June quarter 2020 statistics in for corporate and personal insolvency.

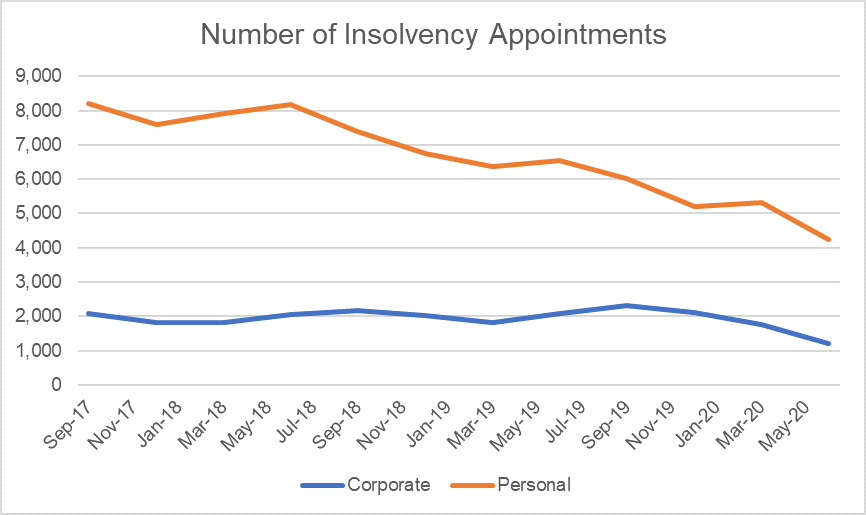

The long-term downtrend in insolvency appointments has accelerated in the June quarter 2020, with the largest quarterly drops in both corporate and personal insolvency ever recorded.

Personal insolvency

The Australian Financial Security Authority (AFSA) personal insolvency statistics for the June quarter of 2020 recorded an overall drop of 35% from the June 2019 quarter. This is the largest percentage fall in bankruptcy since quarterly statistics began in 1988.

Bankruptcies saw the largest decline, with a fall of 42%. Bankruptcies are now at their lowest level since 1989. Debt agreements also declined by a significant 25%, however, given recent growth, were not at all-time lows. Personal insolvency agreements also recorded a decrease of 10%, however on a significantly lower number of appointments than bankruptcy and debt agreements.

Decreases were records in every state and territory, with Tasmania recording the largest decrease (57,8%), while the largest states, New South Wales and Victoria, saw drops in the 30% range.

Corporate insolvencies

The corporate insolvency statistics released by the Australian Securities and Investments Commission also showed a record fall, with corporate insolvency down 42% from the June 2019 quarter. This is the lowest level of corporate insolvencies since the September quarter of 2001.

Decreases were seen across all types of corporate appointment, except for receiverships, which increased by 61%. However, significant drops were seen across the most popular appointment types, court wind-ups (61%), creditors' voluntary liquidations (40%) and voluntary administrations (32%).

Reasons for the decrease

These record-setting decreases in both personal and corporation insolvency appointments appear to be the result of government intervention to support business and jobs and protect directors from potential liability. Measures such as the JobKeeper payments, the moratorium on collection action by creditors, and an amnesty to protect directors from potential insolvent trading claims.

Without these measures, we would have expected to see an increase in insolvency appointments as several indicators that usually correlate with an increase in insolvency activity have been present over the last two quarters.

Looking forward

With the extension of several of the government support policies, in particular JobKeeper, we expect that insolvency activity will remain depressed over the rest of 2020.

However, indicators such as consumer confidence (which have been negative since later 2019), business confidence (negative through all of 2020) and the unemployment rate (sharply up since April 2020) all point to towards more significant insolvency activity.

It appears likely, based on current timetables, that support measures will be withdrawn before the economy has had the opportunity to recover fully. Once these support measures begin to expire or be wound back, we expect that both personal and corporate insolvency appointment will return to levels above those seen in 2019.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.