An insolvency practitioner’s view on the rise of financial distress.

No one has ever accused me of being fashionable. In fact, accountants are generally regarded as the least fashionable people in the world; but, much like high-waisted jeans or oversized blazers, insolvency is back in fashion. The last 12 months have certainly seen an increase in the demand for insolvency services. Insolvency appointments are often seen as a litmus test for the economy, after all, small business is the biggest employer in Australia.

Record appointments

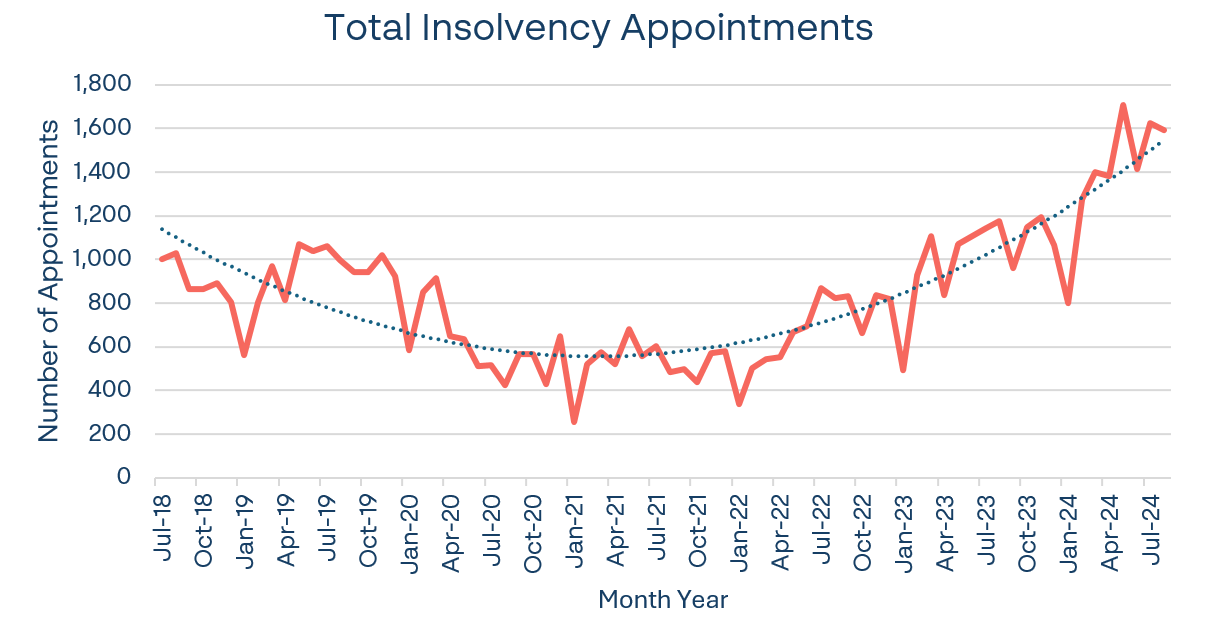

External administration appointments are currently at record highs. There were 11,053 appointments in FY2024, beating the previous record high of 10,757 in FY2012. This was off the back of record lows in the industry: during the COVID-19 pandemic monthly appointment numbers dipped to the lowest since the year 2000.

The low number of appointments during COVID-19 was counter-intuitive. During that period, my colleagues and I were frequently having the same conversation with other professionals who all thought insolvency numbers would be through the roof thanks to lockdowns freezing the movement of people around the country.

The number of appointments per month over the last 6 years is illustrated below¹.

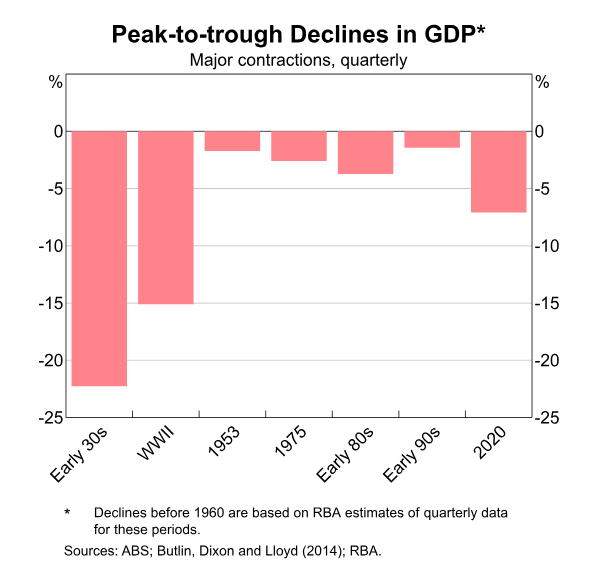

The high number of appointments is the result of many factors, some of which are detailed below. According to the Reserve Bank of Australia (RBA), the contraction of the Australian economy in 2020 was greater than the last four recessions (note, Australia did not experience a large economic downturn during the global financial crisis)²˒³.

