Use the rest of 2020 to prepare clients for 2021.

The Federal government’s announcement[1] on the significant changes to the Australian insolvency laws focuses on two areas:

- A new restructuring process for insolvent companies that intends to be streamlined and less complex.

- A new cut down or “simplified” liquidation process focused on reducing costs and increasing the return to creditors.

Subject to the legislation and regulations passing these changes will be introduced on 1 January 2021. This article will focus on what is proposed for (which may change) new debt restructuring process for small businesses.

The new debt restructuring process will be available to companies with debts less than $1 million and allows from what is referenced as a ‘debtor-in-possession’ model. In simple terms this means that directors can continue to trade their company’s business (subject to certain control and restrictions) while undergoing the restructuring process.

The voluntary administration (VA) regime was introduced in 1993 to enable companies to address insolvency issues and if possible, return it to a healthy trading prospect by empowering creditors to vote on a Deed of Company Arrangement. The government has introduced this new debt restructuring scheme as they believe it is less complex and costly than a VA appointment. We are still waiting for the legislation and regulations to be formalised—so time will tell whether this is the case.

For the purpose of this article we cover the high-level information released by the federal government to date. As more information becomes available, you can be assured Worrells will keep you in the loop.

So how might this work in practice on a very high level? Let’s consider the following example.

- Bob operates a Bar and Restaurant.

- During COVID-19 restrictions, Bob’s income substantially decreased. Despite these challenges the business has managed to stay afloat on the government’s life-support measures.

- Emerging from the lockdown /restrictions the business is starting to earn an income—but is facing serious insolvency concerns with outstanding debts incurred during the lockdown period and other legacy debt issues.

- Bob is also now concerned about insolvent trading given the moratorium is ending on 31 December and wants to formalise a deal with creditors and avoid breaching any of his director’s duties.

- Bob comes to Worrells upon his accountant’s and lawyer’s recommendation to get help and appoint us as a Small Business Restructuring Practitioner (SBRP).

- The intention is to formulate a plan to repay creditors over time and secure the business’s future.

- Once Worrells is appointed we notify creditors the process has commenced and over the next 20 business days we develop a restructuring plan with Bob.

- As provided under the proposed legislation Bob continues to trade the business and only needs to seek Worrells’ approval on transactions outside the scope of normal business.

- The restructuring plan is formalised and verified by Worrells and put to creditors to vote over a 15-business day period.

- Employee entitlements and tax lodgements are also brought up to date during this period, which we believe will be a qualifying criterion to access this new scheme.

- In this example, creditors agree to the restructuring plan and Worrells involvement thereafter is to monitor compliance with the terms.

- Upon the restructuring plan’s completion all the company debt is resolved, and its solvency problems are alleviated.

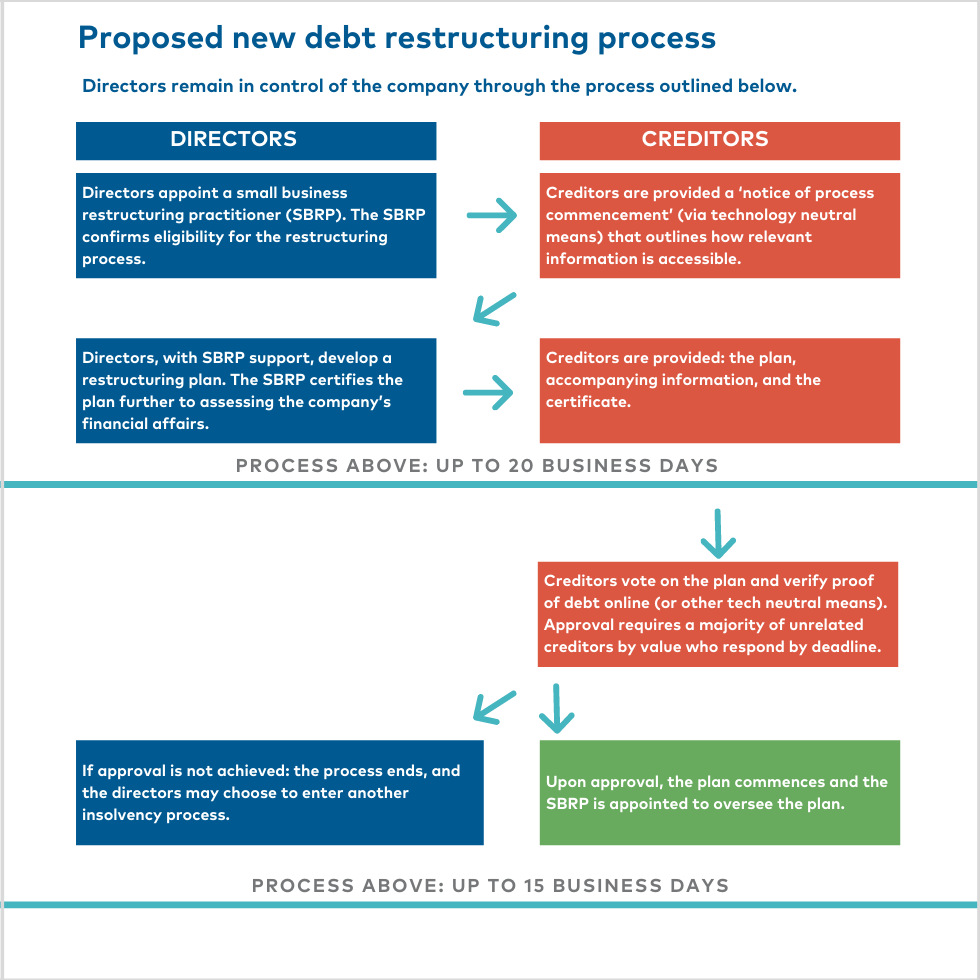

The following is an adapted flowchart following the government’s Insolvency reform to support small business factsheet to assist in visualising the process.

Obviously, this is a simplistic high-level example and we expect a lot to change as the ‘nuts and bolts’ regulation is released in the coming months. But this article is designed to start a conversation with your clients facing upcoming solvency problems about this new restructuring option.

The earlier we can start planning and getting things such as tax lodgement up to date, employee entitlements paid, financial records up to date and working capital requirements planned—the easier and less disruption this process will prove in practice.

We are here to help. Speak to us today!

[1] Announced 21 September 2020.