Gift certificates can be thoughtful and practical, but choose wisely, act quickly, and know your rights if the issuer becomes insolvent.

Gift certificates and prepaid experiences are often an ideal gift for any occasion —thoughtful, flexible, and practical. They allow the giver to demonstrate consideration by selecting a store or experience that reflects the recipient’s tastes or lifestyle, while still offering the recipient the freedom to choose something they truly want. Whether it’s a fine dining experience, a scenic helicopter flight, or a visit to a local salon or boutique, gift certificates can elegantly package experiences and support local businesses at the same time.

However, there is a dark side to gift certificates, one that could render them worthless to the recipient. From a liquidation perspective, every gift certificate purchase carries a degree of financial risk; if the business goes bust, what happens to the gift certificate?

The short answer is that the holder of the gift certificate becomes a creditor in the liquidation. Of course, the holder wants to know one thing: Can I get a refund? The simple answer is no, it’s very unlikely you will see any amount refunded. The majority of retailers and hospitality businesses have very little assets and a very low rate of return.

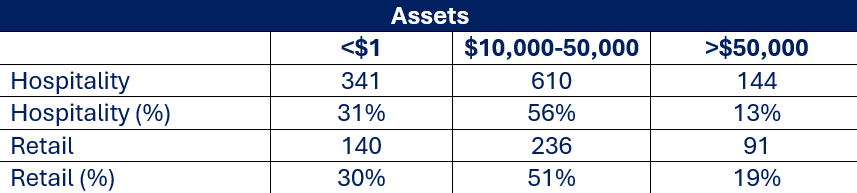

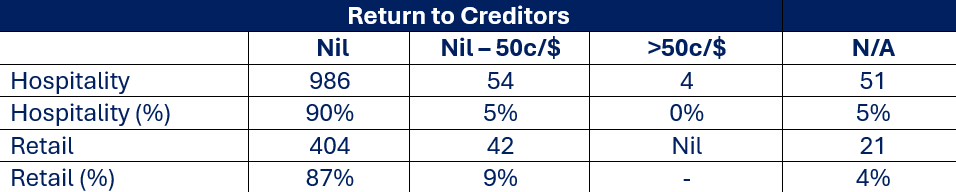

The following statistics are drawn from EX01 reports, which were lodged during the 2024 financial year. These statutory reports are filed by liquidators in Australia to outline the outcomes of external administrations.

So, of the businesses captured in this data set, 90% of hospitality liquidations and 87% of retail liquidations won’t result in any return to unsecured creditors.

Furthermore, a liquidator is not obliged to pay a dividend if the quantum of the amount being paid will be less than $50. As a result, even if you were in the minority of gift certificate holders that were lucky enough to potentially receive a dividend of between 1 cent to 50 cents, if your gift voucher was valued under $100, it’s unlikely you would receive any refund at all.

How to mitigate gift card risk?

Gift certificates are still a great option when considering purchasing a present. There are a few ways you can protect your purchase and the recipient.

Encourage the recipient to use the gift certificate promptly. The longer you hold a certificate, the less likely it is to be redeemed. This could be due to the recipient losing the certificate, the certificate expiring, or the insolvency risk articulated above.

Purchase with a credit card. Some credit cards have insurance, and if the product was not fit for purpose, the insurance may guarantee a refund. In addition, if you paid with a credit card, your financial institution or card provider may be able to get your money back by reversing the payment. This is known as a ‘chargeback’; however, there are time limits on chargebacks.

Don’t purchase from businesses that exhibit signs of financial distress. Some common signs of financial distress that customers may be able to identify include:

Dilapidated premises

Unhygienic bathrooms

Staff uniforms are excessively aged

Old systems and technology (except for David Jones, of course)

High turnover of staff

Frequent clearance sales (except for Robin’s Kitchen and EB Games)

Gift certificates issued by larger businesses and conglomerates carry lower risk than those from small independent retailers; however, they are not immune. A gift card from the Woolworths group is safer than one from your corner coffee shop.

What can you do if you are a creditor?!

If you are already a creditor for a gift voucher, there are a few actions you can take:

Check the method of payment. If the purchaser paid with a credit card, debit card or payment provider, they may be able to get some money back by reversing the payment through a ‘chargeback’. There are time limits on chargebacks, so contact the financial institution straight away.

Submit a claim in the liquidation. There’s a small chance that there will be a return to creditors, and it only takes a small amount of effort.

If the original business owner has opened a new business, they may be willing to honour the gift certificate. To be clear, there is no legal obligation for them to do so. However, the vast majority of liquidations are due to unfortunate circumstances and are not orchestrated by business owners seeking to rip customers and creditors off. If they have opened a new business, there is a chance they may be willing to honour your gift certificate.

Gift certificates can still be an excellent option for a present. It shows a lot more thought than an envelope of cash! Just be mindful of the risks and how to mitigate them.