Graph from The COVID-19 Pandemic: 2020 to 2021 | Explainer | Education | RBA

Graph from The COVID-19 Pandemic: 2020 to 2021 | Explainer | Education | RBA

The explanation for the downturn in insolvency appointments during the COVID-19 recession is simple: record economic stimulus. The first stimulus package was announced on 12 March 2020, the second on 22 March 2020 and the third on 30 March 2020. That third package included jobkeeper. The three packages combined were estimated to cost $154 billion⁴(approximately 8.8% of 2023 GDP, or approximately $6,000 per person).

In addition to direct economic stimulus there were other measures such as the ATO ceasing most of its collection activity and accepting the non-payment of accounts, as well as a moratorium on insolvent trading.

The flipped switch

As readers will be aware, the cost of that stimulus combined with record low interest rates and global factors resulted in record high inflation. The consumer price index (CPI) peaked at 7.8% in December 2022⁵, the highest since September 1987.

It would be remiss not to mention that the inflation surge was experienced worldwide. Many countries experienced their highest inflation rates in decades. Aside from monetary stimulus there were unique pandemic related reasons, such as supply chain disruptions and price gouging. Overseas conflicts also had an effect on oil prices, natural gas, fertiliser and food prices.

As a result of the high inflation and government stimulus, Australia’s cash rate increased by 4.25% in a 20-month period, from 0.10% in April 2022 to 4.35% in November 2023. The effect of that increase was home lending rates tripling from approximately 2% to >6%.

The movements in the cash rate are illustrated below:

Essentially, post-COVID, there was a complete 180 degree turn on policy, as the RBA attempted to slow the economy down. The combination of a post-slow down hangover, the increase in interest rates and ATO collection policies have all resulted in the record high number of external administration appointments we are currently seeing.

Sectors impacted

Unsurprisingly the two sectors most impacted by the above circumstances are "Arts and Recreation" and "Accommodation and Food Services"⁶. The following charts track the profits in those industries before income tax:

Arts and recreation

Arts and Recreation has been hit the hardest of all sectors. Oddly, profits peaked in September 2020, perhaps the result of government stimulus. Post-COVID the sector is struggling with a material contraction in profits. Profits before income tax in the 2024 financial year were $1.7 billion, whereas pre-COVID, in the 2018 financial year they were $3.2 billion.

Businesses in this sector include:

Live performances, events or exhibits

Artists

Musicians & performers

Venue operators

Sporting or recreational activities

Gyms

Sports clubs

Amusement parks

Horse and dog racing

Museums

Zoos

Nature reserves

Botanical gardens

Gambling activities

Casino

Online gambling

Lottery operators.

.png)

Accommodation and food service

Whilst the accommodation and food services sector doesn’t appear to be going terribly, readers should bear in mind that after accounting for inflation (each dollar of profit is worth less) and Australia’s population growth, which is estimated to have gone from 23 million people in 2014 to 26.7 million people in 2024, the industry is in a contractionary state.

Whilst the accommodation and food services sector doesn’t appear to be going terribly, readers should bear in mind that after accounting for inflation (each dollar of profit is worth less) and Australia’s population growth, which is estimated to have gone from 23 million people in 2014 to 26.7 million people in 2024, the industry is in a contractionary state.

Businesses in this sector include:

Hotels

Motels

Serviced apartments

Other short-term accommodation for visitors.

Cafes

Restaurants

Takeaways

Pubs

Bars

Other businesses that sell meals, snacks and beverages.

Both the above sectors are discretionary in nature. The reduction in demand for those sectors was by design, as the RBA sought to tighten spending in the economy. As can be seen, the policy has been a success. This is a small comfort to the businesses we speak to who often do not have the capital to sustain them through these types of downturns and only have one option: to close up shop.

