When resigning is not abandonment, but fulfilling your duty to the company and to yourself

Business relationships are no different from personal ones; they can be affected by conflict, emotion, and breakdown.

Breakdowns in relationships can arise for many reasons and are such a core part of the human experience that an extreme version can be seen at the start of the Bible in the Book of Genesis, where Cain murders his brother Abel. It took a whole 4 chapters of the book to get to fratricide [1]. Like family relationships, business relationships can be driven by emotions rather than the objective duties of directors. When emotions run high, directors’ duties and rational decision-making can take a back seat. This article aims to highlight when it might be wise to consider stepping down as a director to protect yourself.

Being a company director in Australia carries serious legal responsibilities. The Corporations Act 2001 (Cth) imposes duties that directors cannot ignore. When a company becomes dysfunctional or financially distressed, or when a director no longer has access or influence over key decisions, remaining in office can expose that director to significant personal liability. In these situations, a timely and informed resignation may not only be appropriate but necessary.

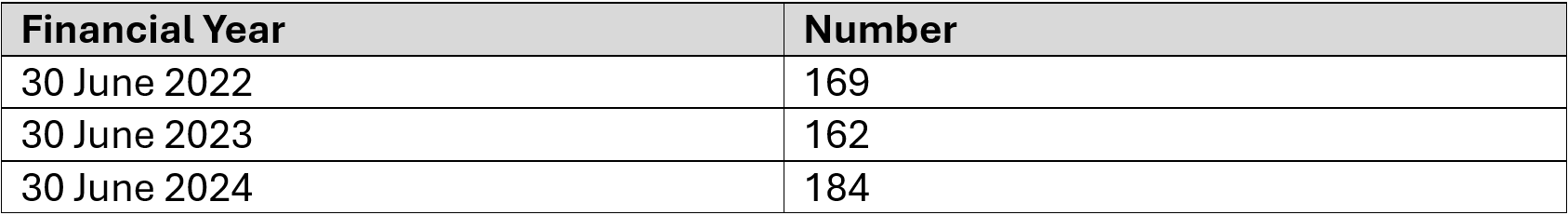

The Numbers

Disputes amongst directors can lead to the failure of a business. Based on liquidator reports to ASIC, on average, there are 172 corporate business failures per year that are the result of a dispute amongst directors:

Admittedly, that’s a small percentage of the total number of companies that enter external administration each year. Based on anecdotal experience, I suspect that the real number is higher, or liquidators have chalked disputes up to be a symptom rather than the cause of a business failure.

When resignation becomes necessary

Resignation may be necessary when:

You no longer have access to financial records.

You are excluded from key decisions.

Other directors are engaging in unlawful conduct.

The company is trading while insolvent, and members/directors refuse to place it into external administration.

In these scenarios, a director risks personal liability by remaining in office. Timely resignation can protect you, but it must be properly executed.

Legal Duties of Directors

Directors must exercise:

Care and diligence (s180): Directors must stay informed and actively oversee the company’s affairs. The "business judgment rule" under s180(2) protects directors if decisions are made in good faith and on a properly informed basis.

Good faith and proper purpose (s181): Directors must act in the best interests of the company, not for personal benefit.

Proper use of position and information (ss182-183): Misusing company position or confidential information is strictly prohibited.

No reckless or dishonest breaches (s184): Breaches involving recklessness or dishonesty attract civil penalties and potential criminal prosecution.

Prevent insolvent trading (s588G): Directors must not allow the company to incur debt when it is insolvent or where insolvency is likely.

These obligations require directors to be active, informed, and involved. Ignorance or passive reliance on others is not a defence. In Daniels v Anderson (1995), the Court made clear that all directors, executive or not, must understand the business and supervise its affairs and cannot rely solely on others’ advice or delegate responsibilities without oversight.

Director Penalty Notices (DPNs)

The ATO can issue DPNs [2] to hold directors personally liable for unpaid company tax obligations, such as PAYG, GST, and superannuation.

Non-lockdown DPNs allow 21 days for the director to act: pay the debt or place the company into administration, liquidation or small business restructure.

Lockdown DPNs arise where the company has failed to lodge returns within 3 months of their due date. The director becomes automatically liable, and resignation or liquidation offers no protection.

Resignation does not shield directors from DPNs relating to debts incurred while they held office. However, if you have lost control over the Company or do not have insight into the Company’s tax liabilities, you are at risk of being made personally liable for any ongoing/future unpaid Company tax debts if you do not resign as a director. Depending on the size of the business, this could be thousands or millions of dollars in a worst-case scenario.

Insolvent trading risk

Directors are liable for debts incurred while a company is insolvent under s588G [3].

If you are a director while the Company is trading insolvent, then you could be liable for an insolvent trading claim, regardless of whether you had access to the Company’s financial records or were able to influence decision-making. In a case where a company is trading insolvently [4], the sooner you resign, the shorter your period of exposure is.

Voluntary Administration as an alternative

Disputes can also arise between directors and shareholders/members. Directors carry the above risks while members carry none. If a company is insolvent and shareholders/members refuse to pass a resolution to place the company into liquidation, directors still have the ability to act. Under Part 5.3A of the Corporations Act, a director can appoint an external administrator to take control of the company via voluntary administration.

Voluntary administration provides breathing room while an independent administrator assesses the company’s financial position and recommends a course of action. This can lead to a deed of company arrangement (DOCA), liquidation, or return of control to the directors. Crucially, appointing a voluntary administrator can offer directors protection from insolvent trading liability if the appointment is timely and in accordance with the law.

This mechanism can be especially important where internal deadlock or shareholder inaction is preventing responsible decision-making. Directors must not allow the company to continue trading whilst insolvent simply because members won’t act. If you cannot secure the necessary resolution to wind up the company, initiating a voluntary administration may be the most appropriate and legally defensible course.

Lack of control Is No Defence

A director who is shut out of decisions or denied access to records is still liable unless they take reasonable steps. Courts have rejected arguments based on a lack of knowledge when the director failed to make appropriate inquiries. In Daniels v Anderson, the director's failure to understand and investigate financial dealings led to personal liability.

Directors must insist on visibility. If blocked, they must escalate, formally protest, or resign. Remaining silent while being sidelined is not a legal shield.

How to resign effectively

Submit a written notice stating the resignation date.

Ensure ASIC is notified (Form 484 or Form 370) within 28 days.

Keep copies of resignation documents and any related correspondence.

Raise concerns in writing if unlawful activity is suspected.

Seek legal and accounting advice to document efforts and assess exposure.

Resignation is not a "get-out-of-jail-free" card. You may still be liable for events during your tenure. But a prompt and documented resignation can prevent further liability.

Final thoughts

If you are unclear on your responsibilities as a director, refer to ASIC’s website, which has some great material. If you are in a dispute with another director, then you may need to seek personal legal or accounting advice to ensure that you understand your situation.

Directorship is not a passive role. If you cannot fulfil your duties due to dysfunction, exclusion, or financial mismanagement, remaining on the board as a director may result in you taking on significant risks for minimal benefit.

[1] That’s chapter 4 out of 1,189 chapters in the King James Version.

[2] Director Penalty Notices: Personal Liability and Defences

[3] What is Insolvent Trading & How It Affects Businesses | Worrells & Insolvent trading: How does a director become liable for insolvent trading? | Worrells

[4] The best course of action is to appoint a Voluntary Administrator or Liquidator. If the requisite resolutions cannot be passed than resignation may be the only option left.