ASIC’s flurry of disqualifications, bannings, and charges.

A quick visit to the Australian Securities and Investments Commission’s (ASIC) news centre shows a flurry of activity regarding regulator action over director duty failures and breaches.

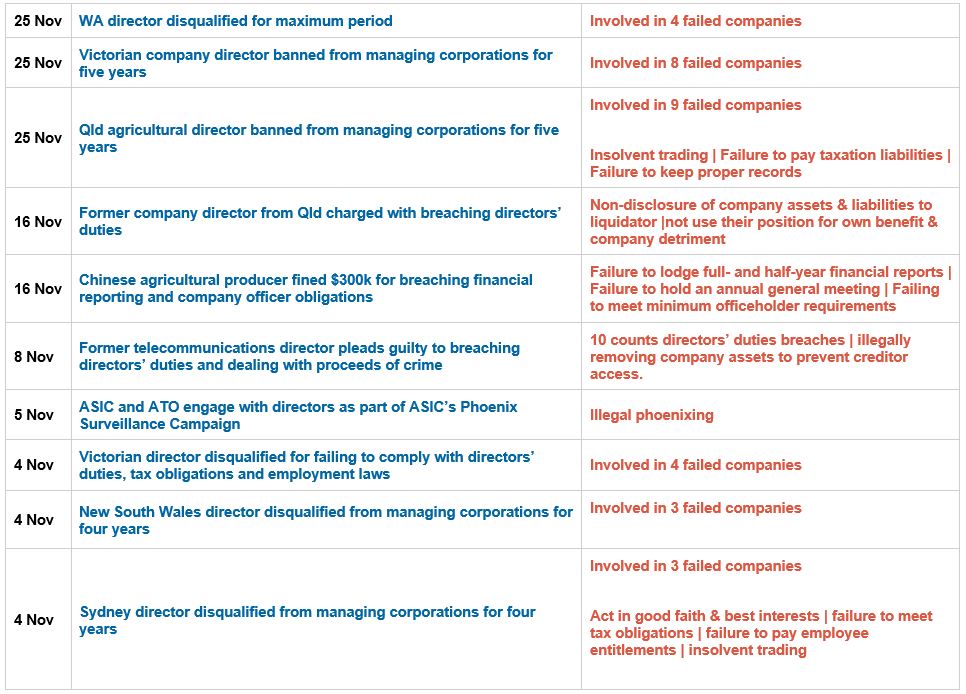

Here’s a snapshot of last month’s press releases:

According to ASIC’s website directors/officers key duties, which are predicated on the Corporations Act 2001 and common law, include[1]:

- being honest and careful in all your dealings

- understanding what your company is doing

- making sure your company can pay its debts on time

- ensuring your company keeps proper financial records

- acting in the company's best interests, even if this conflicts with your personal interests

- using any information only for the good of the company. Using information to gain an unfair advantage for yourself or others could be a crime.

It is well known, that under 588G of the Corporations Act a director has a duty to prevent a company from incurring a debt if:

- The company is already insolvent at the time the debt is incurred; or

- By incurring that debt, or by incurring a range of debts including that debt, the company becomes insolvent; and

- At the time of incurring the debt, there are reasonable grounds for suspecting the company is already insolvent or would become insolvent by incurring the debt under section 588G(1) of the Corporations Act.

A quick visit to the Australian Securities and Investments Commission’s (ASIC) news centre shows a flurry of activity regarding regulator action over director duty failures and breaches.

Other potential ramifications for directors who trade while insolvent include:

- pecuniary penalty order that the director pay $200,000

- a court can disqualify a director from managing a corporation under section 206C of the Corporations Act.

If a director is found to have committed a criminal offence under section 588G(3) of the Corporations Act, a court can also order:

- that the director should pay a fine of 2,000 penalty units, which is equal to $220,000; or

- that the director be imprisoned for up to five years.

So, what does this mean? Directors must be cautious when managing company affairs if they have concerns as to the financial viability and its ability to repay a debt incurred. More so, directors should look at the company’s financial position in sufficient detail to satisfy themselves it is solvent when complying with their obligation to resolve that their company is solvent within two months of the company's "review date" (as notified in ASIC's annual statement under section 347A of the Corporations Act).

Our Solvency Self-Assessment Checklist assists advisors to form an opinion on their clients' business solvency status. Download (click here) our checklist for the seven key factors that can assist you in supporting your clients in their director duties. As always, we're here to help, so connect with your local partner to discuss.

Related articles:

Director duties: Risk versus reward

A director's personal liability is not limited to the Corporations Act

Liquidation—the ugly side for directors

[1] https://asic.gov.au/for-business/running-a-company/company-officeholder-duties/your-company-and-the-law/

.jpeg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=400&h=400&q=25&blur=5&sat=-100)