Contrary to what you may expect, bankruptcy is a very expensive process for stakeholders.

The Bankruptcy Act 1966 is a complex piece of legislation, and Bankruptcy Trustees have many responsibilities when carrying out their duties, including:

Identifying and selling assets and property

Assessing creditor claims

Disbursing money to creditors

Taking custody of a Bankrupt’s passport and assessing travel requests

Identifying and reporting offences

Investigations into voidable transactions or undisclosed property

Discharging duties under taxation laws or other legislation

Assessing a bankrupt’s annual income.

Even a basic bankruptcy comes with a considerable time cost to discharge the minimum set of duties. Given the expertise and risk involved, insolvency professionals have a high charge-out rate.

Additionally, the Australian Financial Security Authority (AFSA) plays a crucial role in the bankruptcy system. They regulate the industry, investigate and prosecute breaches of personal insolvency law and administer estates for the Official Trustee. AFSA is partially funded by a levy imposed across all bankruptcies in Australia. [1]

2 Types of Trustees

There are two types of Bankruptcy Trustee in Australia: a private bankruptcy trustee (Worrells has 16 Bankruptcy Trustees across Australia) and the Official Trustee.

The Official Trustee is a body corporate created under the Bankruptcy Act, which administers bankruptcies and other personal insolvency arrangements where the general administration of the matter is in the public interest, or it is uncommercial for private (registered) trustees to administer. It is controlled by AFSA.

As a rule of thumb, if a Bankrupt Estate is complex, AFSA will transfer it to a private Bankruptcy Trustee, pursuant to Section 181A of the Bankruptcy Act.

How are Trustees paid?

The simple answer is:

The Trustee draws their remuneration from the Bankrupt Estate they are administering.

A realisation charge is levied across ALL bankrupt estates when there is an asset realisation. These levies form part of AFSA’s funding.

All interest accrued on funds held by Bankrupt Estates are paid to AFSA, which forms part of their funding.

Official Trustee Charges

For bankrupt estates administered by the Official Trustee, the following charges apply, in addition to the realisation charge and interest collected [2]:

Administration fee: $4,000 + 20% of money received into the estate.

Business management add-on: $62.50 per 15 minutes if the estate involves operating a business.

If the administration of the bankruptcy is transferred from AFSA, their fees are determined on a time cost basis ($62.50 for 15 minutes or part thereof) for the period during which AFSA administered the estate.

Private Trustees

Private Trustees may elect a method of payment from three options:

Hourly rate

Fixed quote, or

Percentage of realisations.

The most popular method is an hourly rate, in which a Trustee charges their time and staff’s time based on seniority and experience.

Before they can take any payment for work completed, their remuneration needs to be approved by creditors, the Inspect General or the Court. Their fees are taken before any funds are distributed to ordinary unsecured creditors.

Order of Priority

Section 109 of the Bankruptcy Act sets out how funds realised by the Bankruptcy Trustee are distributed. For a detailed breakdown, please refer to Annexure A on the relevant AFSA webpage[3]. Generally, funds are paid in the following order:

Realisation Charge (currently 7% of gross realisations)

