Are economic conditions to blame?

The September quarter of Australian Financial Security Authority (AFSA) personal insolvency statistics are out, and the trends of 2017 continue. Total personal insolvencies are up by 8% compared to a year ago, and debt agreements continue their significant growth. Debt agreements reached a record high of 3,885 and increased to 47.4% of total personal insolvencies. Bankruptcy increased just 0.1% for the quarter.

In September, AFSA also released annual data about personal insolvency causes for the 2016-17 year. These provide some interesting insights into what leads to personal insolvency.

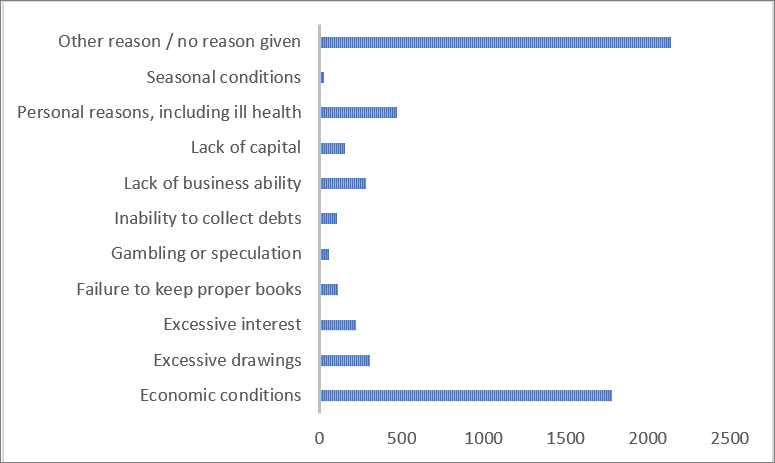

Business related personal insolvencies

Just 16.1% of debtors declare bankruptcy for business related reasons, with economic conditions most often cited as the main reason. It is worth noting that economic conditions have been the most common business related cause of debtors entering personal insolvencies every year since the 2007–08 year.

This is in stark contrast to our experience as insolvency practitioners, where we have identified a lack of business acumen and a failure to keep proper records as the main driver of business related insolvencies.

The chart below shows all the major causes cited by debtors.

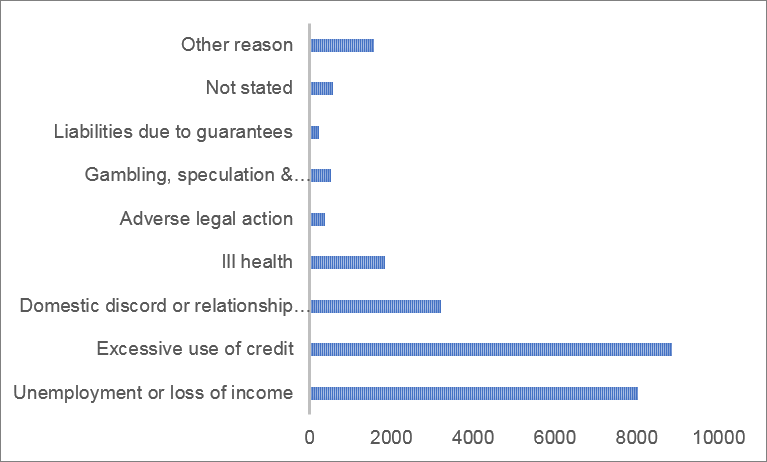

Non-business related personal insolvencies

The remainder of debtors declare bankruptcy for non-business related reasons. In this area, two factors are overwhelmingly dominant—excessive use of credit, and unemployment.

2016-17 marks the first time since data collection began in 2007-08 that excessive use of credit has taken over unemployment as the main reason for non-business related personal insolvency.

The chart below shows the major causes debtors cite.

Looking ahead

The trend towards debt agreements looks set to continue. These agreements remain the most aggressively marketed form of personal insolvency and appear attractive to debtors, as they carry less social stigma than bankruptcy.

However, there is a potential threat to the dominance of debt agreements on the horizon. This month the government introduced draft legislation to shorten the bankruptcy period from three years to one year. This may significantly increase the attractiveness of bankruptcy as an alternative solution to debt agreements, should the legislation pass.

What is a 12-month bankruptcy? More on this in our next edition of ‘Worrells - On The Pulse’.

.jpg?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=800&h=480&q=25&blur=5&sat=-100)