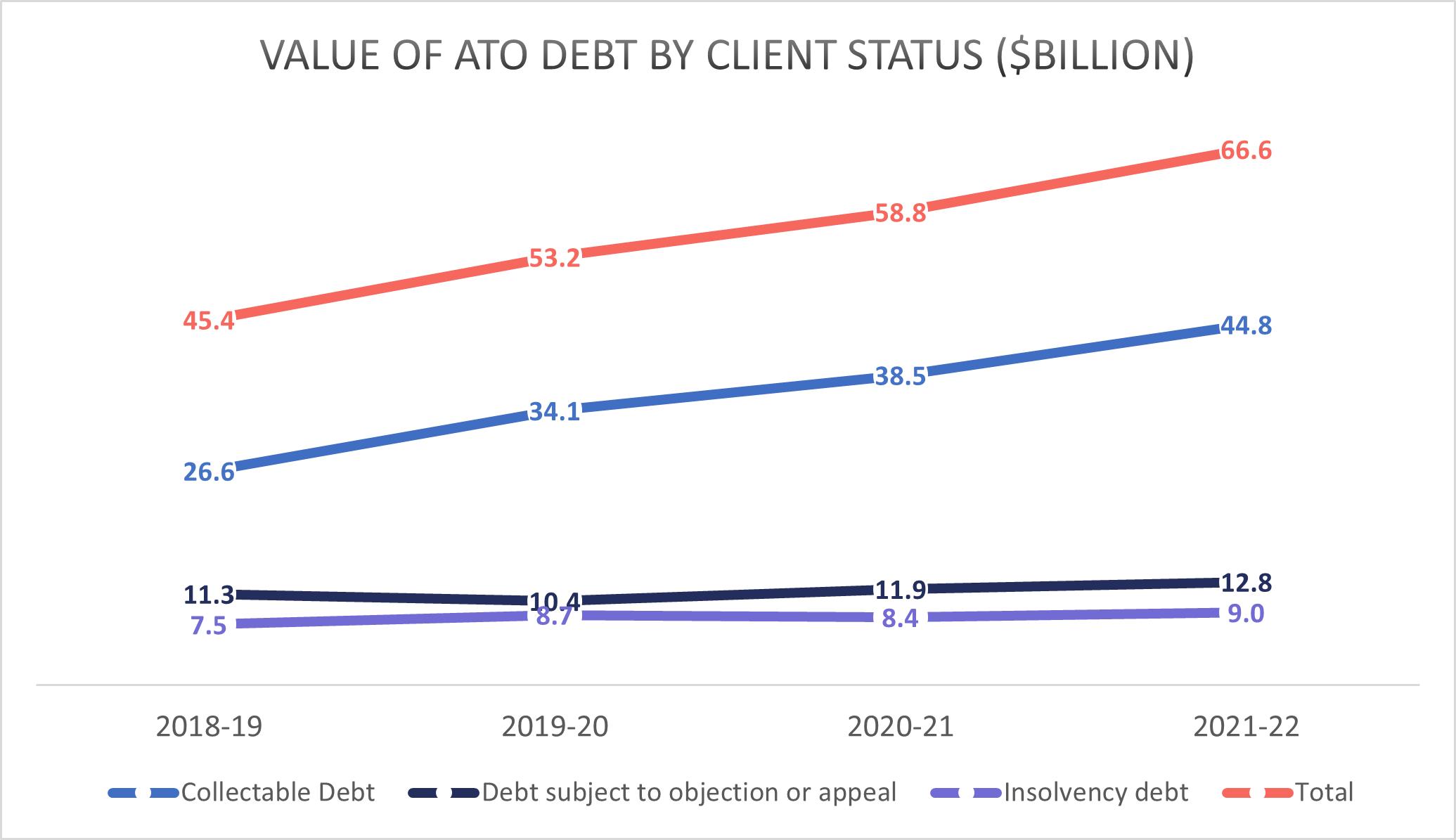

This pause in ATO debt recovery meant its total book debts sat at $66.6 billion at the close of the 2022 financial year. This is an increase of 13.27% on the 2021 financial year, and a 25.19% increase since the pandemics start. The increase in the value of the total debt holdings reflects the ongoing impacts on businesses’ cash flow in the challenging post-pandemic economic environment. Conversely and due to the ATO’s pause, its insolvency debt remained steady throughout the course of the pandemic.

