It is no secret the Australian Taxation Office (ATO) has become a lot more aggressive and difficult to deal with for taxpayers in arrears of their tax obligations. Times have certainly changed from the COVID era when payment plans were readily accepted, with little scrutiny and often on extended terms, and interest waivers granted without question.

In more recent times we have seen a return to the days of ATO payment plans requiring a significant upfront payment, with terms commonly being limited to a maximum two-year period, and quite often a blanket “no” when it comes to requests to waive interest (in stark contrast to the COVID years where 9 out of 10 requests were granted).

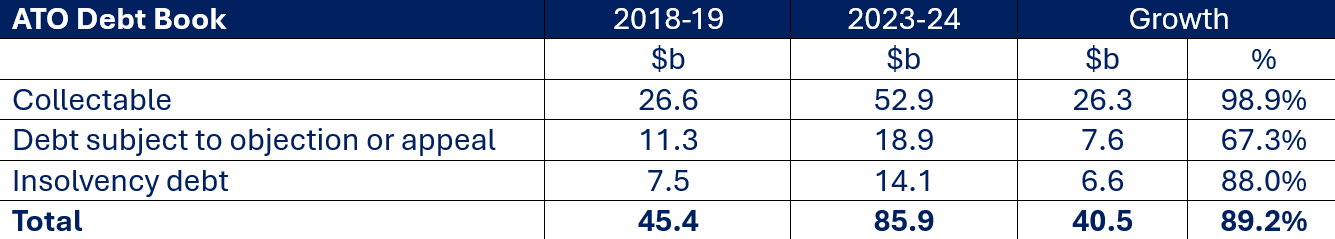

The landscape around ATO debt collection has certainly changed, and when looking at the growth in the ATO debt book, it is quite clear what is behind their aggressive approach:

We have seen the ATO debt book grow from $45.4b to $85.9b in the 5 years to 30 June 2024 – that’s an increase of $40.5b or 89.2%. While most of the growth in the debt book was over the COVID years, the numbers are nonetheless staggering and have not been brought back into the normal range since. Clearly this trajectory is unsustainable.

The ATO has been very public about their focus on a small group of taxpayers who exhibit the most non-compliant behaviour in avoiding their obligations:

This includes recently announcing that from 1 April 2025, they were moving 3,500 taxpayers from quarterly to monthly lodgments to “improve their compliance”. I am sceptical about whether this will achieve its intended purpose, and for me, it is perhaps more a case of it now being 12 times a year that those directors risk a lockdown DPN due to late lodgments, instead of 4 times with their current 1/4ly lodgments; and

In his opening statement to the Senate Economics Legislation Committee in February 2025, Commissioner Rob Heferen noted:

only 22,000 taxpayers were responsible for $11b of debt;

which is about 1% of total taxpayers responsible for 20% of collectible debt

The ATO has said that is where their focus lies.

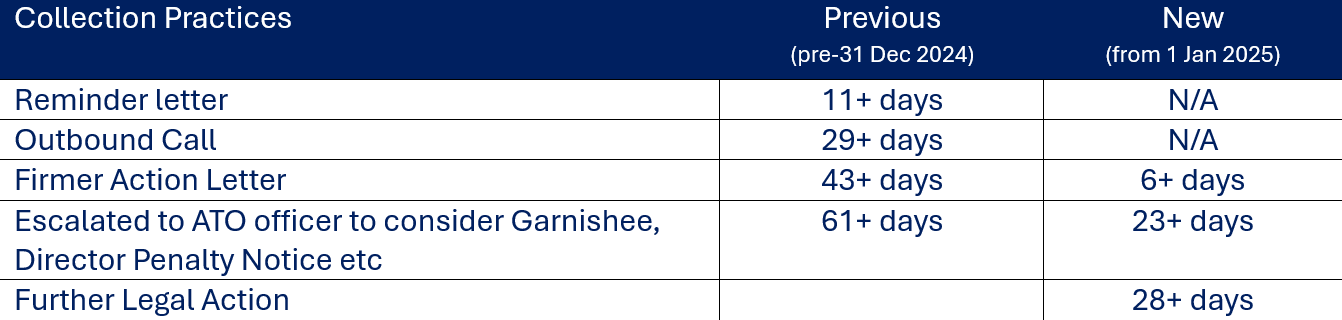

The ATO was also doing a roadshow last year announcing that collection practices for taxpayers who do not engage with the ATO will be a lot tighter and less forgiving from 1 January 2025. The previous and new collection timeframes implemented from 1 January this year are shown in the table below:

You will note that the window where the ATO uses a much softer approach to encourage payment, such as reminder letters or calls, has been removed, with the ATO going straight to a firmer action letter. And after that firmer action letter, they are implementing enforcement actions as quickly as 23 days from the date payment is overdue.

It’s fair to say we’ve certainly seen the ATO moving much more urgently to firmer action, deploying the full powers available to them, including reporting defaults to credit agencies, issuing DPNs and garnishee notices and taking wind up action.

We have also seen recent and pending law changes around:

Service of Director Penalty Notices, which has perhaps flown a little under the radar:

Previously, the Commissioner could rely on the ASIC records to determine the director’s address for the purpose of serving a DPN

Cases in the past have held directors liable where the ATO has used this address, when the director has said they didn’t receive it, as they have moved, as it is the director’s responsibility to keep the ASIC records up to date

However, the law now says, instead of using ASIC records, the Commissioner can rely on the records of the Registrar, which at the moment is himself, the Commissioner of Taxation, as part of managing the Director Identification regime

With the change around service of DPNs, it remains to be seen whether this opens up a new area to dispute the receipt of DPNs.

Legislation denying income tax deductions for amounts of General Interest Charge and Shortfall Interest Charge has now been passed into law (awaiting Royal Assent) for commencement on 1 July 2025. The timing is highly convenient for the Government, being the day before an election was called! There’s certainly a very clear message here from the Government, which is don’t use the ATO as a bank.

Not to mention Payday super which is scheduled to be effective from 1 July 2026. The Government has recently released exposure draft legislation and explanatory material, which was open for consultation until 11 April 2025.

There is a lot happening around collection of ATO debt, it’s all very fluid and given it pierces the corporate veil, high risk for your clients!

If you have any clients on the receiving end of ATO debt recovery, please reach out to your contact at Worrells for advice on the available options.