What will be the impact of structural risks created by the response to COVID-19?

The 2021 financial year (FY) has been and gone and it has been a quiet year for both personal and corporate insolvency appointments.

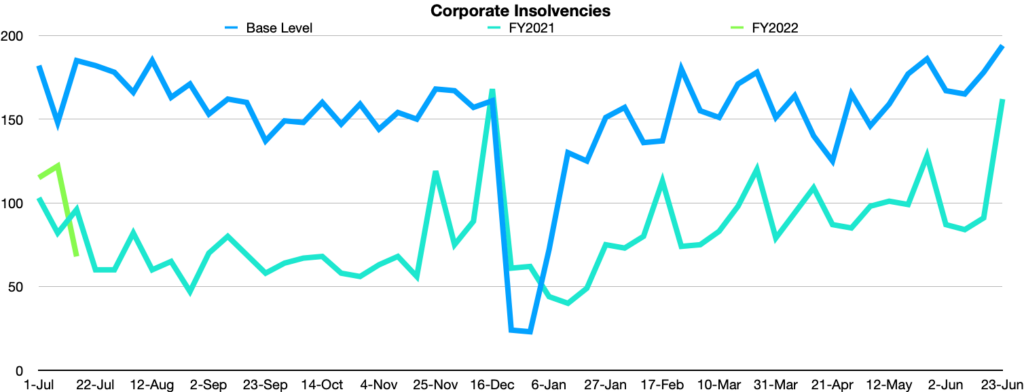

The corporate insolvency numbers

There was a total of 4,234 corporate insolvencies in FY 2021, a 42.5% fall on FY 2020, which itself was down 7.18% for the historical average. This means 3,709 fewer companies went into external administration last financial year than we would expect in an average year. This biggest fall was seen in court liquidation appointments (down 72%), where government restrictions made it almost impossible to wind up a company for most of the financial year. While creditors’ voluntary liquidation only had a fall of 29%.

I was surprised to see voluntary administrations (VA) down 41% as I expected to see more company directors taking advantage of the VA process and the relatively ‘soft’ approach to debt collection adopted by the Australian Taxation Office (ATO) and institutional creditors through the COVID-19 period to restructure company balance sheets.

Finally, the newly introduced small business restructuring process remained little used, with only 12 companies taking advantage of the process in its first six months. It appears to be unused by a mix of lack of awareness in the marketplace; companies not meeting the criteria to enter the process; and the general lack of creditor pressure on companies.

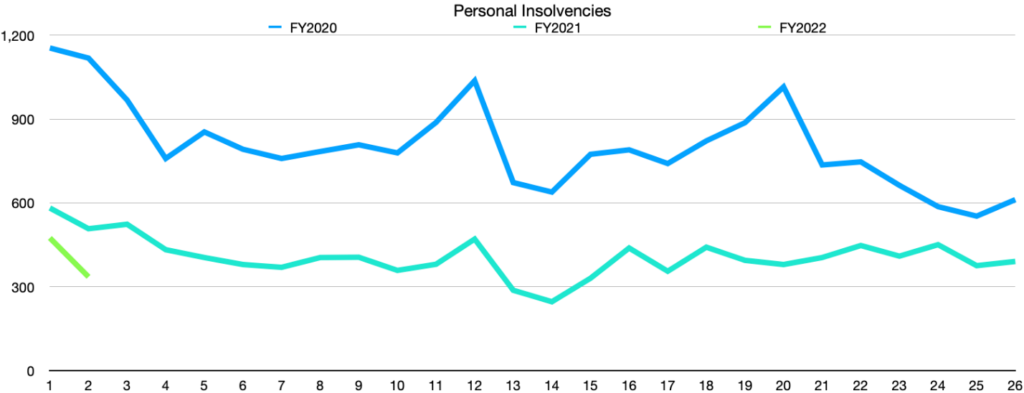

The personal insolvency numbers

Personal Insolvency appointments fell even more than corporate insolvencies. There was a total of 10,621 personal insolvencies in FY 2021, down from 20,078 in FY 2020, a fall of 49.6%. Once again, the biggest falls were seen in court-originated creditors’ petition appointments, which were down 65.2%. The rest of the main appointment types had falls of around 40%, with debt agreements seeing a slightly higher fall of 54%.

What’s next for insolvency numbers

In my last article, I walked through the key drivers of the historically low number of insolvency appointments and predicted that appointment numbers were likely to stay low through the end of 2021 and into 2022. Since then, South Australia (SA), Victoria (Vic) and especially New South Wales (NSW) have all been thrown into lockdowns. While Vic and SA look to be heading out of lockdown relatively quickly, the NSW lockdown shows no sign of ending soon and is having a dramatic impact on Australia’s economy. In response, the government has slammed its foot back on the stimulus pedal—providing significant support to both businesses, individuals and households.

Australia’s economy had an excellent third quarter of FY 2021 and all signs pointed to a rapid recovery from the COVID-19 recession. This was one reason why I expected insolvency numbers to remain depressed. However, things don’t look so rosy now and it is almost certain that Australia will see negative growth in the first quarter of FY 2022 (July through September 2021). The Commonwealth Bank of Australia (CBA) forecast that Greater Sydney’s seven-week lockdown would cause the national economy to shrink by 0.7% in the three months to September 2021 and lockdown is already stretching to nine weeks, and the consensus forecast is that it will likely run to at least thirteen weeks.

Consumer confidence also saw dramatic falls in June, down 5.2%, according to the ANZ-Roy Morgan report[i]. Confidence is sure to see another hit in July as lockdowns continue. Retail sales were also down 1.8% in June and are forecasted to see a further decline in July.

These negative indicators would usually point to a significant untick in insolvency appointments. However, the key drivers that kept appointment numbers low last financial year are still in play.

The government has announced a new support package for affected businesses and individuals that is set to see approximately $1.1 billion of stimulus pumped into the economy every week. While significantly less than the Cashflow boost and JobKeeper programs provided in 2020 (which averaged out to about $2.8 billion per week), the package is still going to help many businesses through lockdowns and continue to depress insolvency numbers. Similarly, institutional creditors and the ATO, both of which were starting to return to normal debt collection activities, are likely to step back and provide companies with further forbearance due to the lockdowns.

When the competing factors shake out, I expect we’ll see a modest increase in insolvency appointments though the next six months. I expect we will continue to see regular lockdowns through to the end of the year, while Australia’s vaccine program ramps up, which will continue to negatively impact both the economy and businesses. At the same time, the government isn’t providing as much support and other factors last year, like the moratorium on debt collection activities and the insolent trading haven’t been reinstated.

What about the longer term?

Some longer-term structural risks that have coming out of the pandemic period are likely to significantly impact on both the economy and the number of insolvency appointments we see over the coming years.

Firstly, the zombie phenomenon, companies that are hopelessly insolvent and doomed to fail, yet continue to be alive due to the lack of pressure on their directors to initiate a formal insolvency appointment. These companies will create a long-term drag on the productivity of the economy as they soak up resources and employees, compete against healthy companies, and run up large debts while dissipating assets that could have enabled returns to creditors.

Lastly in the longer term, there’s the risk that the government’s significant stimulus will trickle through to inflation and force an increase in interest rates. So far, the majority of this inflationary pressure has manifested in asset prices, with housing especially seeing significant growth this year, but the risk remains that the 'inflation genie' escapes its bottle and derails the recovery.

[i] http://www.roymorgan.com/morganpoll/consumer-confidence/consumer-confidence

.jpeg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=400&h=400&q=25&blur=5&sat=-100)

.jpg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=800&h=480&q=25&blur=5&sat=-100)