As small businesses account for 53% of the total debt book, these taxpayers undoubtedly remain a key focus for the ATO’s payment and debt strategies. If you’ve followed our On The Pulse articles, you’ll know the ATO recommenced its collection activities earlier in the year. And undoubtedly you’ve noticed an increase in your clients receiving ATO payment notices and demands.

In Episode 5 of our Worrells Webinar series in October, we had the pleasure and benefit of an ATO guest speaker enlightening our attendees on the ATO’s current approach to tax debt and lodgment obligations. It was emphasised that since collection processes resumed, the ATO was taking a timely and tailored approach to client’s debts, with its primary strategy being to engage, communicate, educate, and assist clients.

The ATO’s strategies include much of its former offerings, but with a more client-concerted focus, along with some new processes; summarised below.

Prevention and early intervention such as:

an enhanced engagement program through a series of awareness campaigns

the use of tailored analytics to identify clients suited to receive automated SMS reminders, debt demand, firmer-action warning letters, and re-engagement letters

engagement programs for tax practitioners

streamlining its online payments systems

engaging clients to enter into payment plans. The ATO will try to negotiate a payment plan that best suits a client’s particular circumstances. In less complex situations, clients can set up payment plans through ATO online services, for debts up to $100,000 and payment terms under two years.

A gradual return to business as usual with “firmer and stronger action” such as:

issuing garnishee notices and director penalty notices (DPN)

disclosing the business tax debt to a registered credit reporting bureau (CRB) following a notice of intent, if necessary action to manage the debt is not taken within 28 days

obtaining court judgments and issuing bankruptcy and winding up proceedings.

In its 2021-22 Annual Report, the ATO released the following statistics, illustrating the success of the awareness and engagement piece.

“In March 2022, we wrote to approximately 30,000 businesses and 52,000 directors with significant tax obligations outstanding, through 2 key client awareness programs that focused on transparency of clients’ obligations, actions and remediation. In total these clients owed $10.4 billion. As a result of this initiative:

over 25,000 clients contacted the ATO

more than $2.21 billion has been paid outright

over 13,000 clients entered into payment plans worth $2.16 billion

over 3,200 clients no longer have a debt and more than 850 others have debts that are no less than $10,000.

For those that did not engage with the ATO, we escalated to enforcement actions – including issuing director penalty notices with respect to more than 2,800 companies since 1 May 2022.” [2]

We note that the ATO is currently averaging 300 DPNs each business day, with this number continuing to increase.

The key takeaways from our ATO guest speaker are:

The ATO’s top focus for collections is currently small business clients with superannuation guarantee charge (SGC) debts, and clients with the largest debts.

Clients must ensure they complete their lodgments even if unable to pay the associated liabilities. Having transparency of the client’s debt position will enable the ATO and the client to reach an agreed payment plan in a timelier manner.

Clients should engage with the ATO about their circumstances early.

No matter at which point in the process, the ATO will work with clients to get the best outcome to assist them in meeting their obligations.

Where clients fail to work with them or take appropriate action to resolve their situation on their own, it is business as usual for the ATO, and it will take the necessary action to resolve it.

With collection activities restarting, we would expect that the ATO’s collectable debt will begin to decline, not only from recovering debts, but also a conversion to insolvency debt. It is these clients who are unable to meet their tax obligations that will instead find themselves needing an insolvency practitioner if they don’t act fast and engage with the ATO. We hope this article is a timely reminder for tax agents and clients alike to conduct financial health checks, and if required, have those tough conversations with clients who may be in a space of denial.

As always, if you or your clients want to understand the options in view of their particular circumstances around formal insolvency appointments, including if the small business restructuring regime is suitable, please reach out to your local Worrells office for a complimentary discussion.

Related articles:

Director penalty notices have arrived

Royal assent for ATO to disclose business tax debt information

ATO garnishee notices: can stop businesses in its tracks

[1] Australian Taxation Office – Commissioner of Taxation Annual Report 2021-22 https://www.ato.gov.au/uploadedFiles/Content/CR/Downloads/Annual_Reports/n0995_ATO_annual_report_2021-22_Digital.pdf

[2] Australian Taxation Office – Commissioner of Taxation Annual Report 2021-22