Viable or unviable, that is the question.

It is clear that COVID-19 has had an impact on most businesses in one way or another. Some businesses have been impacted for the better, some for the bad and some for the worse. We have seen businesses flourish and become more profitable as a result of changes in consumer behaviour, while others have taken a financial hit from which they may not be able to recover.

As we see the end of government support and other temporary relief measures implemented during 2020, it is now the time for advisors to take stock and ask the question: Is my client’s business viable?

This has always been a key question but in the post-Covid business world it is more important than ever and now is the time for advisors and their clients to undertake this assessment.

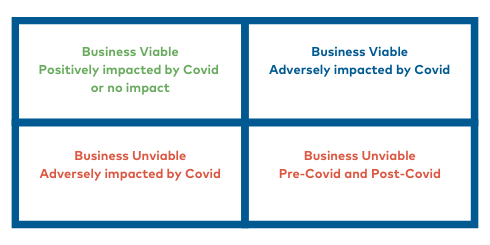

So, which of the 4 categories below do your clients fall into?

Business Viable - Positively impacted by Covid or no impact

These are the businesses which have seen an increase in demand for products or services. Their revenue and profits have increased, and in some cases, resulting from owners successfully pivoting and changing their business models. The challenge for advisors and clients is to ensure that this growth is not just temporary and to secure the long-term viability of their business.

This category also includes those businesses where it has been “business as usual” and there has been little or no impact at all.

Business Viable - Adversely impacted by Covid

There will be a large number of businesses which were viable prior to Covid however, they have been adversely impacted and may now be faced with accumulated debts such as tax or rent deferred.

Notwithstanding the impact that Covid has had on these businesses, the underlying business is viable and had it not been for Covid, the client would not have had any financial issues. Further, the post-Covid business is reassessed as being viable for the foreseeable future.

Assessing the cashflow of these businesses will be critical to determine how they can deal with their accumulated debts. These clients also have the greatest scope for being able to be restructured through either formal or informal arrangements. The options include:

- Voluntary Administration

- Small Business Restructuring Process

- Safe Harbour

- Informal Restructuring

Business Unviable - Adversely impacted by Covid

We have seen many industries impacted by Covid - hospitality, tourism, aviation and some areas of retail to name a few. In other cases, we have seen particular areas or regions impacted due to a change in consumer behaviour brought about by lock-downs, restrictions and workplace changes.

These changes have rendered businesses in this category unviable and there is little to no chance that they will be able to generate future profits to repay accumulated debts and/or restructure.

Advisers may assist clients to determine whether further investment is warranted or whether it is time to seek advice about the options that are available and discussed further below.

Business Unviable - Pre-Covid and Post-Covid

The businesses falling into this category are those that were unviable prior to Covid and remain so. It is likely that in many cases these businesses were able to continue operating during Covid or in some cases, simply continuing to exist, due to the various government stimulus packages and temporary protection measures.

The risk for directors is now that Jobkeeper and other government assistance has ceased, and the temporary protection measures have come to an end, continuing to trade exposes them to potential personal liability for insolvent trading or for non-payment of PAYG Withholding tax, GST, superannuation and other company liabilities.

It is these clients that require an exit strategy and the options for these companies include:

- Creditors Voluntary Liquidation

- Simplified Liquidation

- Orderly wind-down

- Distressed sale of business

At Worrells we are always available at no cost to meet and discuss the options outlined above to ensure that directors are armed with all of the information necessary to make a fully informed decision that is right for them and their company.