And when will the volume return?

It’s a question the insolvency industry has been asking over the last 18 months. As the economy has gone through lockdowns and a technical recession, insolvency appointments have fallen to record lows. Let’s dig into what has kept insolvencies so low through the pandemic period and now we are on the other side, when will things bounce back.

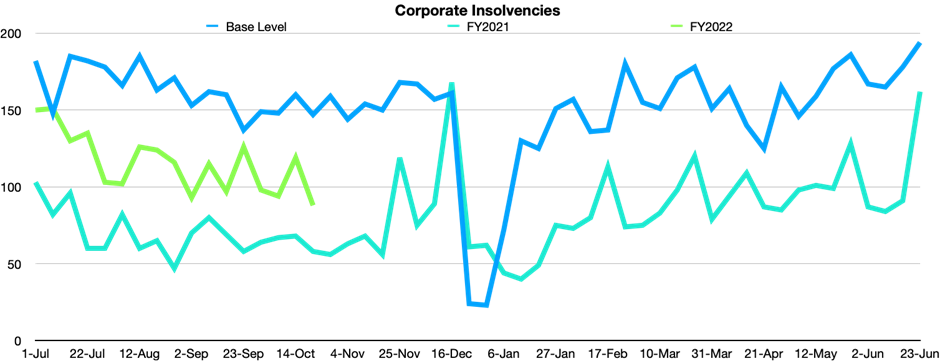

Corporate insolvency

Corporate insolvencies have continued the trend through the pandemic and remained well below historical levels through the third quarter of 2021. While recovering somewhat from the ultra-low numbers seen through 2020, numbers of corporate insolvency appointments are still 30% below historical levels.

Through the pandemic period there have been approximately 4,500 less corporate insolvencies than we would normally expect to see over the same period. This has surprised pretty much everyone, usually we would see a significant increase in insolvencies during difficult economic times. While the low number of appointments in 2020 was explained by the moratorium the government put in place, the factors keeping numbers low in 2021 are a bit more complicated.

The main reason appears to be a mix of factors that are allowing marginal and struggling businesses to defer making a decision to make an insolvency appointment. The various business stimulus and support packages and the general lack of pressure from major institutional creditors and the Australian Taxation Office (ATO) gave business just enough breathing room to defer the decision on whether to make an insolvency appointment.

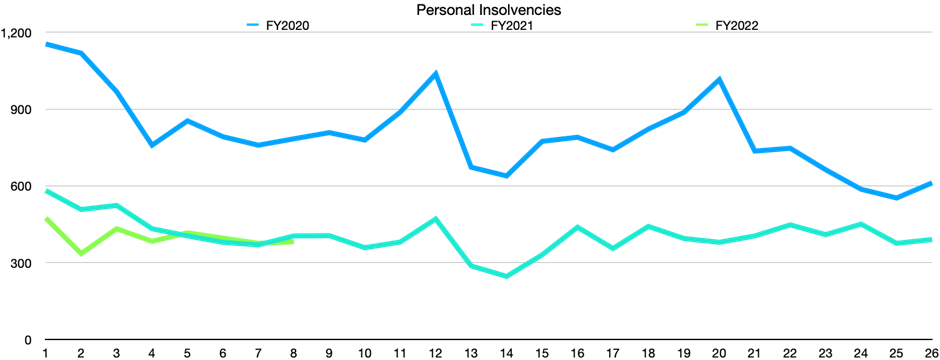

Personal insolvency

Personal insolvencies also fell dramatically during 2020, when government moratoriums made it very difficult to make someone bankrupt. However, unlike corporate insolvencies, personal insolvencies have remained at the very low 2020 levels through 2021.

The reasons here are similar to those for corporate insolvency, extra cash from the government propping up household balance sheets combined with a lack of pressure from creditors. However, cuts to interest rates, that have brought mortgage repayment down to records lows and a boom in asset prices (especially housing and shares) have also helped support households and allowed them to defer any insolvency decision.

The pandemic economy is ending

Australia is now well on the road to exiting the pandemic economy and returning to business as usual. A very successful vaccination program has seen lockdowns around the country come to an end as we get outbreaks under control and we will soon see international borders reopening.

Government stimulus is also being wound back, with major business support programs scheduled to end this month.

However, there are significant additional headwinds for business to face as they try and trade their way out of the pandemic:

- Businesses will face difficulties finding staff. Unemployment is at near record lows, with international migration anticipated to be slow to recover as borders reopen, the labour market is anticipated to remain tight for at least the next year. This is also likely to put upwards pressure on wages.

- Global supply chain issues are expected to continue to impact the economy, making it difficult for businesses to reliably source products and putting upward costs pressure on inputs.

- Many businesses are carrying significant accrued debt, particularly in the form of deferred taxes and rent. These debts will need to be serviced out of post-pandemic revenue putting further pressure on business cash flows. Institutional creditors and the ATO have both indicated that their permissive approach to debt recovery will be wound back, likely starting in 2022.

- The Reserve Bank of Australia (RBA) has started to signal that rate hikes are coming. On Tuesday 2 November, the RBA abandoned its position that it would keep the cash rate at 0.1% until 2024. Market analysts are now predicting five increases (1.25%) through 2022. This would place significant pressure on both businesses and households and put a break on the economy’s recovery. An increase of 1.25% in the cash rate is forecast to consume an additional 5% of household disposable income.

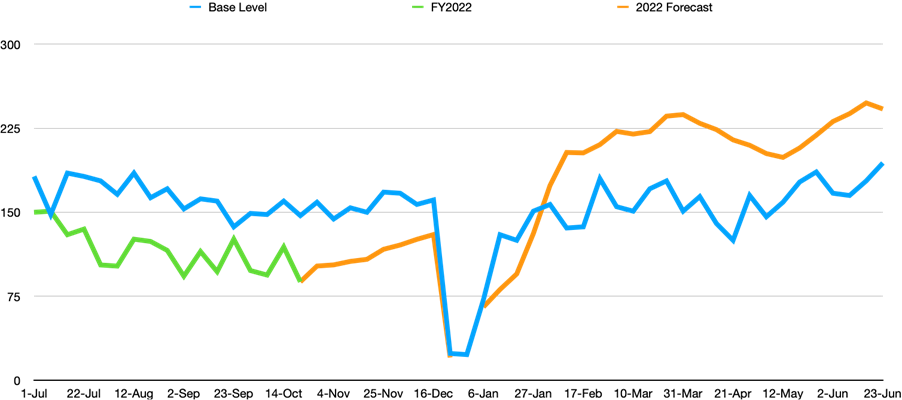

What does this mean for insolvencies?

We predict that the number of corporate insolvencies will increase rapidly in 2022. As various factors combine to force a significant portion of the companies that put off making a decision to make an insolvency appointment, to now take that step. This will mean we see some ‘catch up’ in the corporate insolvency numbers, where some of the deferred insolvencies take place through 2022, pushing insolvency numbers well above historical levels.

With personal insolvencies we expect to see a slow return to historical levels. Low rates of unemployment, signs of wage growth and the rapid growth in asset prices through the last 18 months will all work to insulate many households from financial stress and curtail any spike in personal insolvency appointments through 2022.

Corporate insolvency statistics are copyright Australian Securities & Investments Commission. Reproduced with permission.

.jpeg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=400&h=400&q=25&blur=5&sat=-100)

.jpg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=800&h=480&q=25&blur=5&sat=-100)