Lowest record of bankruptcies in 23 years!

The Australian Financial Security Authority (AFSA) released the personal insolvency statistics for the December quarter of 2018, which continued the downward trend from the September quarter. Overall, personal insolvencies fell 8.19% in the December quarter 2018. This significant drop saw activity reach its lowest level since the December quarter 2005, nine years ago.

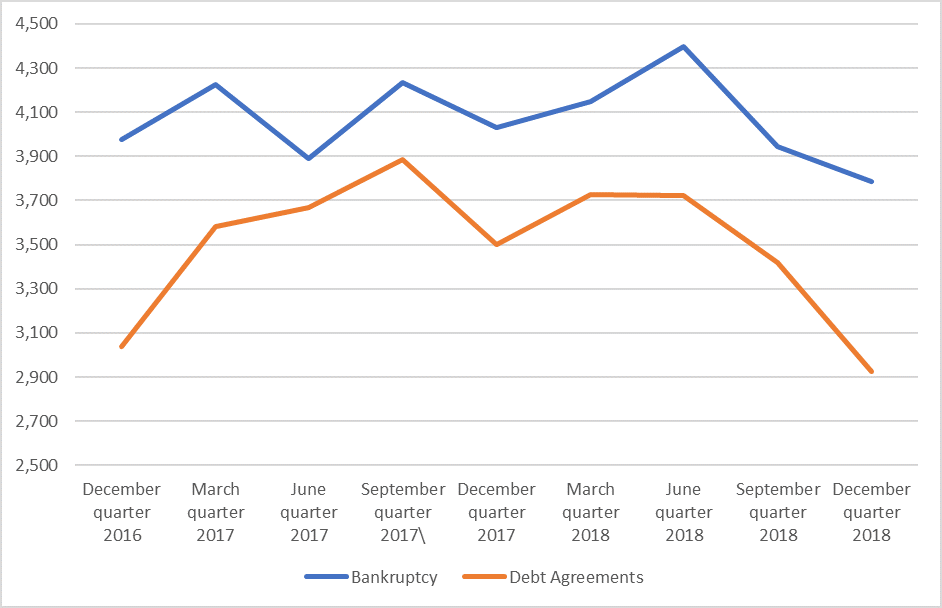

Personal insolvencies again fell across all three types of appointments. Bankruptcies fell 4.0%, debt agreements saw an even more significant drop of 14%, and personal insolvency agreements, while by far the smallest in volume, fell the most significantly with a decline of 27%.

This was a notable surprise, with bankruptcies in particular falling to their lowest level in 23 years. While debt agreements reached their lowest level since 2015, ending a run of strong and consistent growth in the form of personal insolvency.

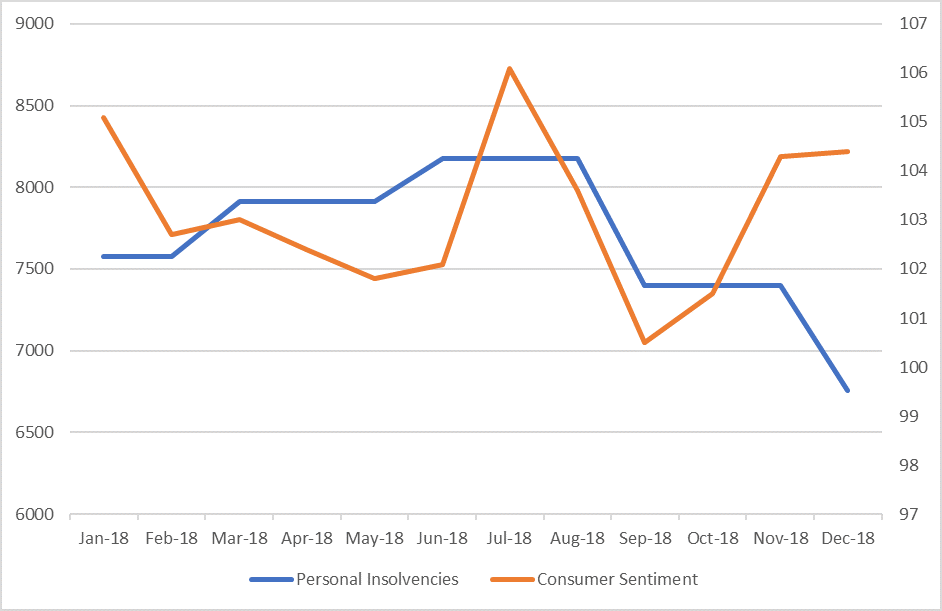

We had anticipated a rebound in personal insolvency numbers in following a fall in the Westpac Consumer Sentiment Index in September and October 2018, however the index rebounded sharply in November and December 2018 as consumer confidence improved over the run-up to the Christmas spending season. This may be the reason that personal insolvencies fell. There is some relationship between the indicator and the number of personal insolvencies.

Looking forward we expect that now that the holiday season and the optimism that comes with it, has passed, we will again see a rise in personal insolvencies. This was reflected by a sharp fall in consumer sentiment at the start of 2019. However, this may be offset by the change in tone coming from the Reserve Bank of Australia, with markets now considering an interest rate rise in 2019 to be unlikely.

.jpeg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=400&h=400&q=25&blur=5&sat=-100)

.jpg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=800&h=480&q=25&blur=5&sat=-100)