Betting against the house: how pre-bankruptcy moves could backfire.

In the context of bankruptcy, the bankruptcy trustee is responsible for scrutinising transactions conducted prior to the bankruptcy filing. This is to identify any asset transfers that may have improperly diminished the estate available to creditors. If the trustee identifies suspicious transactions, they may seek to reverse these transactions to reclaim assets or funds for the benefit of the creditors.

Objective

The principal objective of voiding transactions in bankruptcy is to ensure that all assets of the bankrupt individual are appropriately contributed to the bankruptcy estate. Transactions that have been executed in a manner that reduces the pool of assets available to creditors can be contested. They can potentially be reversed to uphold equitable distribution among creditors.

Trustee’s responsibilities

To invalidate a transaction, the trustee must:

Identify the specific transaction and the parties involved.

Demonstrate that the transaction occurred within a specified timeframe prior to the bankruptcy filing or while the individual was insolvent.

Establish that the transaction was either undervalued, executed with the intent to evade creditors, or was preferential compared to other creditors.

Confirm that the transaction did not involve property that is exempt from bankruptcy proceedings.

Types of voidable transactions

Proceeds of execution (Section 118): If, within six months of the bankruptcy, a creditor received moneys from the sale of the bankrupt’s property resulting from an execution of a charge or charging order in favour of that creditor.

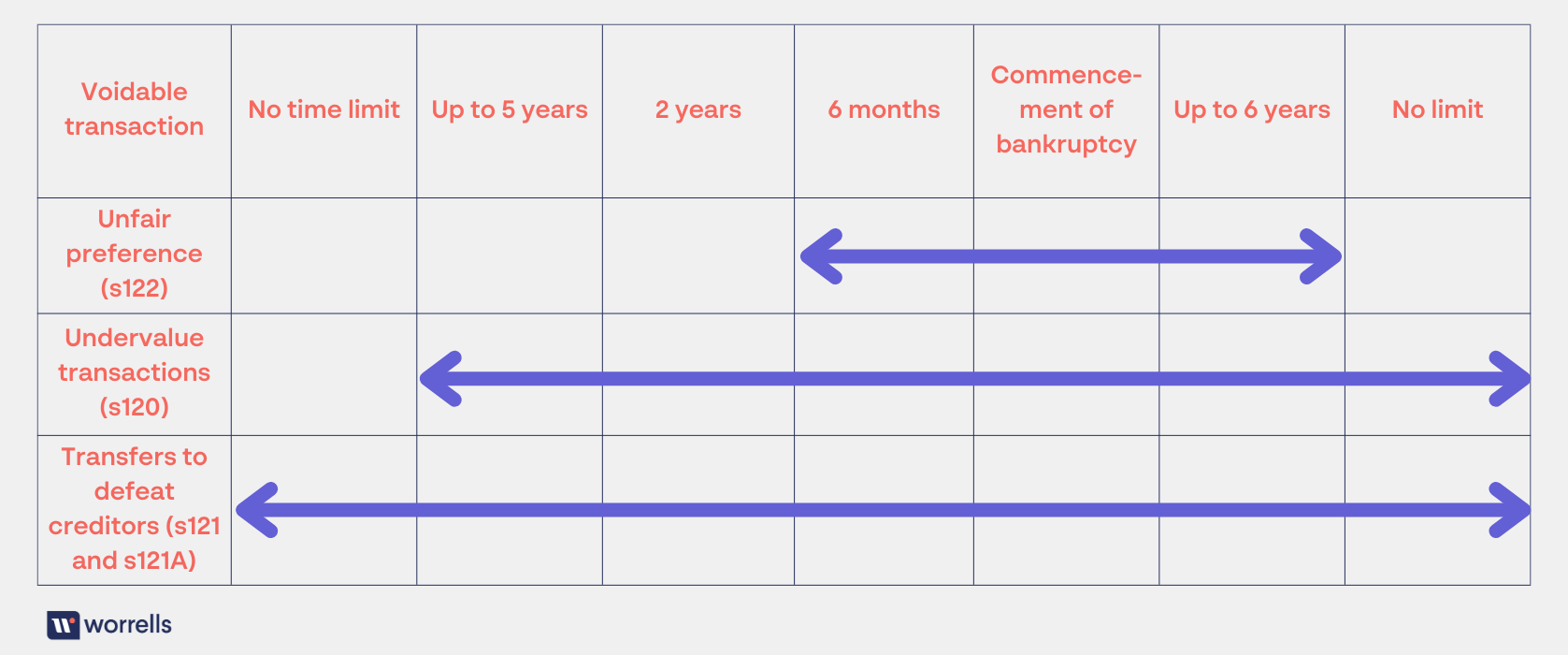

Undervalued Transactions (Section 120): This category pertains to transactions where assets are transferred at less than their market value. Examples include selling property to a relative for nominal consideration or overvaluing purchases. Such transactions may be reversed if they occurred within five years prior to the bankruptcy.

Transfers to Defeat Creditors (Section 121, 121A): These transactions involve the transfer of assets intended to hinder creditors from accessing them. If it is evident that the transfer aimed to conceal assets from creditors, the trustee can seek to void the transaction against the creditor and/or third party who received the consideration that should have been paid to the bankrupt

Preferential Payments (Section 122): A preferential payment is defined as a payment made to one creditor over others within a specific period before the bankruptcy. For instance, paying off a debt to one business in full just before filing for bankruptcy, while neglecting other creditors, may be reversed if it occurred within six months of the bankruptcy or the creditor’s petition.

Superannuation (Section 128B, 128C): If the bankrupt or third party contributed funds into a bankrupt’s superannuation fund with the intention to defeat creditors, in circumstances where the contributions was out of character and was, or resulted in, the bankrupt becoming insolvent.

Entities controlled by the bankrupt (Part 6, Div4A): Seeks to make available, any accumulation of assets that has occurred in an entity that resulted from the bankrupt’s efforts or exertions.

.png)

Exceptions and Protections

Protected Transfers: Certain transfers are exempt from being voided. For instance, transactions conducted more than two years prior to bankruptcy (or four years if involving related parties) when the individual was solvent might be protected. Transfers made for tax payments or to satisfy family law obligations are also generally protected.

Good Faith Transactions: Purchasers who acquire assets from the bankrupt party in good faith, without knowledge of the bankruptcy or intent to conceal assets, may be protected. These individuals must demonstrate that their actions were reasonable and uninfluenced by the bankrupt's insolvency.

Timeline for Challenge

Sections 118, 120, 121 and Div4A: Trustees typically have six years from the date of bankruptcy to challenge such transactions.

Section 121A, 128B, 128C: Trustees can act at any time after discovering the transaction.

In summary

Bankruptcy trustees play a crucial role in investigating and potentially reversing pre-bankruptcy transactions to ensure a fair distribution of assets among creditors. While certain protections exist for specific transactions and for those conducted in good faith, the trustee's mandate is to uphold the integrity of the bankruptcy process and ensure equitable treatment of all creditors.

.jpeg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=400&h=400&q=25&blur=5&sat=-100)