The brewing troubles of the hospitality industry in Australia.

My favourite food is, of course, beans. No, not lima beans, kidney beans, black beans or green beans. I am of course referring to the coffee bean. Based on advertisements for home coffee machines, I am not unique in rolling out of bed and reporting straight to the kitchen to feed my coffee addiction. In fact, would go so far to claim that coffee is the new tobacco. Caffeine is addictive, and drinking coffee is a popular way for people to socialise together, much like smoking was back in the day. However, unlike tobacco vendors, we constantly see cafés in Australia going under.

According to CreditorWatch, business failures are at their highest rate since the COVID-19 pandemic in October 2020 at 5.08%. Food and Beverage recorded the highest failure rate of all industries in October 2024, increasing to 8.5% on a rolling 12-month basis from 8.3% in the 12 months to September. CreditorWatch’s 12-month forecast is for the failure rate in the sector to further increase to 9.1%. Accordingly, almost 10% of business failures in Australia are attributable to cafés.

So what drives the cycle of cafés opening and closing? It can be dissected into 2 parts: the ease of opening and the difficulty in making money.

Cafés: an open doorway

Despite the high failure rate, there doesn’t seem to be a shortage of people who are keen to try their hand at the romanticised life of the barista. As far as businesses go, the café industry is relatively easy to get into:

Low regulation: you do not need a licence to make coffee (at least not yet. I wouldn’t be surprised if Melbourne’s mayor was considering one).

Relatively low cost to enter the market. A second-hand commercial coffee machine can be purchased for a few thousand dollars from Facebook marketplace.

Minimal training needed for staff.

Commercial landlords love a café space as it helps drive foot traffic. Carefully inspect any lease documents for personal guarantees and security clauses!

As far as opening a business goes, a café may be one of the easiest. With the added allure of working with something most people enjoy (coffee!), there does not seem to be a shortage of people who make the investment to turn the dream of being their own boss into a reality.

Cafés: a revolving door

Due to the low barriers of entry, the industry faces a high level of competition, that according to IBIS World, is only increasing.

In addition to strong competition, revenue in the industry is volatile. This can be attributed to several factors, including:

Consumer discretionary spending is currently down, due to inflation over the past 2 years and high interest rates.

Consumer patterns can rapidly change. When new vendors open, fickle customers may change to the newest café or spread their patronage between cafés.

It is very difficult to make a profit, as cafés operate at a very low margin. With an average profit margin is of 3.3%, it just takes a small blowout in one area of expense to tip your profit into a loss. Just think, on a $4.00 latte sale the owner takes a profit of $0.13.

Per IBIS World’s Cafés and Coffee Shops in Australia Report (October 2024), the industry has the following benchmarks:

5 employees per business

Revenue of $80,614 per employee

$14,281 profit per business

Profit margin of 3.3%

61.0% of revenue is derived from coffee

20.2% of revenue is derived from food

18.8% of revenue is derived from other beverages

At revenue of only $80,614 per employee, even paying minimum wage ($47,626.80 gross for a full time employee plus $5,477.08 superannuation guarantee) there is not much room for leases, fit out costs and stock.

In terms of competition, cafés compete with restaurants, fast food/takeaway providers, convenience stores and fuel retailers and a fleet of do it yourself at home coffee machines. It’s safe to say that any business that serves food has recognised the demand for coffee by its customers. As a result, I’ve seen gyms, florists and hairdressers all add on café style coffee as a revenue stream or service for clients. It’s just a matter of time until your local mechanic tries to upsell you a flat white.

