Advisors must prioritise a plan for lodgment due dates.

A company structure is often praised for its asset protection benefits, as the 'corporate veil' can shield the directors from personal responsibility for the company's debts. However, in recent times, directors have been increasingly exposed to personal liability for company debts, sometimes unknowingly, especially concerning unpaid and unreported liabilities owed to the Australian Taxation Office (ATO) due to the lockdown director penalty provisions (lockdown DPN).

Lockdown DPNs

Advisors and directors must be aware of the automatic exposure for directors in lockdown DPNs (director penalty notices).

A lockdown DPN applies when:

a company failed to lodge its business activity statements (BAS) and instalment activity statements (IAS) within three months of the due lodgment

superannuation guarantee charge (SGC) statements within one month and 28 days after the end of the quarter that the superannuation charge contribution relates to.

In such cases, the director’s exposure to the penalty is automatic and permanent. A director does not need to have been issued a notice (DPN) for the exposure to exist and there is no ability to remit (i.e. cancel) the penalty, other than by paying the debt in full. To avoid this exposure, directors must ensure they complete their lodgments even if unable to pay the associated liabilities.

Case example

For instance, let's consider the scenario where a director operates on a quarterly BAS reporting cycle and business activities during the June quarter results in a GST liability of $10,000.

Normally, the June quarter BAS lodgment is due by 28 July. However, the director fails to lodge the BAS within three months (i.e. by 28 September), the director becomes personally liable for the $10,000 liability, and there is no possibility of remitting this “director penalty”.

In recent months we are seeing increasing situations where company directors have let their ATO obligations go by the wayside, with many having lodgments outstanding for many months, and in some cases, years. Often it is a surprise to advisors and directors that the lockdown DPN provisions means there is personal exposure that cannot be remitted by appointing an external administrator (as in the case of non-lockdown director penalties).

Due dates

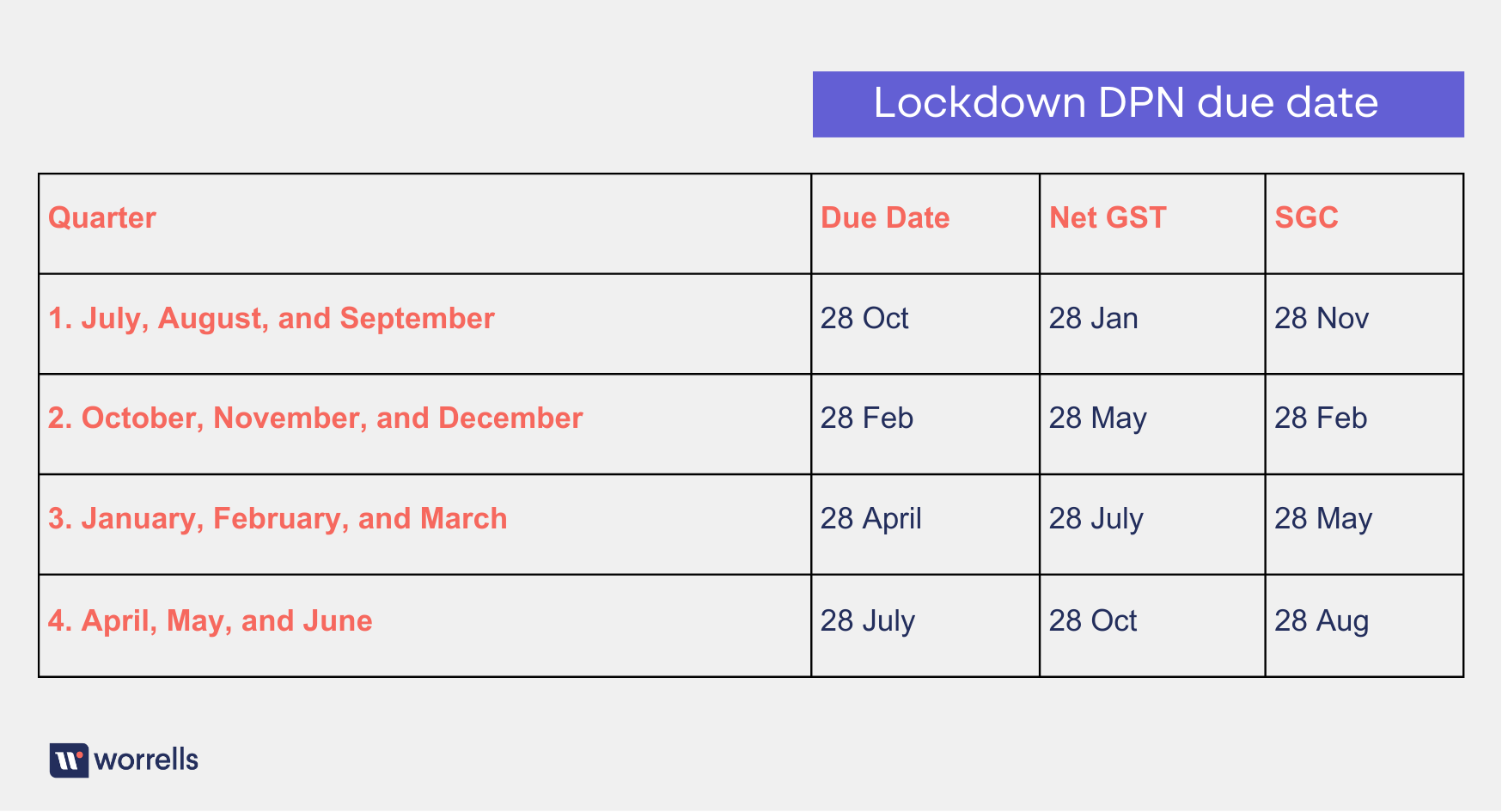

The lodgment due dates are critical; directors and advisors must now have a plan and reminder in place to ensure a company meets its lodgment dates on time. As an example, directors and advisors must ensure that they are aware of the lockdown DPN due dates for quarterly reporting, see the table below.

If a registered tax or BAS agent is used, different dates may apply.

Recovery action

After being issued a lockdown DPN—receipt is not legally required, just that it was issued—directors have 21 days to either:

pay the corresponding penalty amounts in full

engage with the ATO and negotiate a payment plan for the company debt.

Notably, the ATO may still offset personal tax credits against this debt.

The ATO can also recover the penalty by:

issuing garnishee notices

offsetting any director’s personal tax credits against the director penalties

initiating legal recovery proceedings against the director to recover the director penalty.

Worrells can help

If you’re concerned about a director’s exposure to a ATO debt, please speak with your local Worrells Principal. We’re here to help and can take you through the practical solutions available.