Costs incurred by the trustee in preserving assets

Petitioning Creditor’s costs

Bankruptcy Trustee’s remuneration

Employee Entitlements, to a capped amount

Unsecured creditors on a pari-passu/pro-rated basis

Case Study

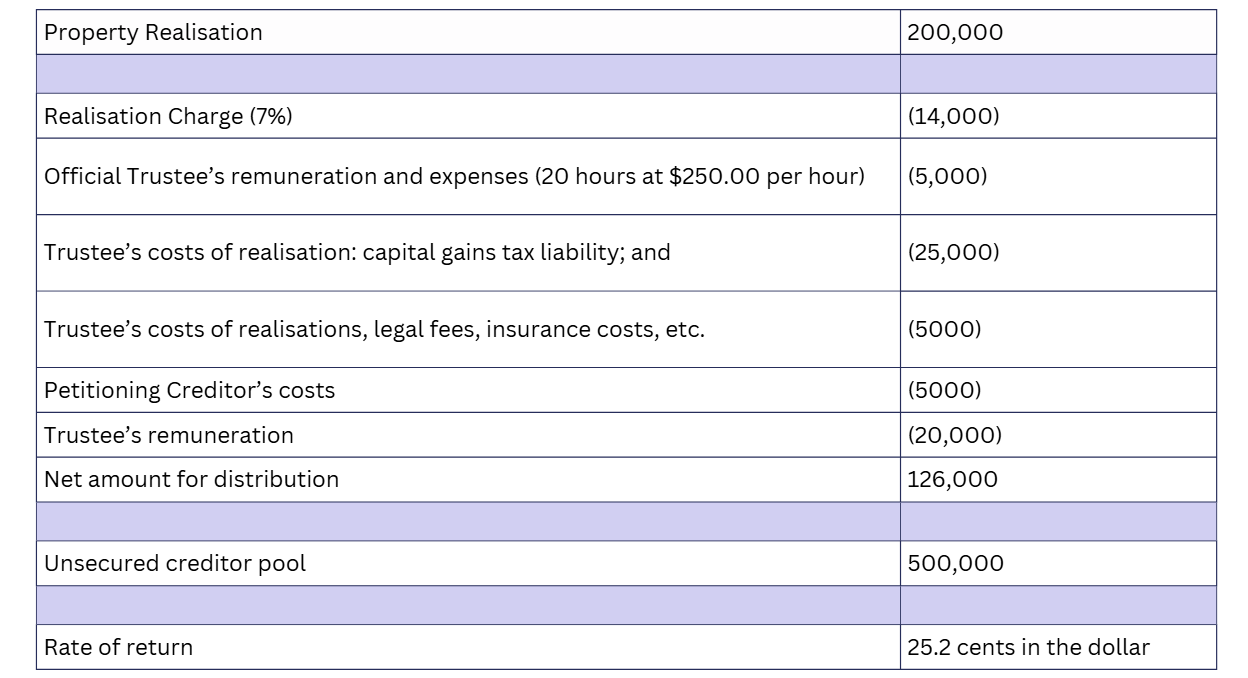

Mr Smith is made involuntarily bankrupt by the Court via a sequestration order. The petitioning creditor’s taxed costs are $5,000. The Court appoints the Official Trustee as the bankruptcy trustee. The Official Trustee identifies that Mr Smith owns an investment property. The administration of his bankrupt estate is then transferred to a private bankruptcy trustee. Mr Smith owes unsecured creditors $500,000.

The bankruptcy trustee sells the property for $1,000,000. It had a mortgage of $800,000 on it.

Upon settlement, the Trustee receives $200,000 and incurs a capital gains tax liability of $25,000 on the property.

Funds are disbursed in the following order:

Practical FAQs

Q: Does a debtor pay an AFSA filing fee?

A: No, there is no debtor filing fee to apply for bankruptcy.

Q: Who pays trustee remuneration?

A: Trustee remuneration and AFSA charges are paid from the estate before any creditor dividends.

Q: Are there court filing fees for a creditor’s petition?

A: Yes, creditors pay court filing fees and legal costs upfront, recoverable from the estate if funds permit.

In Summary

The good news for debtors who are considering bankruptcy is that they do not have to pay to go bankrupt. AFSA does not charge a fee to them directly and is funded via realisation charges. If there are assets available in the bankrupt estate, then these go towards paying for the cost of administering the bankruptcy before any funds are disbursed to creditors. The bad news for creditors is that the costs of administering a bankrupt estate can be high. For small bankrupt estates with marginal assets, any realisations can be quickly “chewed up” by the costs of administration.

[1] Collection of realisations and interest charges | Australian Financial Security Authority

[2] Fees and charges | Australian Financial Security Authority

[3] Treatment of debts in bankruptcy | Australian Financial Security Authority

Annexure

AFSA Order of Priorities:

Treatment of debts in bankruptcy | Australian Financial Security Authority