How to recalibrate, not hibernate.

We have no desire to pedal fear during this COVID-19 crisis. We do however have a desire to make quality information available so business advisors and their clients can make informed decisions and strategies for their business to recalibrate and survive the crisis and for the immediate short- to medium-term and beyond.

Following the government’s economic response with various stimulus provisions and temporary insolvency rules until 25 September 2020, many people will choose to assimilate to the atypical environment created for them. And we understand why. But we liken already distressed businesses either “hibernating” or trading on compromised terms to being like a driver who changes lanes on the highway without checking their blind spot.

Hitting pause and waiting to see what unfolds during this unprecedented, wildly uncertain and frankly horrible time is a sensible attitude. And has untold benefits on mental health: everyone can take a breath, connect with loved ones and the community, and focus on what’s important to them on so many different levels. But what we’re urging people to also do is recalibrate with professional insolvency and restructuring advice. The goal being that this phase of “hibernation”, as the government is calling it, is actually restorative and not a synthetic, twilight-like sedation. There has literally never been a time like now for business owners and directors to adopt a restructuring approach to all aspects of business operations.

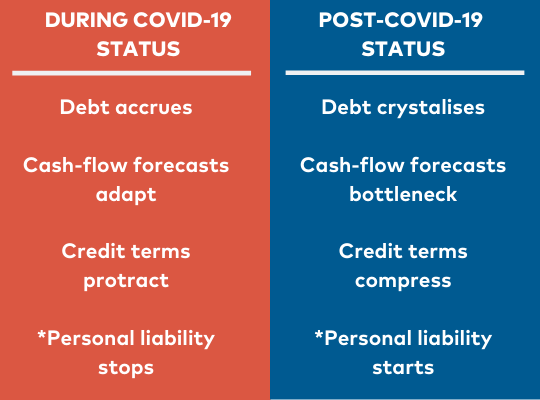

Negligence is defined as a breach of duty of care that results in damage. It would be negligent for us as insolvency practitioners with 47 years’ experience not to illustrate the contrast between a COVID-19 status and post-COVID-19 status for already distressed businesses—meaning already teetering on the edge of unrecoverable insolvency. Our biggest concern, especially in view of conversations with a myriad of businesses across the country, is that the overall sentiment seems to be that once the pandemic is over business will go back to normal. It won’t. Only the strongest businesses that are proactive now will have the best chance of survival. The contrast of what will happen to already distressed businesses during and post-COVID-19, is outlined in our model below.

We hope that this brief illustration builds some awareness of what this means to business owners and directors for their business performance come 25 September 2020[1]. It aims to illustrate the issues, if distressed businesses do not restructure through, they will be burdened with legacy debt and new debt. And their only recourse to try and deal with exacerbated debt will largely be a decreased revenue base. Calculating the quantum of that debt may be the best determiner to understand just how much the business needs to recalibrate, which may require either an informal or formal restructure. Through gaining agreement from all its creditors (formally), the business owners and directors will have the confidence that once the pandemic is over, no creditor can take any action against them—and they can focus on paying the current debt. The company therefore becomes well positioned compared to its competitors who will be dealing with the old debt and new debt.

Each element in the model above is reviewed (and more) in the restructuring process to ensure that business operations are optimised to a range of conditions and minimises the risks associated to its owners and directors. Personal liability is asterisked above as it’s critical to note that any insolvency appointment that follows the six-month hiatus does not include:

- personal guarantees (some with charging clauses)

- director penalty notices

- director loan accounts

- unreasonable director-related transactions.

Our guide on the new insolvency rules explains the technical aspects and the practical application from both the directors’ and creditors’ perspectives. It concludes with our view on the government’s new insolvency rules and how we can help. To distil the plethora of information and advice out there, we’ve created a model to build the ‘big picture’ and show how to break the challenge down into three facets to guide actions as part of a robust crisis management strategy.

In the meantime, we’re here to help.

Speaking to an insolvency and restructuring expert could make this difficult period restorative (as much as is possible during this pandemic). We can take you through your business structure and position to map out all the areas of vulnerabilities and opportunities to increase strength to develop a strategy for increased business resilience. Our initial advice is complimentary and obligation free.

Worrells has 33 offices across the country as part of our ethos of being focused locally, resourced nationally. Contact us here.

[1] These legislative amendments received royal assent on 24 March 2020.