And how formal insolvency appointments fit in.

As the landscape of business and commerce continues to evolve, one significant area of discussion concerns the crossover of liability for debts between various business structures and people’s roles. How these intersect is crucial for every person in business.

So, let's highlight the differences in these roles.

Company structure

A company is a separate legal entity that has its own rights and responsibilities; with a person appointed as its director to guide the company's operations and decisions.

One of the core reasons people in business opt for a company structure is the concept of limited liability. In this case, the company becomes liable for its own debts—if a company incurs debt, it's typically the company, not the directors or shareholders, that’s legally bound to repay it. This structure offers a protective shield to the individuals behind the company.

But it's not that clear-cut. In some circumstances, directors can be held personally liable for the company's debts, including:

Where a director (or other party) personally guarantees the company’s obligations.

Where a director trades a company while it is insolvent in breach of their statutory duty. This can result in an insolvent trading claim which then quantifies the amount of debt directors may be liable to pay

The Australian Taxation Office (ATO) imposed director’s penalties for any overdue pay as you go (PAYG) withholding, net GST (goods and services tax, wine equalisation tax, and luxury car tax), and superannuation obligations.

Sole trader structure

A sole trader is a person running a business in their own name; bearing all the rewards and the risks. Typically, sole traders have unlimited liability for all business debts and any litigation.

A sole trader structure has no legal distinction between the business and the owner. Therefore, if a sole trader's business incurs debt, the sole trader is personally liable and that liability can extend to their personal assets, like their home or car, which can be used to repay the business debts.

Partnership

In a partnership, the partners share both the business’s profits and the liabilities. Each partner is jointly and severally personally liable for the debts, obligations, and liabilities the partnership incurs.

Joint and several liability means each of the partners can be held personally liable for the full amount of the partnership's debts. Creditors can generally pursue any partner for the entire debt, regardless of their individual contribution or involvement in incurring the liability. This is the case regardless of whether the partners are corporations or individuals.

The intersection of liability for debts among company structures, directors, partnerships and sole trader businesses is complex and nuanced. It's a delicate balance that must be considered when choosing the structure of a business. Understanding these legal obligations can be the difference between flourishing and floundering in the marketplace.

That said, the crossover of debt liability isn't all doom and gloom. Instead, it underscores the importance of financial literacy, responsible management, and prudent decision-making. It reminds us of the weight of the responsibilities we bear in our roles, and the need for informed, ethical, and sustainable business practices.

Trusts

The liability of a trustee of a trust can vary depending on the type of trust and the trustee's actions or omissions. Trustees, which can be either a corporate trustee (i.e. a company acts as the trustee) or a person, have important responsibilities to manage the trust assets and act in the interests of the beneficiaries. If a trustee becomes obliged to meet trust liabilities, the trustee usually has a right to be indemnified from trust assets. When trust assets are insufficient to meet those liabilities and the trustee becomes insolvent, there’s a range of elements that must be considered before determining an appropriate type of formal insolvency appointment. This topic is a specialist and complex area.

Creditors are entitled to pursue a trustee for a trust debt regardless of whether the trustee is corporation or individual.

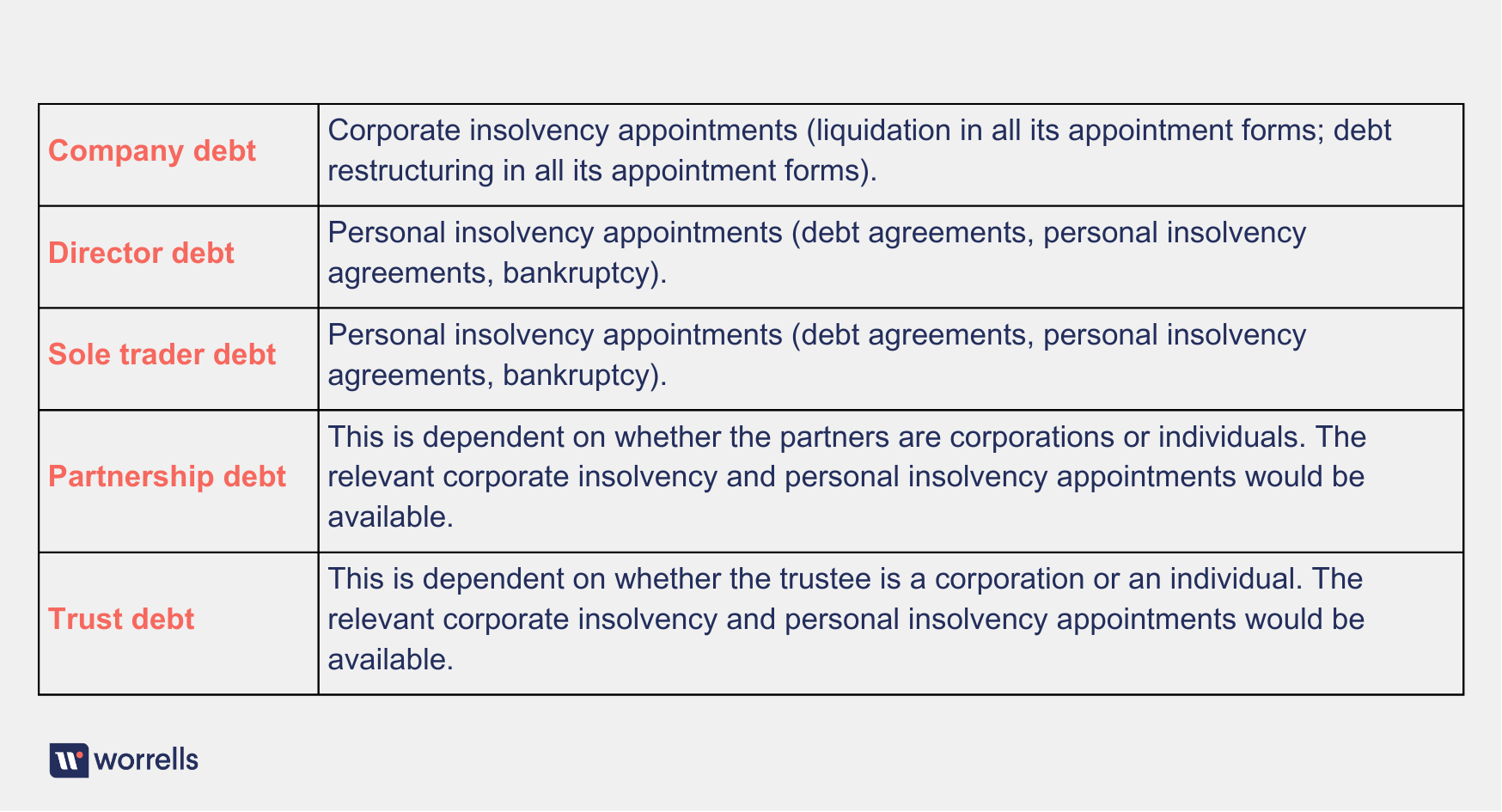

When it comes to formal insolvency appointments to deal with unmanageable/unserviceable debt i.e. the company or person doesn’t have the liquid assets or funds to meet their obligations, the table below shows which appointment types may apply.

In conclusion, while the legal structures and the implications might seem daunting, they serve a purpose: to balance the entrepreneurial spirit with accountability, to encourage innovation, while keeping check on any reckless pursuits. Every company, director, partner, sole trader or trustee must understand their liability for debts thoroughly; it's not just about the law, it's about long-term viability and business integrity. So, tread wisely, plan responsibly, and navigate the business waters with an eye on the liability horizon.