Currently remaining flat as economic headwinds increase…but for how long?

The last quarter has been a wild one for the Australian economy, with mounting headwinds from a range of international and domestic factors. While these factors have placed increasing pressure on businesses, they haven’t yet caused a significant increase in the number of insolvency appointments we are seeing.

Corporate insolvency

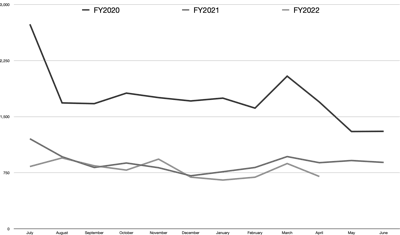

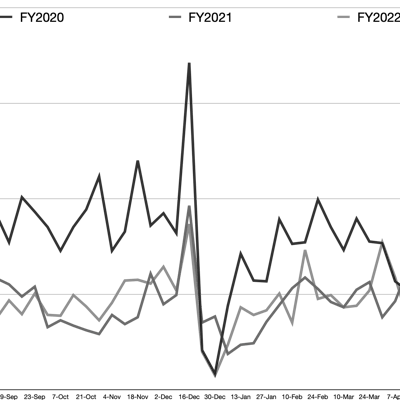

Corporate insolvency appointments in FY 2022 has tracked along at essentially the same rate as FY2021. In FY 2021, we saw total corporate insolvency appointments of 6,049, and while all the numbers aren’t in for FY2022 yet, I expect the final number will be around 6,500 appointments for the year. While that’s an increase of about 7% on last financial year, it is still a long way below the long run average of 10,744 appointments per financial year.[i]

Personal insolvency

Personal insolvency appointments for FY2022 remained historically low. Running at about 40% of historical norms and continuing to fall in FY2022. For FY2021 there were 10,628 personal insolvency appointments, while we are likely to see in the order of 9,500 in FY2022 by the time all the numbers come in. This is a pretty surprising outcome. Despite the lifting of restrictions on enforcing debts and taking bankruptcy action, we have still seen personal insolvency numbers fall in FY2022. [ii]

.jpeg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=400&q=25&blur=5&sat=-100)

The economy

Despite the low insolvency appointment numbers in FY2022, the business and financial environment continues to deteriorate, with a number of factors likely to create big negative headwinds for the economy in FY2023.

These include:

Inflation, which was at 5.1% last quarters and is expected to be over 7% by the end of 2022. The RBA has forecast that it will be several years before inflation falls back within their 2 to 3% target range. Continued high inflation will place constant pressure on business and household bottom lines.

Interest rates are set to increase significantly as the RBA is committed to fighting inflation. We had already seen two increases in recent months and markets are predicting the cash rate to reach 3% by then end of 2022 and peak at 3.8% in mid-2023. For each 1% increase in the cash rate, Australian households see about a 5% decrease in disposable income, meaning less money in the economy to be spent in local businesses.

Supply chain challenges will continue for the next 18 to 24 months. The cost of shipping goods from our major import markets to Australia remains almost 400% above the historical averages and shortages in transport capacity will keep prices elevated through all of FY2023. China, Australia’s largest trading partner, has given strong indications that lockdowns to support COVID-Zero will remain a core policy for at least the remainder of 2022. As a result, we will continue to see business experience difficult obtaining needed supplies from overseas.

Staff shortages and increases in wages are already having a significant impact on a lot of industries and this trend will continue through FY2023. Unemployment remains at a near record low of 3.9%, while workforce participation is already at near record highs. One of the key drivers of staff shortages is the freeze on immigration that took place over the pandemic period. While that freeze has been lifted, immigrant workers have been slow to return to Australia and forecasts are that it will be some significant time until immigrations starts to have an impact on staff shortages.

Energy prices remain very high, especially petrol prices as a result of both the Ukraine war and a global shortage in refining capacity. With global demand expected to remain high and the process to bring on additional capacity a long one, petrol prices will remain high in Australia for the foreseeable future. Australia also has a looming increase in the fuel excise in September this year which will put further upward pressure on petrol prices.

Insolvency tsunami?

With all these challenges facing the Australian economy it’s only a matter of time until we start to see the impact on businesses and individuals convert into increasing insolvency appointment numbers. However, I don’t think we will see a tsunami. The most likely outcome is a slow increase in appointment numbers through FY2023, with appointment numbers peaking at around 120% of the historical averages in late 2023.

[i] Source: ASIC – Series 1B Notification of companies entering external administration and controller appointments – weekly.

[ii] Source: AFSA's Monthly personal insolvency statistics 2020; 2021; 2022.

.jpg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=800&h=480&q=25&blur=5&sat=-100)