Section 588FGA and directors’ personal liability for preference payments.

Formal insolvency activity has been heavily subdued since the start of COVID—primarily due to government intervention (which in simple terms put a handbrake on creditors being able to wind up a company for a period of time), the Australian Taxation Office (ATO) effectively pausing its debt collection activity, and other protectionist measures for COVID-impacted businesses coupled with a lot of government money pumped into the economy.

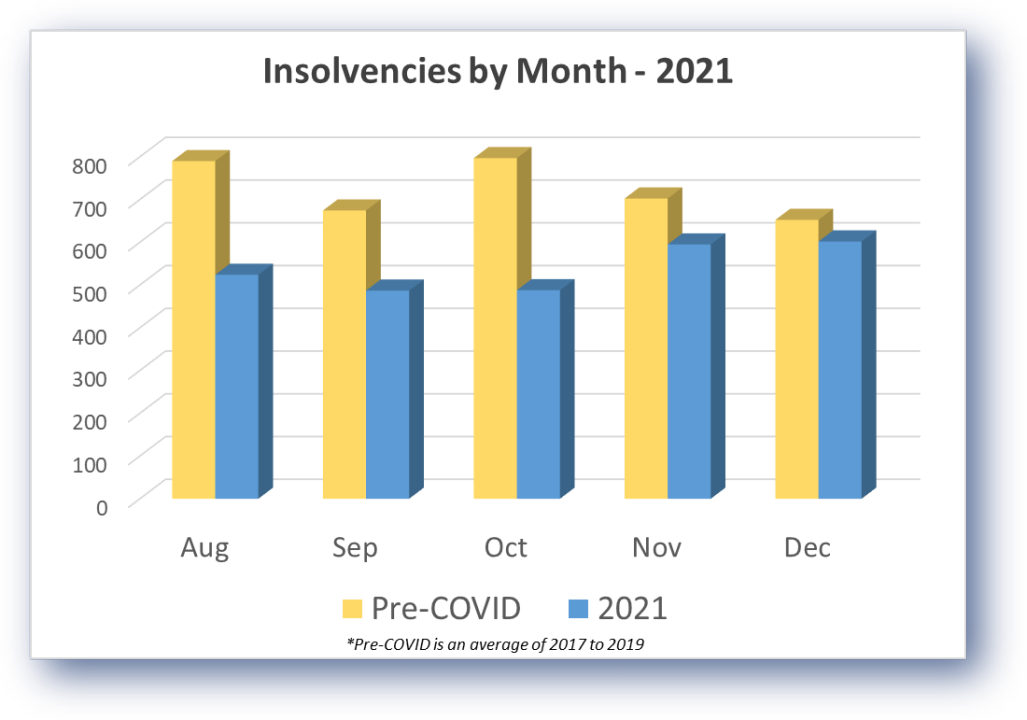

Now two years into the pandemic, almost all the key legislative factors impacting debt collection and insolvency have, or are about to, return to normal. And as the graph below depicts, insolvency appointments are returning to pre-pandemic levels.

Source: Alares Credit Risk Insights (alares.com.au)

Source: Alares Credit Risk Insights (alares.com.au)

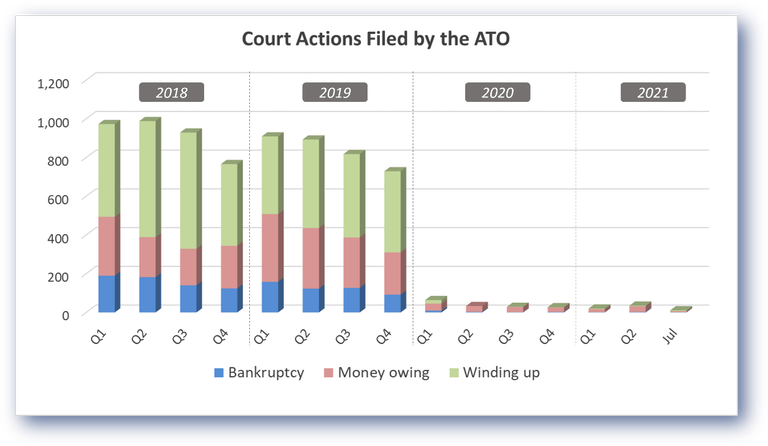

Recently, advisors will have noticed the ATO becoming more visible in pursuing outstanding debt and lodgement arrears—for the first time in many, many months the ATO is actively making telephone calls, sending SMSs and letters threatening firmer action (i.e. legal action). While that may be the case, the data shows the ATO is not pulling the trigger when push comes to shove—at least not yet anyway. As depicted below, quarter 1 2020 saw the ATO all but completely halt its firmer collection activity. And that stance has not changed into 2022.

Source: Alares Credit Risk Insights (alares.com.au)

However, a return to normal ATO collection activity is inevitable, and with it will come an increase in the incidence of winding up applications.

In the lead up to a liquidation appointment, following ATO pressure, it is common for a company to make one-off payments or a series of payments under an arrangement, to appease the ATO and reduce the outstanding debt. However, if the company ultimately ends up in liquidation, directors can find themselves at risk of personal liability for those payments made.

Many directors are unaware of section 588FGA of the Corporations Act 2001, which makes directors liable to indemnify the Commissioner of Taxation when a liquidator recovers an unfair preference from the Commissioner. In layman’s terms, if the Court makes an Order requiring the Commissioner of Taxation to repay a preference payment to a liquidator, the Commissioner can make a claim against the directors for loss or damage resulting from the Order (including costs and interest).

With this in mind, while the ATO may be willing to negotiate a payment plan, directors should not simply frame the proposition as “how little can I pay over how long”. Clearly if a client has a solid business with a tax debt they cannot discharge immediately, but can chip away via instalments, entering into a payment arrangement is entirely logical and appropriate. However, given the risk of personal liability imposed under section 588FGA, there may be cause for a broader discussion about budgeting, provisioning, forecasts, and viability of the business generally. I say that because if the business is doomed to fail, then entering into a payment arrangement—simply to buy time—could actually result in a worse outcome for the directors if the company later goes into liquidation.

Related article: What clients must consider when considering an ATO repayment plan