.png)

Types of corporate insolvency

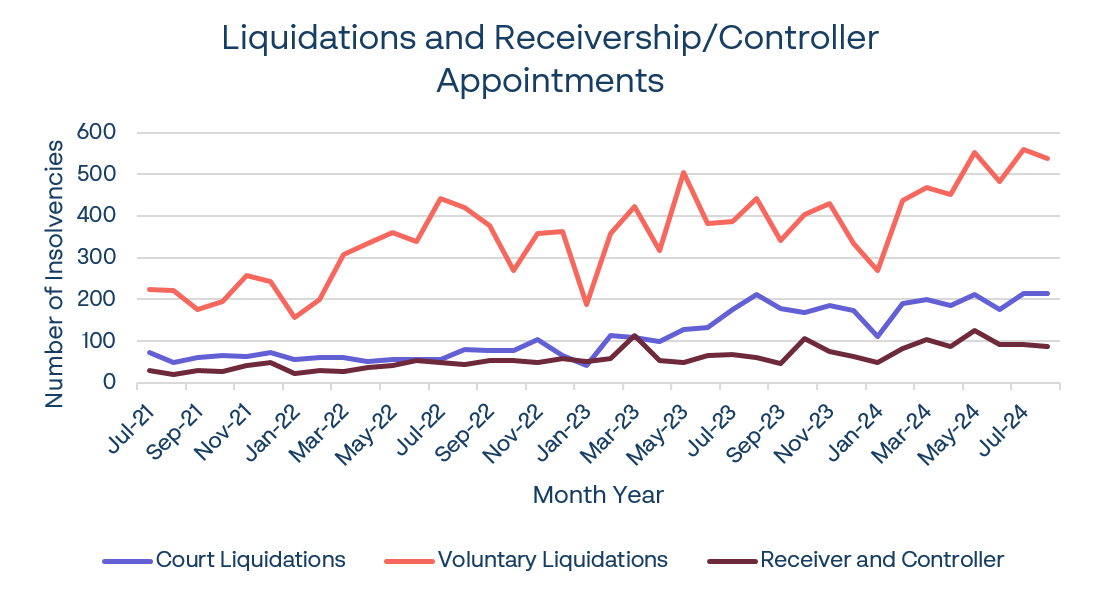

Insolvencies are up across the board with voluntary liquidations seeing the most volatility (on a raw numbers basis):

As can be observed above, voluntary liquidations have seen a large surge, from a trough of 156 new appointments in January 2022 to 560 appointments in July 2024. Court liquidations and receivership/controller appointments have also increased, which indicates:

As can be observed above, voluntary liquidations have seen a large surge, from a trough of 156 new appointments in January 2022 to 560 appointments in July 2024. Court liquidations and receivership/controller appointments have also increased, which indicates:

Companies are failing to meet their debts on time;

Creditors are willing to incur the costs of winding up to chase debts; and

Lenders are making formal appointments to recover loans.

These trends do not currently show any signs of slackening. The ATO is still seeking to recover record amounts of unpaid taxes which are predominately owed by small businesses.

Restructures

The industry has also experienced an increase in voluntary administration appointments and small business restructures (SBR):

The popularity of small business restructures is evidenced above. The regime came into effect on 1 January 2021. Take up was slow but began to rapidly gain momentum. The number of SBRs per month overtook voluntary administrator appointments in March 2024 and is unlikely to drop below voluntary administrator appointments any time soon unless there is a policy shift within government.

Small business restructures now comprise approximately 20% of insolvency appointments. If its current growth rate continues, it may become the most popular type of appointment.

Personal insolvencies

In less gloomy news, personal insolvencies are still lower than pre-COVID levels:

Readers will notice a slight increase in the 2024 financial year from the preceding two years. Bankruptcy is generally regarded as an option of last resort, so we expect that bankruptcy numbers for the 2025 financial year will continue to climb higher.

Readers will notice a slight increase in the 2024 financial year from the preceding two years. Bankruptcy is generally regarded as an option of last resort, so we expect that bankruptcy numbers for the 2025 financial year will continue to climb higher.

