Record breaking numbers of corporate insolvency appointments likely to continue.

On 22 April 2024, ASIC (Australian Securities & Investments Commission) released corporate insolvency statistics for the month of March 2024, and it was a new record. According to the official ASIC data 1,136 companies entered into external administration or had a controller appointed. This beat the previous record of 1,123 way back in February 2012.

There is a surprising link between these 2 records, and that is their relative proximity to the 2 largest economic downturn events this century, the Global Financial Crisis (GFC) and COVID-19.

The GFC-fuelled downturn hit the Australian stock market occurred in January 2008, 4 years and 1 month prior to the previous record of 1,123 corporate insolvencies in February 2012.

COVID-19 business restrictions commenced in March 2020, 4 years prior to the new record in March 2024.

The financial year of 2011/2012 also set the record for the most companies entering external administration, with 10,757. We appear on target to reach a similar number this year. So, does that mean that we are likely to be seeing a peak in corporate insolvency appointments in the recovery from COVID-19?

Sadly, I think the answer to that question is probably no. There are a few key distinctions between the current circumstances and what occurred in 2011/2012:

The amount of taxation debt – In 2012 the ATO’s collectable debt was over $19b and they were in full debt recovery mode, with hundreds of wind-up applications in Court every month. In 2024, the collectable debt exceeds $50b and the ATO is yet to hit its peak in terms of wind-up applications.

The way things unfolded – throughout the GFC and its recovery (from 2008 to 2014), corporate insolvency appointments were at record high levels. Conversely, from 2020 to 2022, we experienced 20-year lows in appointment numbers, due primarily to government stimulus, decreased tax collection and moratoriums on debt collection activities.

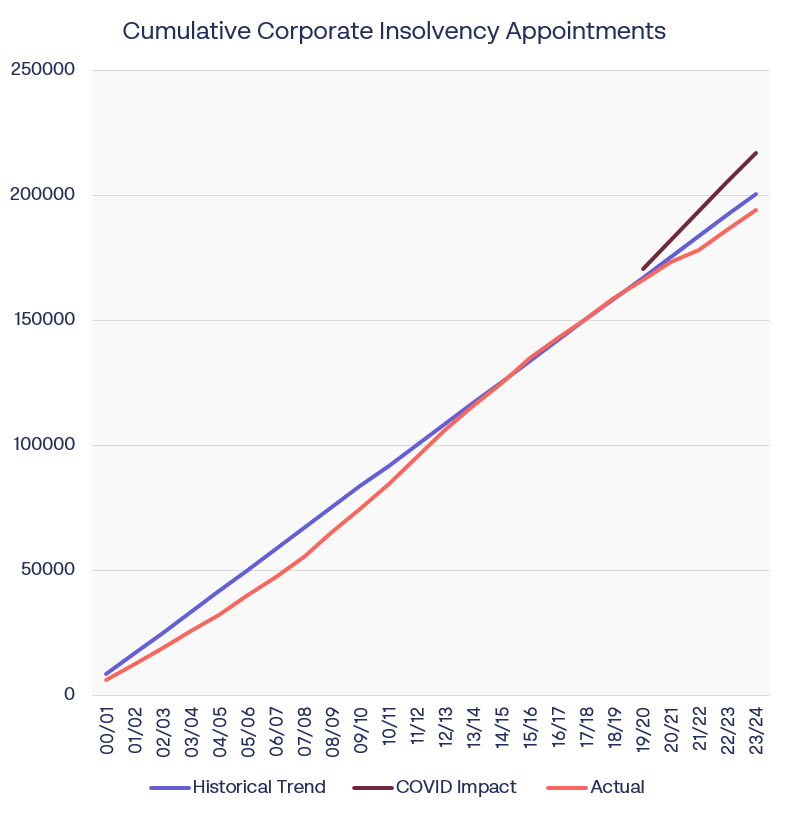

Trend analysis – expanding on the previous point, total cumulative appointments, based on average appointments between July 2000 and February 2020, is well behind where it would have been had appointments followed historical trends, with almost 7,000 additional appointments required to get back on to the historical trend line.

Likely increase beyond historical trends – In the 5 years following the GFC, there was an average increase of 39% compared to the 5 years immediately prior. There is a high likelihood of a similar increase in appointments as a consequence of COVID, but that increase is yet to show through in the appointment data. If we assume a similar increase as a consequence of COVID, then the hypothetical gap between actual appointments and the appointments that need to occur increases substantially to around 22,800.

The following graph depicts the theoretical gap between actual appointments to date, and those which theoretically may need to occur based on the historical trends.

In summary, the economic impact of COVID-19 played out very differently to the GFC. The fact that we have now broken a record for insolvency appointments, set back then, is probably just the tip of the iceberg. I expect that we will continue to see that record broken throughout the remainder of this year, and beyond. But, I never was any good at reading crystal balls.