No tsunami but changes aplenty.

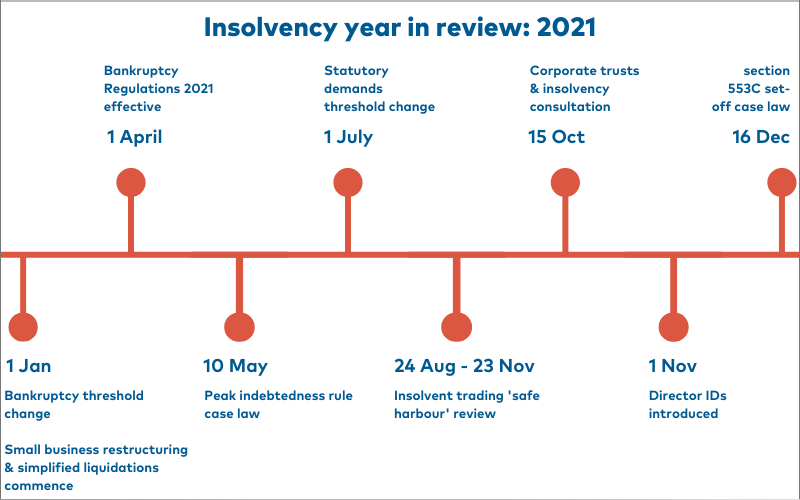

As we embark on the New Year, let’s quickly recap some of the legislation changes, significant cases, and other interesting issues that impacted the insolvency landscape in Australia during 2021. New bankruptcy threshold of $10,000 On 1 January 2021, the personal bankruptcy threshold permanently changed with the minimum amount of debt that can trigger bankruptcy now $10,000. The $10,000 limit replaced the temporary threshold of $20,000, which the government implemented as part of its response to the COVID-19 pandemic in March 2020. Notably, prior to COVID-19’s onset, the threshold was $5,000. Small business restructuring process 1 January 2021 also saw the new small business restructuring process (SBRP) and simplified liquidations commence. Touted by the government as part of the most significant changes to the insolvency framework in almost 30 years, the new legislation can only be described as a fizzer with a meagre 30 SBRP appointments and 19 converting to restructuring plans across the country to 30 November 2021. Bankruptcy Regulations 2021 On 1 April 2021, the Bankruptcy Regulations 1996 were replaced by the Bankruptcy Regulations 2021. These amendments are largely minor and technical in nature, aimed at modernising references, ensuring alignment with the Bankruptcy Act 1966, and clarifying provisions that previously caused confusion or administrative inefficiencies. Badenoch and the peak indebtedness rule On 10 May 2021, the Federal Court delivered its judgement in the matter of Badenoch Integrated Logging Pty Ltd v Bryant, in the matter of Gunns Limited (In liq) (receivers and managers appointed) [2021] FCAFC 64. The Full Court held that the peak indebtedness rule is no longer applicable to section 588FA(3) of the Corporations Act 2001. This means, liquidators cannot choose the date of “peak” indebtedness in the relation-back period to result in the largest potential quantum of an unfair preference claim. (Click here to read our article on this topic). Statutory demands threshold of $4,000 From 1 July 2021, the statutory minimum for a creditor to issue a statutory demand to a company increased to $4,000. Previously, this amount was a minimum of $2,000. Review of the Insolvent trading safe harbour An independent panel undertook a three-month review between 24 August and 23 November 2021 into the insolvent trading ‘safe harbour’ regime. The government is assessing whether the safe harbour provisions remain fit for purpose and its benefits can extend to as many businesses/directors as possible.[1] Corporate trusts & insolvency On 15 October 2021, Treasury opened consultation[2] to seek stakeholder views on whether the treatment of corporate trusts in insolvency law must be clarified; and to gain input on the benefits this could deliver, and how any new framework might operate. Director identification numbers 1 November 2021 introduced the requirement for company directors to obtain a director identification number to help prevent fictitious director identities being used; help regulators trace directors’ relationships with companies over time; and better identify director involvement in unlawful activity such as illegal phoenix activity. Unfair preferences and section 553C set-off In a win for liquidators, on 16 December 2021, the Full Court of the Federal Court of Australia delivered the much-anticipated judgement in Morton as Liquidator of MJ Woodman Electrical Contractors Pty Limited v Metal Manufacturers Pty Limited [2021] FCAFC 228. In this case the Full Court found that a creditor cannot rely on the statutory set-off under section 553C(1) of the Corporations Act, against a liquidator’s recovery of an unfair preference under section 588FA of the Corporations Act. (Click here to read our article on this topic). Insolvency tsunami? Probably the biggest insolvency story of 2021 was the tsunami of insolvency appointments—that never arrived! Formal insolvency appointments were around 30-40% lower than pre-COVID-19 levels and while there was a small increase during 2021, the expected wave of insolvencies as a result of COVID-19 did not materialise as widely purported by the media during 2021.

Badenoch and the peak indebtedness rule On 10 May 2021, the Federal Court delivered its judgement in the matter of Badenoch Integrated Logging Pty Ltd v Bryant, in the matter of Gunns Limited (In liq) (receivers and managers appointed) [2021] FCAFC 64. The Full Court held that the peak indebtedness rule is no longer applicable to section 588FA(3) of the Corporations Act 2001. This means, liquidators cannot choose the date of “peak” indebtedness in the relation-back period to result in the largest potential quantum of an unfair preference claim. (Click here to read our article on this topic). Statutory demands threshold of $4,000 From 1 July 2021, the statutory minimum for a creditor to issue a statutory demand to a company increased to $4,000. Previously, this amount was a minimum of $2,000. Review of the Insolvent trading safe harbour An independent panel undertook a three-month review between 24 August and 23 November 2021 into the insolvent trading ‘safe harbour’ regime. The government is assessing whether the safe harbour provisions remain fit for purpose and its benefits can extend to as many businesses/directors as possible.[1] Corporate trusts & insolvency On 15 October 2021, Treasury opened consultation[2] to seek stakeholder views on whether the treatment of corporate trusts in insolvency law must be clarified; and to gain input on the benefits this could deliver, and how any new framework might operate. Director identification numbers 1 November 2021 introduced the requirement for company directors to obtain a director identification number to help prevent fictitious director identities being used; help regulators trace directors’ relationships with companies over time; and better identify director involvement in unlawful activity such as illegal phoenix activity. Unfair preferences and section 553C set-off In a win for liquidators, on 16 December 2021, the Full Court of the Federal Court of Australia delivered the much-anticipated judgement in Morton as Liquidator of MJ Woodman Electrical Contractors Pty Limited v Metal Manufacturers Pty Limited [2021] FCAFC 228. In this case the Full Court found that a creditor cannot rely on the statutory set-off under section 553C(1) of the Corporations Act, against a liquidator’s recovery of an unfair preference under section 588FA of the Corporations Act. (Click here to read our article on this topic). Insolvency tsunami? Probably the biggest insolvency story of 2021 was the tsunami of insolvency appointments—that never arrived! Formal insolvency appointments were around 30-40% lower than pre-COVID-19 levels and while there was a small increase during 2021, the expected wave of insolvencies as a result of COVID-19 did not materialise as widely purported by the media during 2021. Review of the insolvent trading safe harbour.

Clarifying the treatment of trusts under insolvency law.