A sign of changing times, or the calm before the storm?

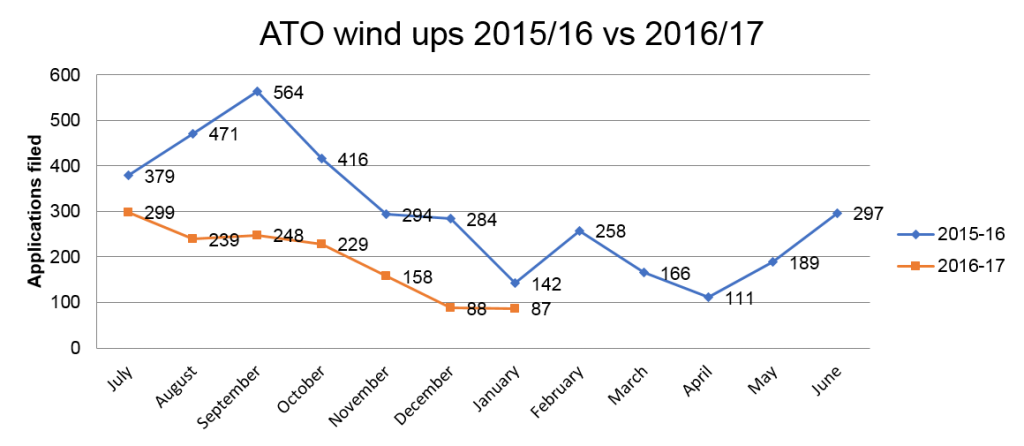

As most advisors would be aware, the Australian Taxation Office (ATO) is very active when it comes to court winding-up applications filed against delinquent debtors. But just how active is the ATO at present? The current level of winding-up applications being filed by the ATO appears to be on the decline with statistics collated from the ASIC Published Notices website showing a steady decease since July 2016. On a month by month comparison we have seen the number of winding-up applications filed by the ATO fall from 299 in July 2016 to only 88 in December 2016 and 87 in January 2017. In comparison, the applications filed by the ATO in December 2015 and January 2016 were 284 and 142 respectively. So are we seeing a permanent reduction in ATO winding-up activity or is this simply the calm before the storm? The decline in winding-up activity appears to be in contrast to statements made by the ATO in August 2016 when it stated it would be taking timely and stronger action against small businesses with outstanding debts. A spokesperson for the ATO at the time said that “The community has told us they want firmer treatment of tax debtors.” The spokesperson further advised that “Businesses that ignore their obligations will receive timely, firmer action from the ATO. This will include legal action where there is evidence the business is insolvent.” It may be that we are simply seeing a lag between the ATO implementing their policy of firmer action and a resulting increase in applications. It is possible that the recent ATO system crash and associated portal issues may have provided some debtors with a stay of execution. While we may not see a return to the level of applications being filed by the ATO in the middle of 2015 which peaked with a mammoth 564 applications in September 2015, an increase from current levels in the short term would not be surprising. As always, the advice to those debtors with accumulated tax debts remains unchanged. That is, it is not a question of will the ATO take some form of recovery action, but a question of when. Note: The data represented in this article and graph have been manually collated in-house from public resources.

Note: The data represented in this article and graph have been manually collated in-house from public resources.