Is the popularity of the debt agreement coming to an end?

Personal insolvency statistics for the June 2018 quarter released by the Australian Financial Security Authority (AFSA) shows the growth continues, with total personal insolvencies increasing 7.4% in the quarter. This was the fourth consecutive quarter of an increase and the ninth quarter of growth in the last ten. This growth was most notable in the Northern Territory and Western Australia, where both revealed record numbers of personal insolvencies in the June quarter 2018.

The long run of debt agreement growth (now twelve consecutive quarters of growth) is finally showing signs of slowing down, with debt agreements growing at only 1.5% in the June 2018 quarter. This was the lowest percentage increase in debt agreements since September 2015.

By contrast, bankruptcies grew 13.1% in the June 2018 quarter, recording their largest year-on-year growth since the March quarter of 2009. This may be a result of growing awareness of the anticipated legislation of one-year bankruptcies, which as currently drafted, will be applied retrospectively once passed. It is expected that one-year bankruptcy will provide a compelling alternative to debt agreements for many consumer debtors (being those where personal debts, such as credit cards and personal loans are driving the need for a personal insolvency).

There are a relatively small number of personal insolvency agreements (PIAs) and accordingly, their levels fluctuate more than those of debt agreements and bankruptcies. In the June quarter 2018, PIAs decreased by 5.2% in year-on-year terms.

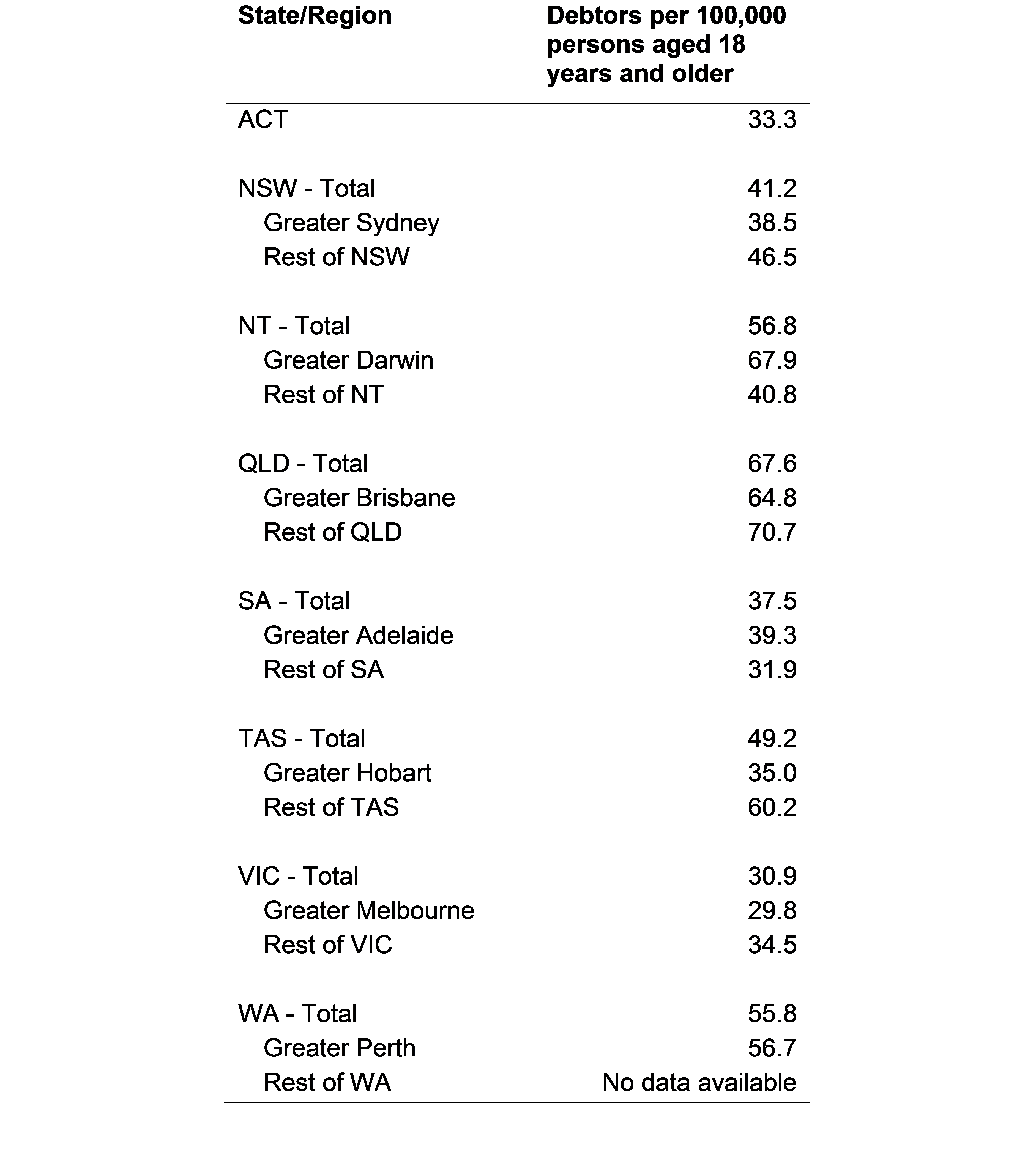

AFSA also released regional data for the June 2018 quarter, breaking down the incidence of personal insolvency for each state/territory and capital city. A summary of those findings is set out below.

It is interesting to note the significant difference between the rates of personal insolvencies between the states/territories, with Qld, NT, and WA having significantly higher rates of personal insolvencies than the other states/territories. Also, of interest is the significant disparity between the personal insolvency rate in Hobart and the rest of Tasmania.

These differences in the rate of personal insolvencies reflect the varying levels of economic stress being experienced across Australia.

Looking Ahead

The key driver of personal insolvency growth in Australia continues to be consumer credit stress. There appears little prospect of significant changes in the economy in the near further, and accordingly, we would expect the current trend to continue.

The introduction of one-year bankruptcies remains the policy of the current government and a Bill to implement that is currently before the Senate. Once the new policy is legislated, we anticipate significant growth in bankruptcies.

.jpeg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=400&h=400&q=25&blur=5&sat=-100)

.jpg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=800&h=480&q=25&blur=5&sat=-100)