Subrogation is a doctrine that preserves equitable fairness among creditors and ensures that parties who discharge the debts of others are not unfairly prejudiced, and this often has application in insolvency.

While often misunderstood or conflated with the concept of assignment, subrogation has its own distinct legal foundation. This article outlines the doctrine of subrogation, statutory recognition of the right of subrogation, a recent WA Supreme Court case, and considers the contrasts with the assignment of debt and/or securities.

The Doctrine of Subrogation

Subrogation is an equitable doctrine that allows a party who has paid the debt of another to "step into the shoes" of the creditor and assert the creditor’s rights against the debtor or third parties. In insolvency, subrogation is most often invoked when:

A guarantor pays out a secured creditor (and claims the same right to payment as the secured creditor had).

A guarantor pays out an unsecured debt (and claims as an unsecured creditor in their place).

A party pays employee entitlements.

An insurer pays a claim and seeks to recover from a third party; or

A party satisfies a creditor’s claim to protect their own interests.

Importantly, subrogation does not depend on an express agreement. It is founded in equity and may be implied where no formal assignment is taken.

Statutory Rights of Subrogation

In some circumstances, there are statutory rights of subrogation, such as:

Section 560 of the Corporations Act, 2001 (Cth): Effectively, this is a statutory right of subrogation that elevates a person who reimburses employee entitlements to the same priority (under s556) as the original employee creditor. This is most often relied upon by the Department of Employment and Workplace Relations to fund employee entitlements under the Fair Entitlements Guarantee Scheme.

Section 3 of the Law Reform (Miscellaneous Provisions) Act 1965 (NSW): In NSW where a person pays a secured debt for another, having provided surety for the secured debt of the other or being jointly liable with the other for the secured debt, they are entitled to stand in the shoes of the original creditor, and to use all remedies available to the original creditor.

The Decision in Sev.en Global Investments v Global Loan Agency Services Australia Nominees Pty Ltd & Ors [2024] WASC 424

In this recent Western Australian decision, the Supreme Court was asked to consider the rights of a parent company, Sev.en Global Investments (SGI), which paid out the secured debt of a subsidiary. SGI sought to enforce its rights of subrogation by seeking orders requiring the trustee for the security trust deed to execute amended documents. However, the Court refused to make the order, in a decision which highlighted the distinction between subrogation and assignment.

Subrogation vs Assignment of Security

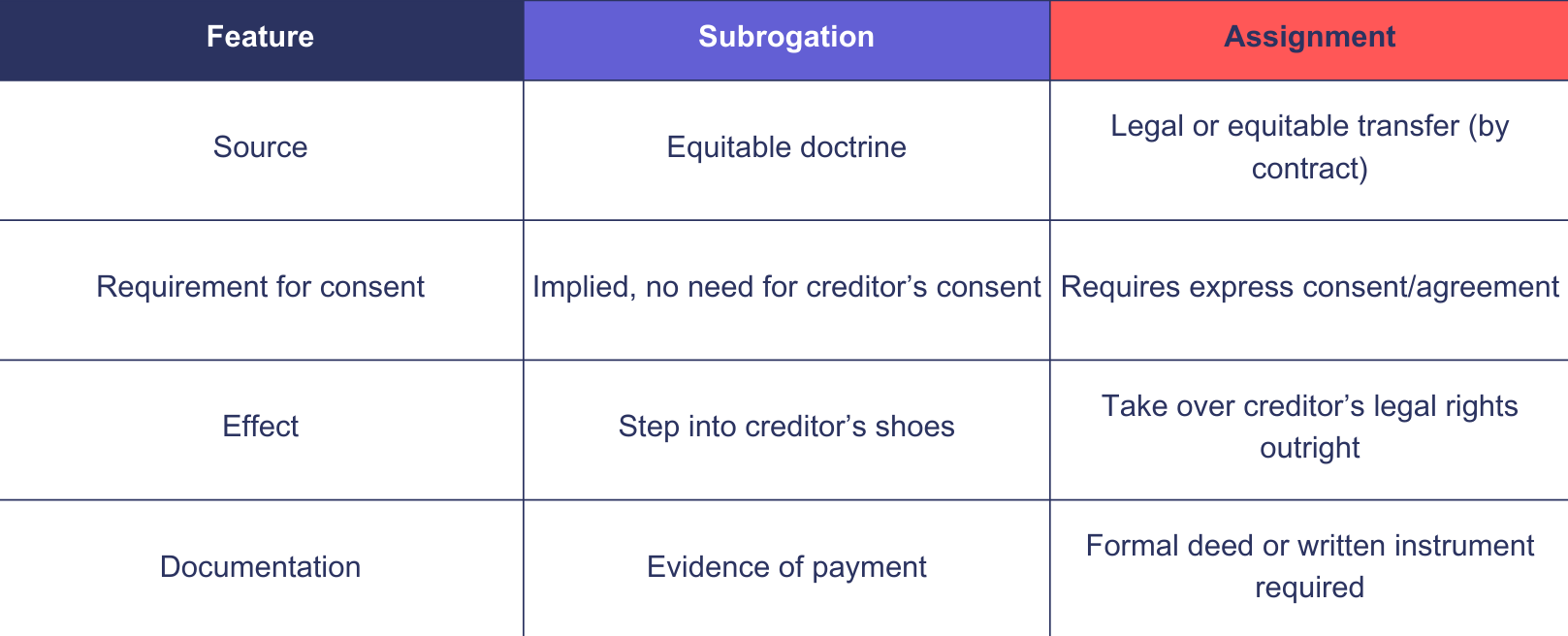

While both subrogation and assignment allow one party to take advantage of another’s rights, they are distinct in both form and substance:

Practically, subrogation is often relied upon where an assignment was not formalised, especially in urgent or informal arrangements.

Conclusion

Subrogation is a powerful equitable remedy, especially in insolvency, where complex inter-creditor arrangements, personal guarantees, and funding for employee entitlements are common. The 2024 Sev.en Global Investments case affirms the continuing relevance of equitable doctrines, but distinguishes subrogation from a formal assignment of a debt or security interest. Before paying off a company debt, consider whether a formal assignment agreement is beneficial, and seek the appropriate advice.

.jpeg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=400&h=400&q=25&blur=5&sat=-100)