However a range of indicators say an uptick is imminent.

While insolvency appointments remained depressed in the September quarter of 2020, we are starting to see signs of growth in appointments. And a range of indicators are pointing towards a significant uptick in insolvency appointments from early next year.

Personal insolvency

The Australian Financial Security Authority’s (AFSA) personal insolvency statistics for the September quarter of 2020 recorded an overall drop of 50% compared to the September 2019 quarter. This is a record drop, exceeding last quarter’s then record fall by 15%.

As would be expected, all three forms of appointments saw significant declines, with both bankruptcies and personal insolvency agreements reaching the lowest level since record keeping began in 1986. At the same time, debt agreements were at their lowest level since 2006.

AFSA also released some detailed statistics on business-related personal insolvencies. In the September quarter, business-related personal insolvencies accounted for 27% of personal insolvencies. This is in line with the usual trend, where business-related personal insolvencies tend to comprise between 24% and 28% of total personal insolvencies. Accordingly, it appears that the support measures related to the COVID-19 pandemic that are largely responsible for the downturn in total insolvencies, have not had a significant impact on the share of personal insolvencies related to business.

AFSA also recently released statistics about the types of debts that business-related personal insolvencies have. Banks and business debts (mainly trade creditors) comprise 35% and 32% respectively of the debts in business-related personal insolvencies. Debts due to the Australian Taxation Office (ATO) make up another 17%. Together these three categories of debt comprise the majority of claims in business-related personal insolvencies.

Corporate insolvency

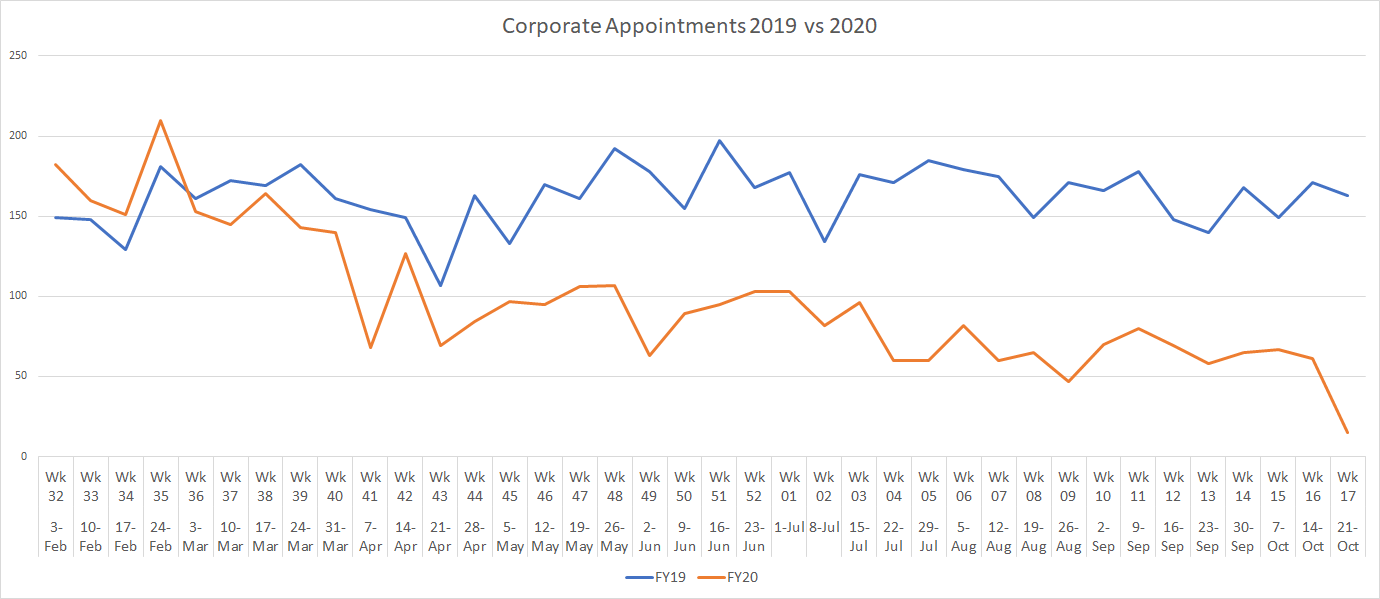

The Australian Securities and Investments Commission (ASIC) is also providing regular updates on the number of corporate insolvency appointments; and there has been a similarly significant downturn in appointments. Corporate insolvency appointments for the September quarter of 2020 recorded an overall drop of 43% compared to the September 2019 quarter. The reduction in appointments in 2020 is evident in the chart below.

Signs of future growth in insolvency

While the number of insolvency appointments has been low, there has been significant growth in areas that indicate a wave of insolvency appointments is likely on the horizon.

Earlier this month, the ATO issued its annual report[1] and disclosed that debt collection activity fell $1.3b short of projections after halting its debt collection activity in response to the COVID-19 pandemic. Additionally, it noted that lodgement performance had dropped, with only 74.6% of Business Activity Statements now being lodged on time. Tax debt is one of the major drivers of insolvency in Australia, especially in the corporate space. This report from the ATO shows that there has been significant growth in both unpaid and unreported taxation liabilities. When the ATO recommences debt collection activities, we expect to see a significant uptick in insolvency appointments.

We are also seeing evidence of significant bad debt accumulating on balance sheets. Earlier this week, the ANZ reported its financial results for the year ending 30 June 2020. The bank took a credit impairment charge (i.e. where the carrying value of an asset is reduced because the recoverable value has decreased) of $2.74b—$2b more than the charge it incurred a year ago. This indicates the ANZ anticipate a significant increased in bad debts in the coming year.

Credit Watch also noted in their September Business Risk Review[2], that the number of business defaults increased in August 2020 by 23%. This was the first increase they had seen since May.

Finally, the growing buy-now-pay later industry has seen accelerated growth through the COVID-19 pandemic. These services generally require only cursory credit checks to access finance, allowing distressed individuals to use them as a quick source of funding. This makes them a relatively high risk of default compared to more traditional financing methods, which have a more difficult application process. We are already seeing a small uptick in the contribution of buy-now-pay-later services to personal insolvencies in AFSA statistics, with these services increasing from 0.96% a year ago to 1.5% of finance debts in bankruptcies in the September 2020 quarter.

All of these factors combined with the roll-out of new corporate insolvency appointment types at the start of 2021, which are anticipated to be cheaper and easier for small business to access than under the existing regime, point towards significant growth in insolvency appointments in early to mid-2021.

[1] https://www.transparency.gov.au/annual-reports/australian-taxation-office/reporting-year/2019-20

[2] https://creditorwatch.com.au/blog/brr-september/

.png?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=800&h=480&q=25&blur=5&sat=-100)