Criteria and defences must be considered.

Staying in business post COVID-19 is already as hard enough with rising costs on literally everything…interest rates, rent, mortgage, supplies, labour etc. You needed your cash flow to keep your business afloat and a customer did not pay your invoice on time, so followed up a few times to remind them.

Your invoice is finally paid after a few attempts and three months later, your client goes into liquidation. To add insult to injury of already losing a customer, you also receive a demand letter from the liquidator clawing back this payment, which the corporate insolvency regime calls an “unfair preference”.

The demand letter ruins your day, and you’re thinking “Why am I paying back the money for services I provided and completed to my best standard?”. With your accountant’s recommendation, you consult with your local Worrells Principal (who’s not the liquidator appointed), who assists you to understand how to successfully to dispute the claim. How was this done? Read on!

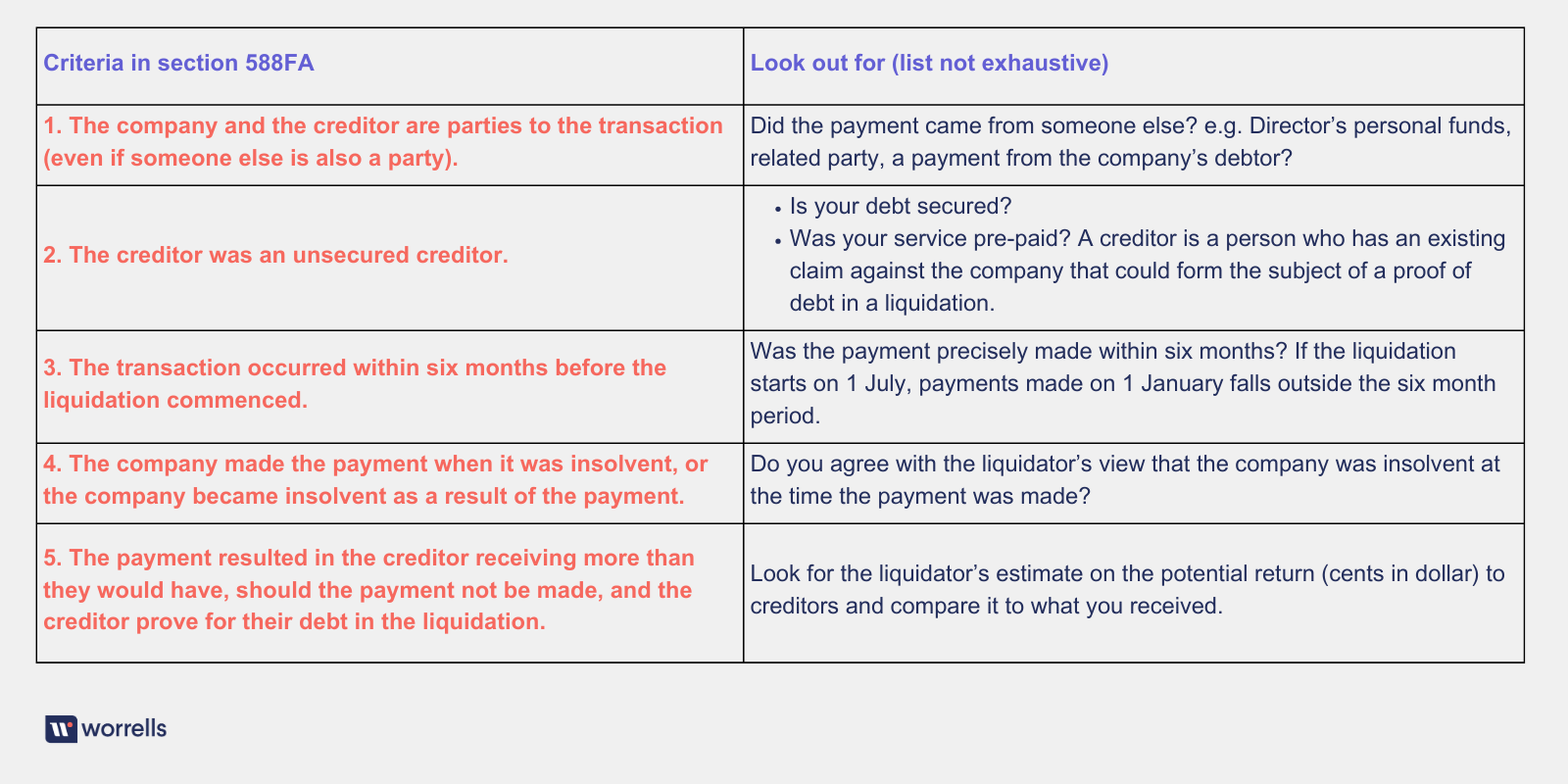

A liquidator can successfully pursue a payment as unfair preference only if all of the following criteria can be satisfied under section 588FA of the Corporations Act 2001.

If the liquidator can prove all of the above, then you will be looking to rely on any of the defences in the table below.

1. Running account defence

If there is a continuing business relationship between you and the company, then only the “net effect” of the transactions can potentially be clawed back. That is, by looking at all the transactions during the six months relation-back day period, if you can show that the net amount owed to you increased (i.e. you provided more goods/services than you received in payments), there is no preference as you were disadvantaged by continuing to provide service to the client over the six month period.

2. Good faith defence

This applies if you became a party to the transaction in good faith, and at the time when the payment is received you had no reasonable grounds for suspecting that the company was insolvent.

3. Doctrine of Ultimate Effect

This considers whether the transaction has ultimately decreased the net value of assets available to meet the competing demands of other creditors.

Often referred to as a “landlord defence”; for example, if a liquidator claimed that a rental payment was an unfair preference, courts have held that the purpose of a payment by the tenant of rent in advance is to secure a continuing right of occupation, without which the tenant’s business could not survive.

4. Set-off provisions

You may have a “set-off” available where there have been mutual credits, debits, and mutual dealings with the company. However, a set-off cannot be claimed if you had notice of the fact that the company was insolvent at the time payments were received.

If all of the above fails, remember that a liquidator is a commercially-minded person. Talk to the liquidator and attempt to negotiate a settlement.

For further guidance in this area, contact your local Worrells Principal.