Superannuation withdrawals

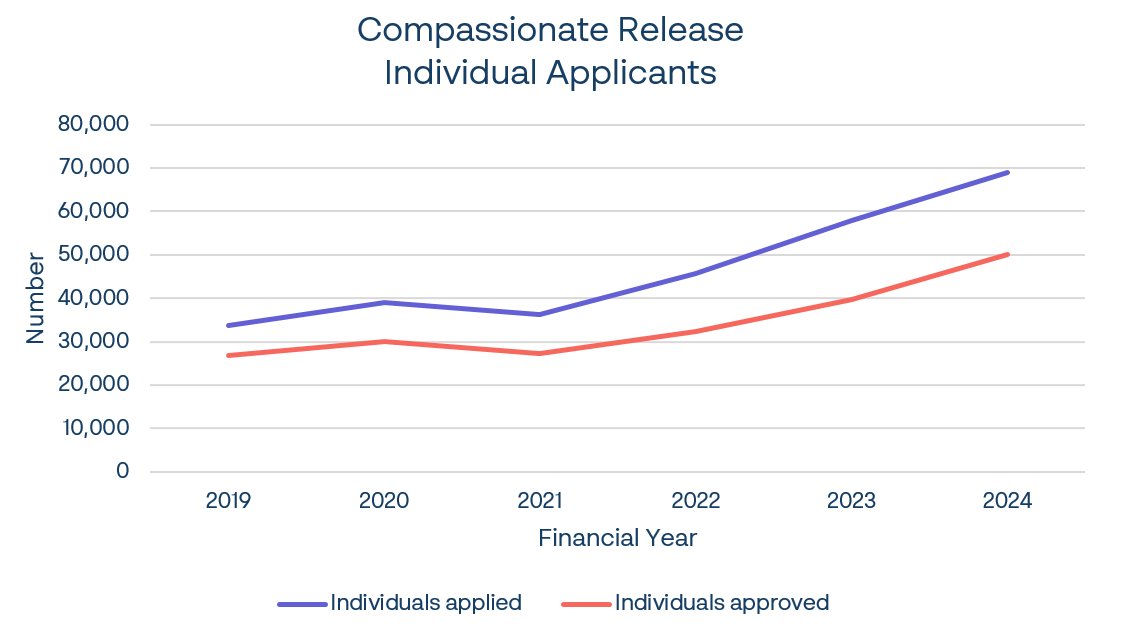

An interesting data point that reveals people are under financial strain is the increase in the number of early release of superannuation applications received by the Australian Taxation Office (ATO) on compassionate grounds.

An early release of superannuation on compassionate grounds may be based on needs for medical treatment, modifying a home to accommodate special needs, palliative care, funeral expenses or the prevention of foreclosure on a home.

An early release of superannuation on compassionate grounds may be based on needs for medical treatment, modifying a home to accommodate special needs, palliative care, funeral expenses or the prevention of foreclosure on a home.