Coffee: supply trumps demand

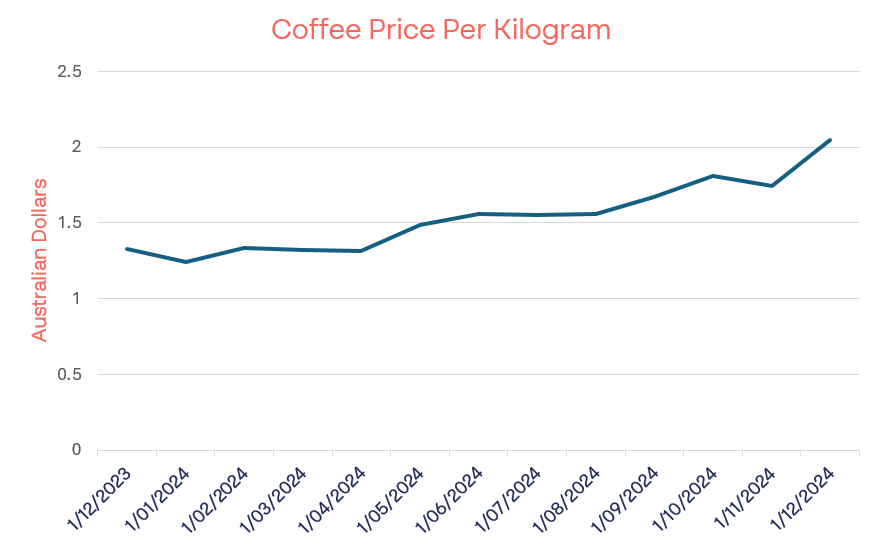

The most important input is obviously the coffee bean. Prices have hit their highest point since 1977, and show no signs of decreasing:

According to Trading Economics, in June 2020 coffee beans cost $AUD0.68 per kg. They have now reached their highest price point since 1977 of $AUD2.04 per kg (note, figures have not been adjusted for inflation).

Turning back the clock, in 1975 an unusual weather event resulted in snow and frost and the destruction of 1.5 billion coffee trees in Brazil. This in turn affected 73.5% of crops in the subsequent year’s harvest . The price spiked to $USD3.10 per pound in 1977. In today’s dollars, that would be $AUD21.96 per kg, ten times the current price.

Similarly, adverse weather in Brazil and Vietnam, the two largest coffee producing companies, have contributed to the increased price in coffee beans that we are currently experiencing. Coffee beans are best grown between 18C and 22C, but earlier this year Brazil’s temperatures were in the high 20s. In addition, there was below average rain. At the same time, Vietnam has been enduring one of the worst droughts on record.

We have almost fifty of years of production increases since 1977, so while coffee prices may continue to increase, it is very unlikely to hit 1977 levels.

Cafés on expiration

In an insolvency context, we frequently see cafés which need to go into liquidation. When a café isn’t making a profit, there are limited options available for owners. Unfortunately, given the low resale value of plant and equipment the best course of action is often to walk away and disclaim the property, which then may be seized by the landlord.

It is not impossible to make a profit, and prior to opening a café business owners should keep in mind that they should limit their exposure to personal liability (good advice for any business owner). The best ways to do so are:

Ensure you have a business plan.

If you are purchasing an existing business, do you own independent due diligence of its figures. On numerous occasions directors of insolvent businesses have advised they purchased a business relying on misleading information.

Check leases and supply agreements for personal guarantees. Consider negotiating to provide alternative forms of security (e.g. bank guarantee) for leases or cash on delivery for suppliers.

Ensure business activity statements are lodged on time in order to avoid non-lockdown director penalty notices.

Ensure superannuation is always paid on time.

Know where to draw the line. If a business continues to trade when it cannot pay its debts as and when they fall due, it is trading insolvently.

Conclusion

Cafés operate in an environment of strong competition and rising costs. Despite the turnover in the industry, given Australia’s demand for the product the industry is not an endangered species. If you do want to support your local friendly barista, don’t baulk next time they have to pass on the cost of coffee beans, wages and rent. It’s a tough industry and the margins are too slim to absorb price increases.

2 IBIS report

3 IBIS report

4 A Brief History Of The Price of Coffee - Sprudge Special Projects Desk