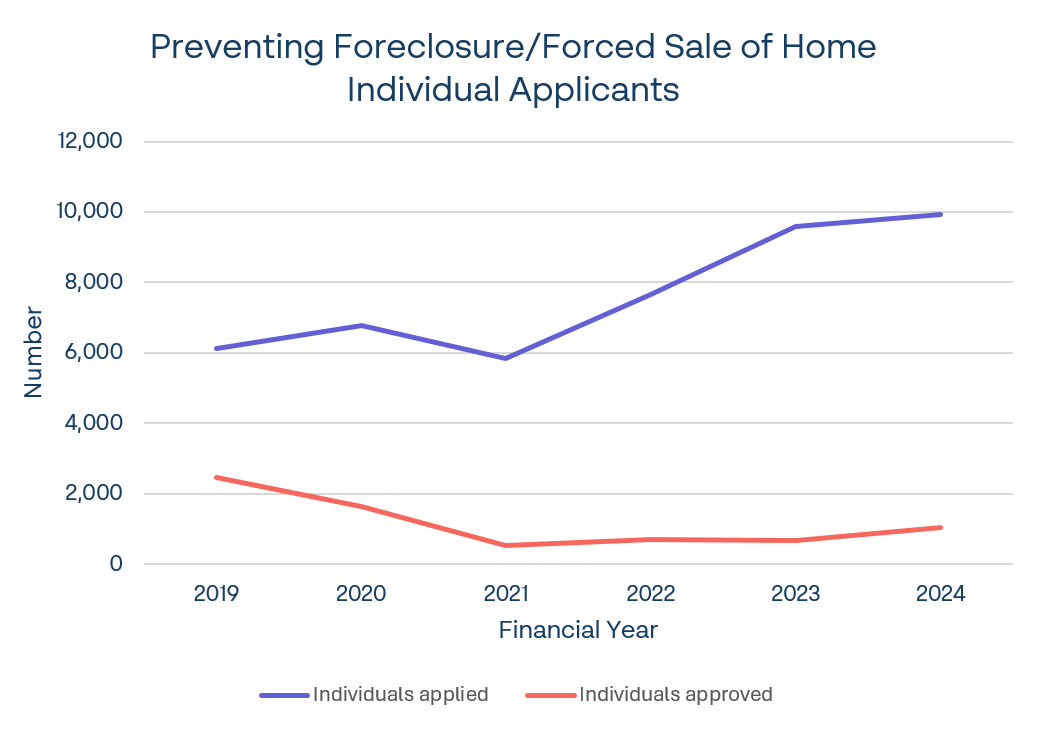

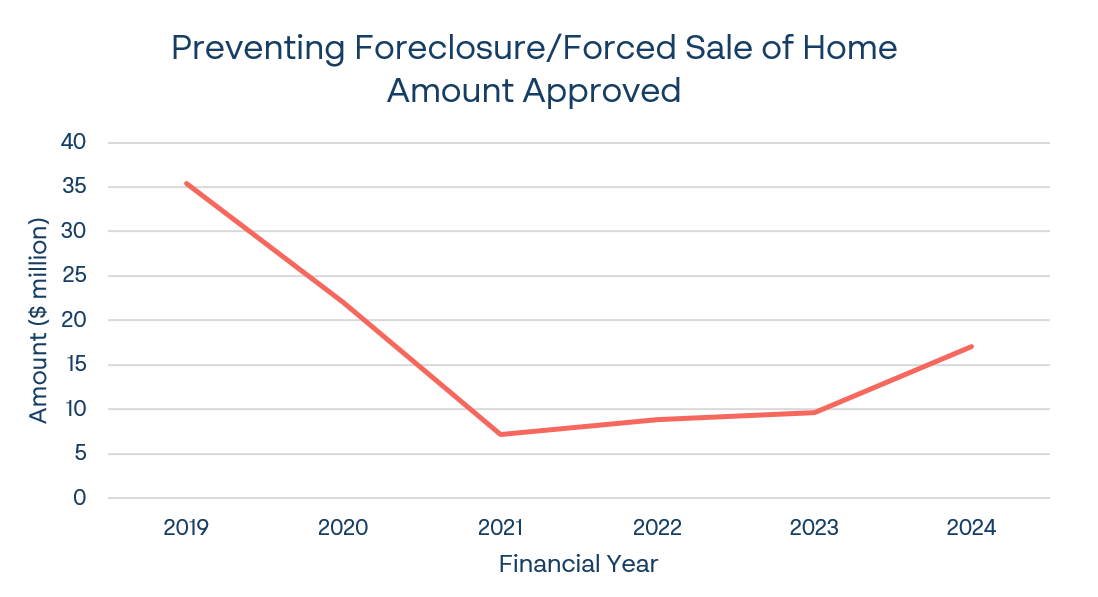

It appears that the main reason people have been seeking an early release of superannuation is on medical grounds, with over 50,000 applications made in the 2024 financial year. Specifically, dental work was the most widely cited reason. However, release from superannuation to due to mortgage stress and to prevent foreclosure on homes was also up. Interestingly, the number of applications in FY2024 is greater than FY2019 however the amount approved is less than half. The below graphs indicate that the ATO is less willing to allow people to access their superannuation to prevent foreclosure, and when they do, it is for a smaller amount:

ATO collection policy

The ATO’s current collection policies are a large driver for the number of insolvencies we are currently experiencing. They are seeking to recover record high amounts of unpaid taxes. In addition, they are set to be more aggressive going forward.

For further information on that topic, please refer to this article from August.

Conclusion

We don’t expect the current record high levels of external administration appointments to last forever. However, we also don’t see any signs of the current factors easing. Until there are reductions in the cash rate, sectors sensitive to discretionary spending will continue to suffer. In addition, while the ATO has a mandate to reduce the amount of uncollected taxes to a more appropriate level, it will remain a key driver of insolvencies.

[1] Based on Australian insolvency statistics released by ASIC on 8/10/2024. 2019 financial year is a “base rate” based on an average of 2017, 2018 and 2019 financial year.

[2] https://www.rba.gov.au/education/resources/explainers/the-covid-19-pandemic-2020-to-2021.html

[3] https://www.rba.gov.au/education/resources/explainers/the-global-financial-crisis.html#:~:text=Australia%20and%20the%20GFC&text=Australia%20did%20not%20experience%20a,a%20period%20of%20heightened%20uncertainty.

[4] https://www.rba.gov.au/education/resources/explainers/the-covid-19-pandemic-2020-to-2021.html

[5] https://www.rba.gov.au/inflation-overview.html

[6] 5676.0 Business Indicators, Australia, from ABS. https://www.abs.gov.au/statistics/economy/business-indicators/monthly-business-turnover-indicator/aug-2024#data-downloads